Lott Company uses a job order cost system and applies overhead to productions on the basis of direct labor costs. On January 1, 2020, Job 50 was the only job in the process. The costs incurred prior to January 1 on this job were as follows: direct materials $20,000, direct labor $12,00, and manufacturing overhead $16,000. As of January 1, Job 49 had been completed at a cost of $90,000 and was part of the finished goods inventory. There was a $15,000 balance in the Raw Materials Inventory account.

during the month of January, Lott Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were also sold on account during the month for $122,000 and $158,000, respectively. The following additional events occurred during the month.

- Purchased additional raw materials of $90,000 on account

- Incurred factory labor costs of $70,000. Of this amount $16,000 related to employer payroll taxes.

- Incurred manufacturing overhead costs as follows: indirect materials $17,000, indirect labor $20,000, depreciation expense on equipment $12,000, and various other manufacturing overhead costs on account $16,000.

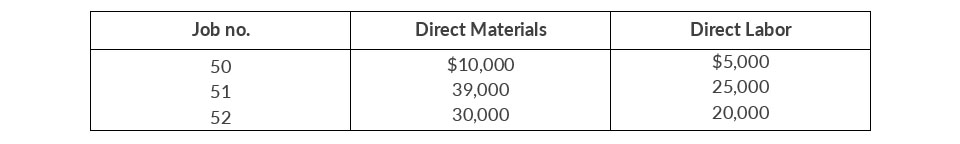

- Assigned direct materials and direct labor to jobs as follows.

Instructions

- Calculate the predetermined overhead rate for 2020, assuming Lott Company estimates total manufacturing overhead costs of $840,000, direct labor costs of $700,000, and direct labor hours of 20,000 for the year.

- Open job cost sheets for Jobs 50, 51, and 52. Enter the January 1 balances on the job cost sheet for Job 50.

- Prepare the journal entries to record the purchase of raw materials, the factor labor costs incurred, and the manufacturing overhead costs incurred during the month of January.

- Prepare the journal entries to record the assignment of direct materials, direct labor and manufacturing overhead costs to production. In assigning manufacturing overhead costs, use the overhead rate calculated in (a). Post all costs to the job cost sheets as necessary.

- Total the job cost sheets for any job(s) completed during the month. Prepare the journal entry (or entries) to record the sale of any job(s) during the month

- What is the balance in the Finished Goods Inventory account at the end of the month? What does this balance consist of?

- What is the amount of over or underapplied overhead?

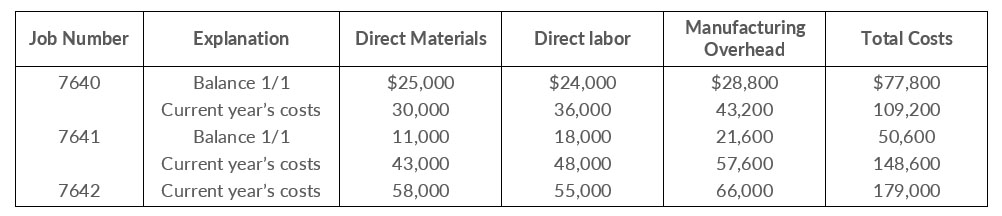

- Raw materials inventory totaled $15,000 on January 1. During the year, $140,000 of raw materials were purchased on account.

- Finished goods on January 1 consisted of Job No. 7638 for $87,000 and Job No. 7639 for $92,000

- Job No. 7640 and Job No. 7641 were completed during the year.

- Job Nos. 7638, 7639, and 7641 were sold on account for $530,000.

- Manufacturing overhead incurred on account totaled $120,000.

- Other manufacturing overhead consisted of indirect materials $14,000, indirect labor $18,000, and depreciation on factory machinery $8,000

Instructions

- Prove the agreement of Work in Process Inventory with job cost sheets pertaining to unfinished work. Calculate each of the following, then post each to the T-account: (1) beginning balance, (2) direct materials, (3) direct labor, (4) manufacturing overhead, and (5) completed jobs.

- Prepare the adjusting entry for manufacturing overhead, assuming the balance is allocated entirely to Cost of Goods Sold.

- Determine the gross profit to the reported for 2020.

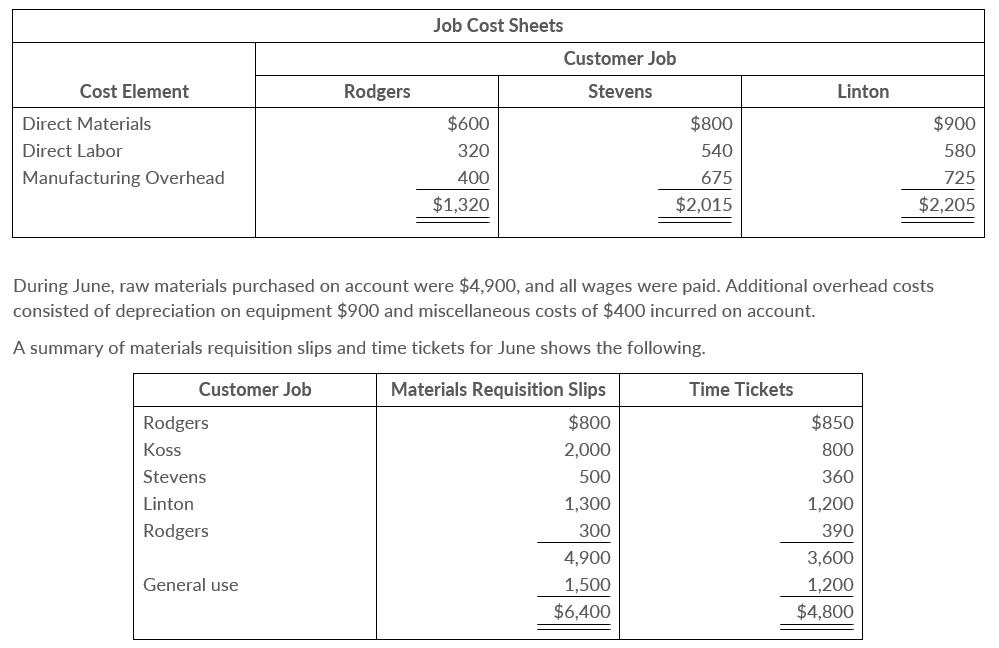

| Raw Materials Inventory | $4,200 | Manufacturing Overhead Applied | $32,640 |

| Work in Process Inventory | $5,540 | Manufacturing Overhead Incurred | $31,650 |

Overhead was charged to jobs at the same rate of $1.25 per dollar of direct labor cost. The patios for customers Rodgers, Stevens and Linton were completed during June and sold for a total of $18,900. Each customer paid in full.

Instructions

- Journalize the June transactions: (1) for purchase of raw materials, factory labor costs incurred, and manufacturing overhead costs incurred; (2) assignment of direct materials, labor; and overhead to production; and (3) completion of jobs and sale of goods.

- Post the entries to Work in Process Inventory.

- Reconcile the balance in Work in Process inventory with the costs of unfinished jobs.

- Prepare a cost of goods manufactured schedule for June

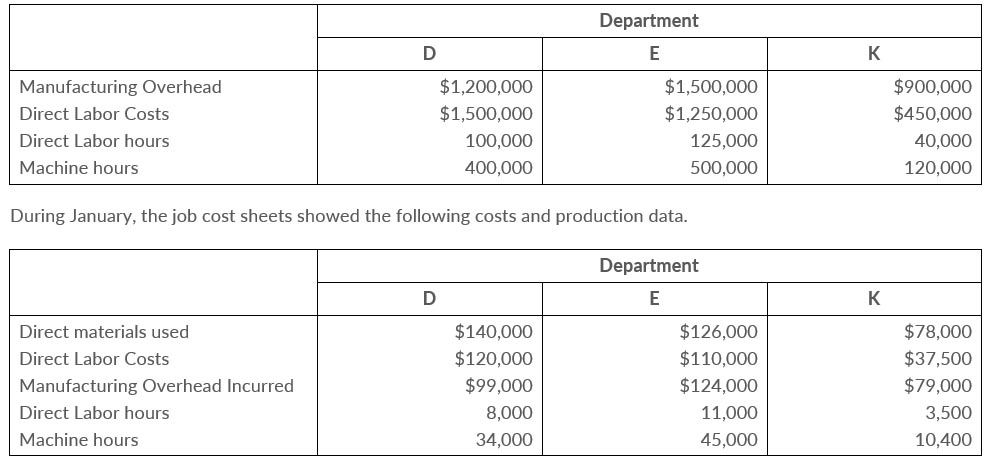

Instructions

- Compute teh predetermined overhead rate for each department

- Compute the total manufacturing costs assigned to jobs in January in each department.

- Compute the under- or overapplied overhead for each department at January 31

Other data

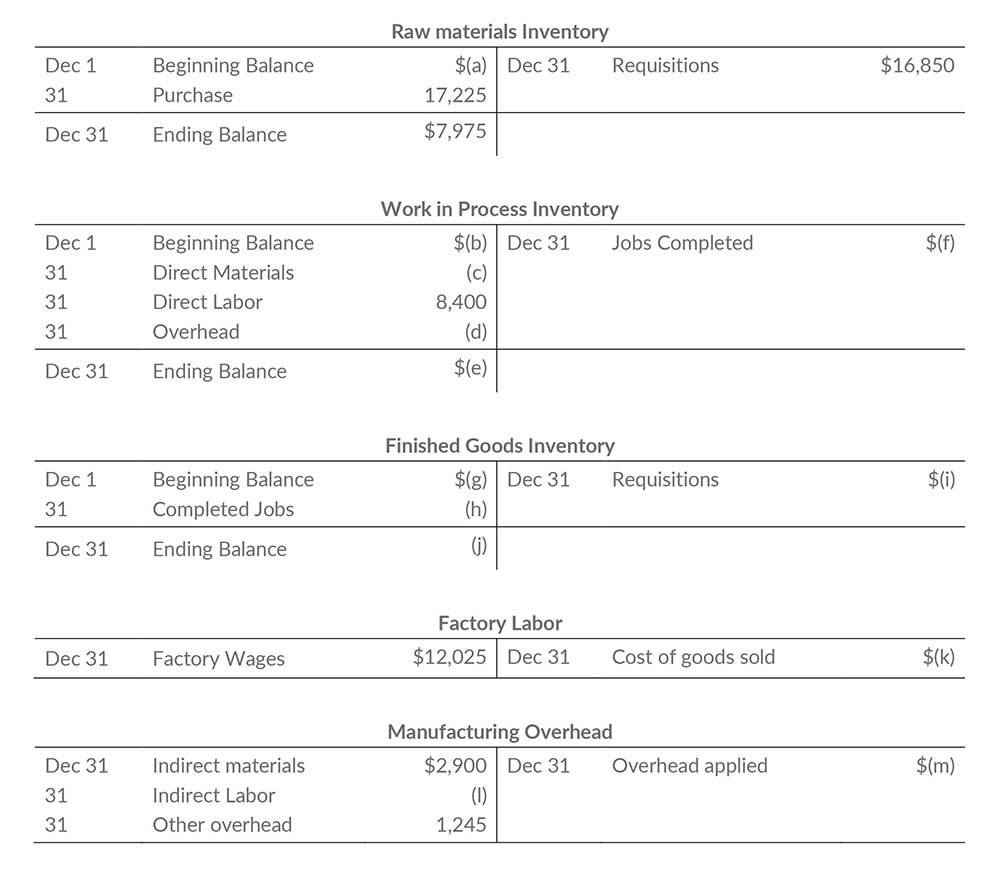

- On December 1, two jobs were in process: Job No. 154 and Job No. 155. These jobs had combined direct materials costs of $9,750 and direct labor costs of $15,000. Overhead was applied at a rate that was 75% of direct labor cost.

- During December, Job No. 156, 157, and 158 were started. On December 31. Job No. 158 was unfinished. This job had charges for direct materials $3,800 and direct labor $4,800, plus manufacturing overhead. All jobs, except for Job No. 158, were completed in December..

- On December 1, Job No. 153 was in the finished goods warehouse. It had a total cost of $5,000. On December 31, Job No. 157 was the only job finished that was not sold. It had a cost of $4,000.

- Manufacturing overhead was $1,470 underapplied in December.

Instructions

- Prepare the entry to record the factory labor costs for the month of January..

- Prepare the entry to assign factory labor to production.

| Job Number | Materials Requisition Slips | Labor Time Tickets | ||

| 429 | $2,500 | $1,900 | ||

| 430 | 3,500 | 3,000 | ||

| 431 | 4,400 | $10,400 | 7,600 | 12,500 |

| General Factory Use | 800 | 1,200 | ||

| $11,200 | $13,700 | |||

Instructions

- Prepare summary journal entries to record (1) the requisition slips, (2) the time tickets, (3) the assignment of manufacturing overhead to jobs, and (4) the completion of job N. 429.

- Post the entries to Work in Process Inventory. and prove the agreement f the control account with the job cost sheets. (Use a T-account.)

Instructions

- On the basis of the foregoing data, answer the following questions.

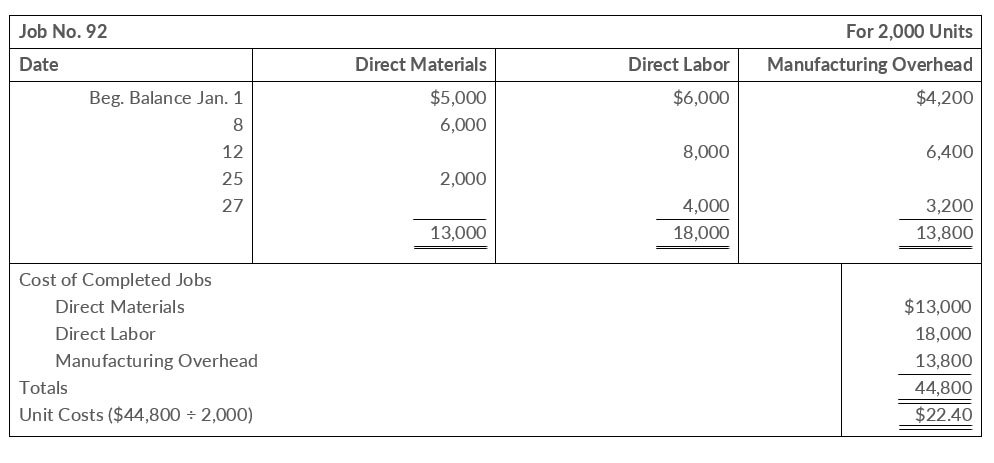

- What was the balance in Work in Process Inventory on January 1 if this was the only unfinished job?

- If manufacturing overhead is applied on the basis of direct labor cost, what overhead rte was used in each year?

- Prepare summary entries at January 31 to record the current year's transactions pertaining to Job No. 92.

Instructions

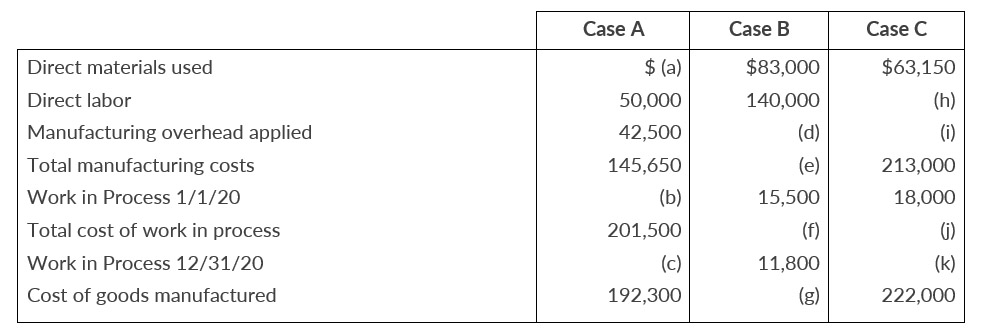

Indicate the missing amount for each letter. Assume that in all cases manufacturing overhead is applied on the basis of direct labor cost and the rate is the same.

Ikerd Company applies manufacturing overhead to jobs on the basis of machine hours used. Overhead costs are expected to total $300,000 for the year, and machine usage is estimated at 125,000 of hours.

For the year, $322,000 of overhead costs are incurred and 130,0000 hours are used.

Instructions

- Compute the manufacturing overhead rate for the year.

- What is the amount of under or over-applied overhead at December 31?

- Prepare the adjusting entry to assign the under or over-applied overhead for the year to cost of goods sold.