On January 1, 2020, Geffrey Corporation had the following stockholders equity accounts.

| Common Stock ($20 par value, 60,000 shares issued and outstanding) | 1,200,000 |

| Paid-in Capital in Excess par-Common Stock | 200,000 |

| Retained Earnings | 600,000 |

During the year, the following transactions occurred..

| Feb. 1 | Declared a $1 cash dividend per share to stockholders of record on February 15, payable March 1. |

| Mar. 1 | Paid the dividend declared in February. |

| Apr. 1 | Announced a 2-for-1 stock split. Prior to the split, the market price per share was $36. |

| July 1 | Declared a 10% stock dividend to stockholders of record on July 15, attributable July 31. On July 1, the market price of the stock was $13 per share |

| 31 | Issued the shares for the stock dividend. |

| Dec. 1 | Declared a $0.50 per share dividend to stockholders of record on December 15, payable January 5, 2021. |

| 31 | Determined that net income for the year was $350,000. |

Instruction

- Journalize the transactions and the closing entry for net income and dividends.

- Enter the beginning balances, and post the entries to the stockholders' equity accounts.

- Prepare the stockholders' equity section at December 31.

Read more: Problem-01: Corporations: Dividends, Retained Earnings, and Income Reporting

The stockholders equity accounts of Kerp Company at January 1, 2020, are as follows

| Preferred Stock, 6%, $50 par | $600,000 |

| Common Stock, 6%, $5 par | 800,000 |

| Paid-in Capital in Excess par-Preferred Stock | 200,000 |

| Paid-in Capital in Excess par-Common Stock | 300,000 |

| Retained Earnings | 800,000 |

There were no dividends in arrears on preferred stock. During 2020, the company had the following transactions and events.

| July 1 | Declared a $0.60 cash dividend per share on common stock. |

| Aug. 1 | Discovered $25,000 understatement of depreciation expense in 2019. (Ignore income taxes.) |

| Sept. 1 | Paid the cash dividend declared on July 1. |

| Dec. 1 | Declared a 15% stock dividend on common stock when the market price of the stock was $18 per share. |

| 15 | Declared a 6% cash dividend on preferred stock payable January 15, 2020. |

| Dec. 1 | Determined that net income for the year was $355,000. |

| 31 | Recognized a $200,000 restriction of retained earnings for plant expansion. |

Instruction

- Journalize the transactions and the closing entry for net income and dividends.

- Enter the beginning balances, and post the entries to the stockholders' equity accounts.

- Prepare a retained earnings statement for the year.

- Prepare the stockholders' equity section at December 31, 2020.

Read more: Problem-02: Corporations: Dividends, Retained Earnings, and Income Reporting

The post-closing trial balance of Storey Corporation at December 31, 2020, contains the following stockholders equity accounts

| Preferred Stock (15,000 shares issued) | $750,000 |

| Common Stock (250,000 shares issued) | 2,500,000 |

| Paid-in Capital in Excess par-Preferred Stock | 250,000 |

| Paid-in Capital in Excess par-Common Stock | 400,000 |

| Common Stock Dividends Distributable | 250,000 |

| Retained Earnings | 1,042,000 |

A review of the accounting records reveals the following.

- No errors have been made in recording 2020 transactions or in preparing the closing entry for net income.

- Preferred stock is $50 par, 6%, and cumulative; 15,000 shares have been outstanding since January 1, 2019.

- Authorized stock is 20,000 shares of preferred, 500,000 shares of common with a $10 par value.

- The January 1 balance in Retained Earnings was $1,170,000.

- On July 1, 20,000 shares of common stock were issued for cash at $16 per share.

- On September 1, the company discovered an understatement error of $90,000 in computing salaries and wages expense in 2019. The net of tax effect of $63,000 was properly debited directly to Retained Earnings.

- A cash dividend of $250,000 was declared and properly allocated to preferred and common stock on October 1. No dividends were paid to preferred stockholders in 2019.

- On December 31, a 10% common stock dividend was declared out of retained earrings on common stock when the market price per share was $16

- Net income for the year was $585,000

- On December 31, 2020, the directors authorized disclosure of a $200,000 restriction of retained earnings for plant expansion. (Use Note x.)

Instruction

- Reproduce the Retained Earnings account (T-account) for 2020.

- Prepare a retained earnings statement for 2020.

- Prepare a stockholders' equity section at December 31, 2020.

- Compute the allocation of the cash dividend to preferred and common stock.

Read more: Problem-03: Corporations: Dividends, Retained Earnings, and Income Reporting

On January 1, 2020, Ven Corporation had the following stockholders equity accounts

| Common Stock (no par value, 90,000 shares issued and outstanding) | $1,600,000 |

| Retained Earnings | 500,000 |

During the year, the following transactions occurred.

| Feb. 1 | Declared a $1 cash dividend per share to stockholders' of record on February 15, payable March 1. |

| Mar. 1 | Paid the dividend declared in February. |

| Apr. 1 | Announced a 3-for-1 stock split. Prior to the split, the market price per share was $36. |

| July 1 | Declared a 5% stock dividend to stockholders of record on July 15, distributable July 31. On July 1, the market price of the stock was $16 per share. |

| 31 | Issued the shares for the stock dividend. |

| Dec. 1 | Declared a $0.50 per share dividend to stockholders of record on December 15, payable January 5, 2021.. |

| 31 | Determined that net income for the year was $350,000 |

Instruction

Prepare the stockholders' eqity section of the balance sheet at

- March 31

- June 30

- September 31

- December 31, 2020

Read more: Problem-04: Corporations: Dividends, Retained Earnings, and Income Reporting

On January 1, 2020, Shellenburger Inc. had the following stockholders' equity account balances.

| Common Stock, no par value (500,000 shares issued) | $1,500,000 |

| Common Stock Dividends Distributable | 200,000 |

| Retained Earnings | 600,000 |

During 2020, the following transactions and events occurred.

- Issued 50,000 shares of common stock as a result of a 10% stock dividend declared on December 15, 2019.

- Issued 30,000 shares of common stock for cash at $6 per share

- Corrected an error that have understated the net income for 2018 by $70,000.

- Declared and paid a cash dividend of $80,000.

- Earned net income of $300,000

Instruction

Prepare the stockholders' equity section of the balance sheet at December 31, 2020.

Read more: Problem-05: Corporations: Dividends, Retained Earnings, and Income Reporting

On January 1, Guillen Corporation, had 95,000 shares of no-par common stock issued and outstanding. The stock has a stated value of $5 per share. During the year, the following occurred.

| Apr. 1 | Issued 25,000 additional shares of common stock for $17 per share. |

| June 15 | Declared a cash dividend of $1 per share to stockholders of record on June 30. |

| July 10 | Paid the $1 cash dividend. |

| Dec. 1 | Issued 2,000 additional shares of common stock for $19 per share. |

| 15 | Declared a cash dividend on outstanding shares of $1.20 per share to stockholders of record on December 31. |

Instruction

- Prepare the entries to record these transactions

- How are dividends and dividends payable reported in the financial statements prepared at December 31?

Read more: Problem-06: Corporations: Dividends, Retained Earnings, and Income Reporting

Knudsen Corporation was organized on January 1, 2019. during its first year, the corporation issued 2,000 shares of $50 par value preferred stock and 100,000 shares of $10 par value common stock. At December 31, the company declared the following cash dividends: 2019, $5,000; 2020, $12,000; and 2021, $28,000.

Instructions

- Show the allocation of dividends to each class of stock, assuming the preferred stock dividend is 6% and noncumulative.

- Show the allocation of dividends to each class of stock, assuming the preferred stock dividend is 7% and noncumulative.

- Journalize the declaration of the cash dividend at December 31, 2021, under part (b).

Read more: Problem-07: Corporations: Dividends, Retained Earnings, and Income Reporting

On January 1, 2019, Frontier Corporation had $1,000,000 of common stock outstanding that was issued at par: It also had retained earnings of $780,000. The company issued 40,000 shares of common stock at par on July 1 and earned net income of $400,00 for the year.

Instruction

- Par value is $10, and market price is $18.

- Par value is $5, and market price is $20.

Read more: Problem-08: Corporations: Dividends, Retained Earnings, and Income Reporting

On October 31, the stockholders equity section of Heins Company consists of common stock $500,000 and retained earnings $900,000. Heins is considering the following two courses of action. (1) declaring a 5% stock dividend on the 50,000, $10 par value shares outstanding, or (2) effecting a 2-for-1 stock split that will reduce par value to $5 per share. The current market price is $14 per share.

Instructions

Prepare a tabular summary of the effects of the alternative action on the components of stockholders' equity, outstanding shares, and par value per share. Use the following column headings: Before Action, After Stock Dividend, and After Stock Split.

Read more: Problem-09: Corporations: Dividends, Retained Earnings, and Income Reporting

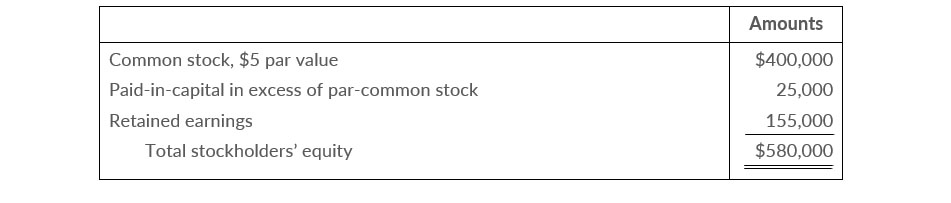

On October 1, Little Bobby Corporation's stockholders equity is as follows.

On October 1, Little Bobby declares and distributes a 10% stock dividend when the market price of the stock is $15 per share

Instructions

- Compute the par value per share (1) before the stock dividend and (2)after the stock dividend.

- Indicate the balances in the three stockholders' equity accounts after the stock dividend shares have been distributed..

Read more: Problem-10: Corporations: Dividends, Retained Earnings, and Income Reporting