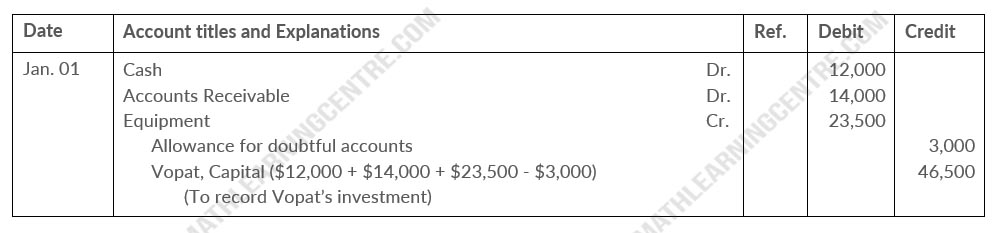

Suzy Vopat has owned and operated a proprietorship for several years. On January 1, She decides to terminate this business and become a partner in the firm of Vopat and Sigma. Vapar's investment in the partnership consists of $12,000 in cash, and he following assets of the proprietorship; accounts receivable $14,0000 less allowance for doubtful accounts of $2,000, and equipment $30,000 less accumulated depreciation of $4,000. It is agreed that tthe allowance for doubtful accounts should be $3,000 for the partnership. The fair value of the equipment is $23,500.

Instructions

Journalize Vapat's admission to the firm of Vopat and Sigma.

Solution

Journal Entry