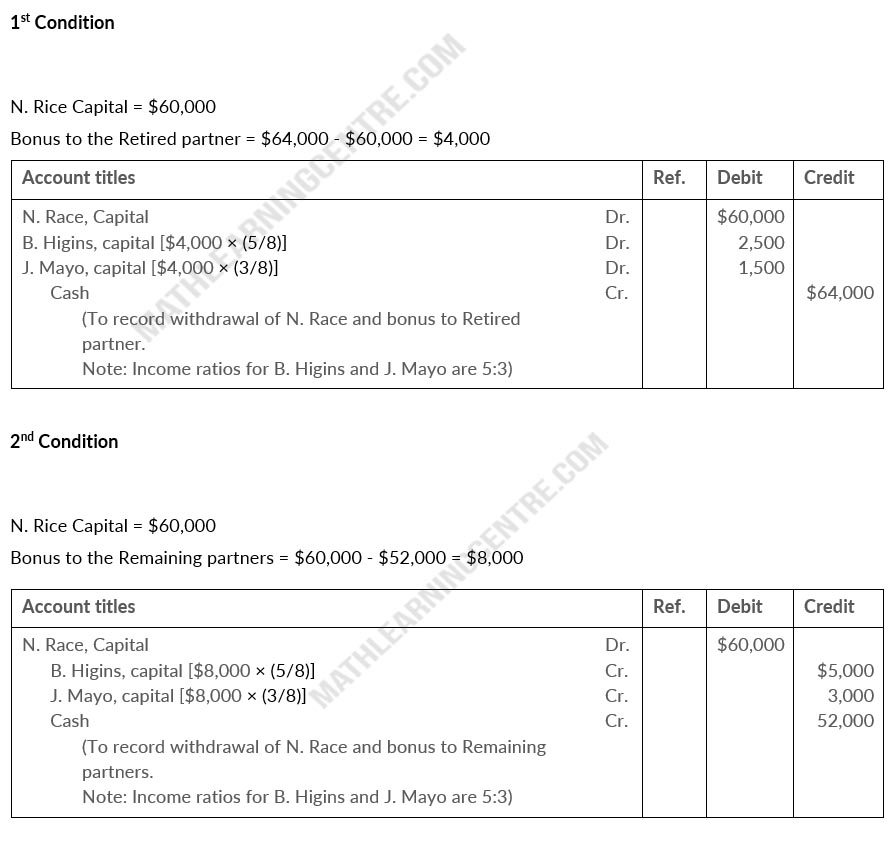

B. Higgins, J. Mayo, and N. rice have capital balances of $95,000, $75,000, and $60,000 respectively. they share income or loss on a 5:3:2 basis. Rice withdrawn from the partnership under each of the following conditions.

- rice is paid $64,000 in cash from partnership assets, and a bonus is granted to the retiring partner.

- rice is paid $52,000 in cash from partnership assets, and bonuses are granted tot he remaining partners.

Instructions

Journalize the withdrawal of Rice under each of the assumptions above.

Solution