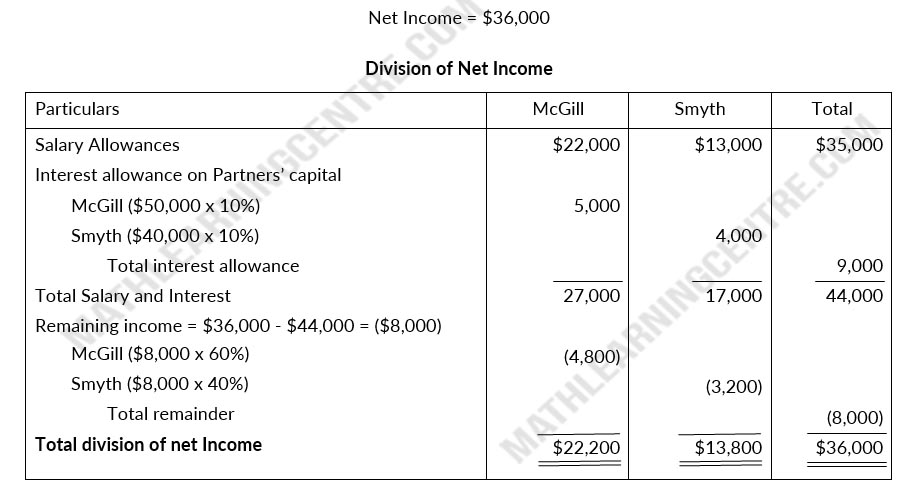

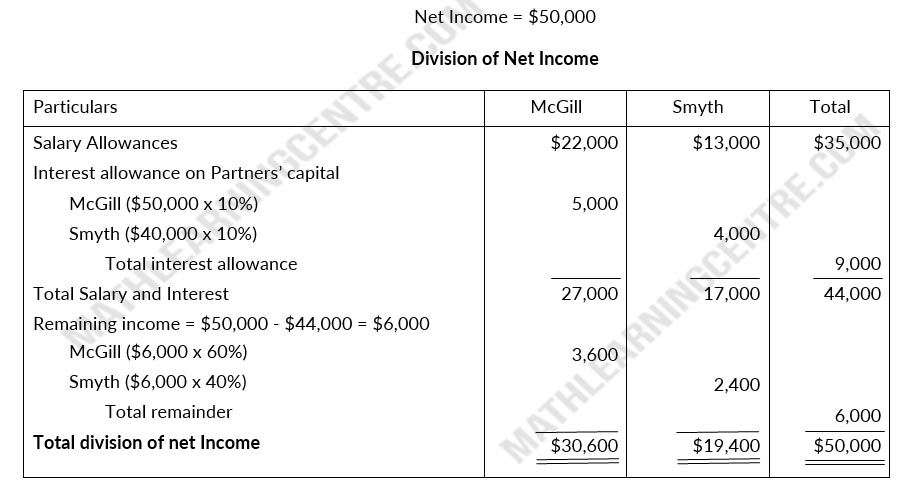

McGill and Smyth have capital balances on January 1 of $50,000 and $40,000, respectively. The partnership income-sharing agreement provides for () annual salaries of $22,000 for McGill and $13,000 for Smyth, (2) interest at 10% on beginning capital balances, and (3) remaining income or loss to be shares 60% by McGill and 40% by Smyth.

Instructions

- Prepare a schedule showing the distribution of net income, assuming net income is (1) $50,000 and (2) $36,000.

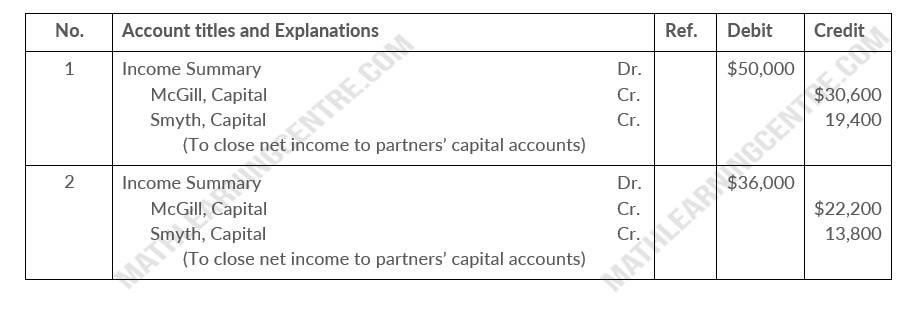

- Journalize the allocation of net income in each of the situations above.

Solution

Division of Net Income

For the Year Ended December 31

Division of Net Income

For the Year Ended December 31