S. Pagan and T. Tabor share income on a 6:4 basis. They have capital balances of $100,000 and $60,000, respectively, when Wolford is admitted to the partnership.

Instructions

Prepare the journal entry to record the admission of W. Wolford under each of the following assumptions

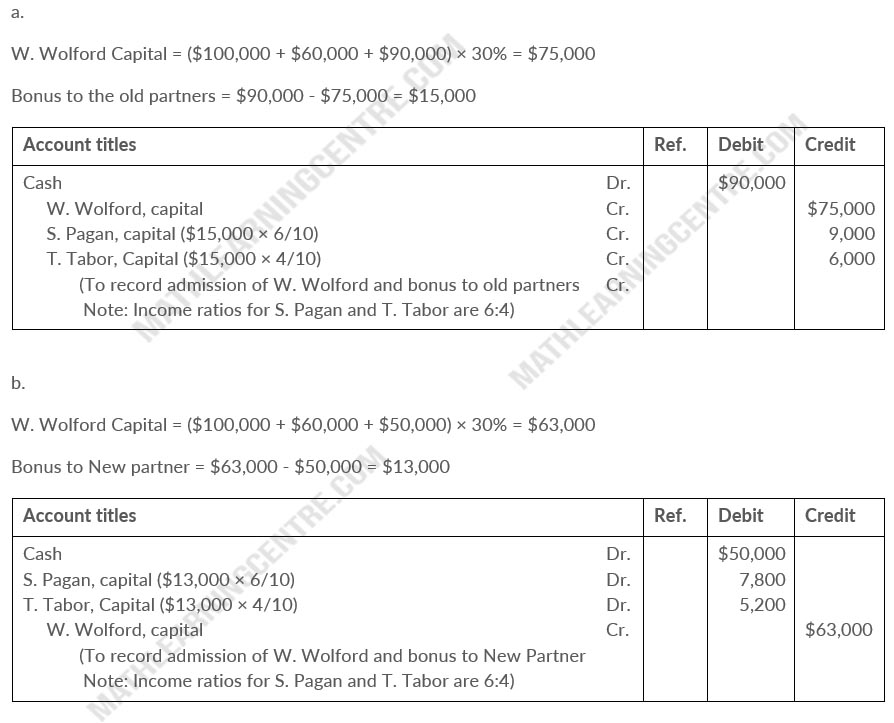

- Investment of $90,000 cash for a 30% ownership interest with bonuses to the existing partners.

- Investment of $50,000 cash for a 30% ownership interest with bonuses to the new partner.

Solution