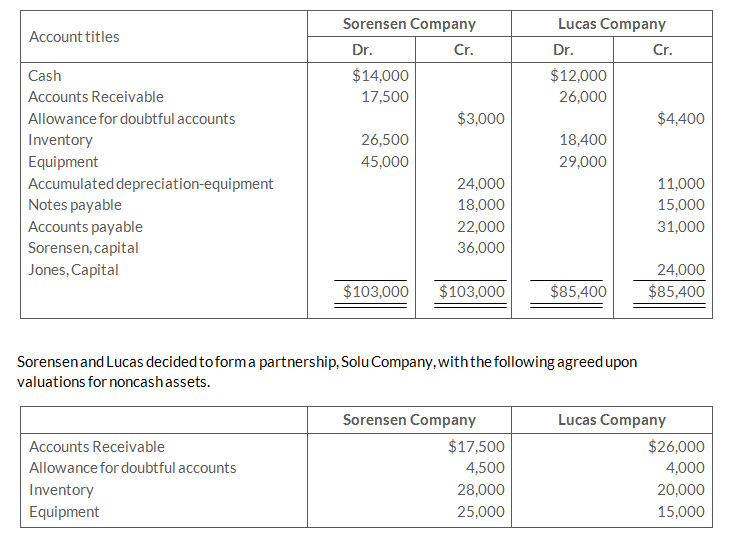

The post-closing trial balances of two proprietorships on January 1, 2019, are presented below.

All cash will be transferred to the partnership, and the partnership will assume all the liabilities of the two proprietorships. Further, it is agreed tat Sorensen will invest an additional $5,000 in cash, and Lucas will invest an additional $19,000 in cash.

Instructions

- Prepare separate journal entries to record the transfer of each proprietorship's assets and liabilities to the partnership.

- Journalize the additional cash investment by each partner.

- Prepare a classified balance sheet for the partnership on January 1, 2019.

At the end of its first year of operations on December 31, 2020, NBS Company's accounts show the following.

| Partner | Drawings | Capital |

| Art Niensted | $23,000 | $48,000 |

| Greg Bolen | 14,000 | 30,000 |

| Krista Sayler | 10,000 | 25,000 |

The capital balance represents each partners initial capital investment. Therefore, net income or net loss for 2020 has not been closed to the partners' capital accounts

Instructions

- Journalize the entry to record the division of net income for the year 2020 under each of the following independent assumptions.

- Net income is $30,000. Income is shared 6:3:1

- Net income is $40,00, Niensted and Bolen are given salary allowances of $15,000 and $10,000, respectively. The remainder is shared equally.

- Net income is $19,000. Each partner is allowed interest of 10% on beginning capital balances. Niensted is given a $15,000 salary allowance. The remainder is shared equally.

- Prepare a schedule showing the division of net income under assumption (3) above

- Prepare a partners' capital statement for the year under assumption (3) above.

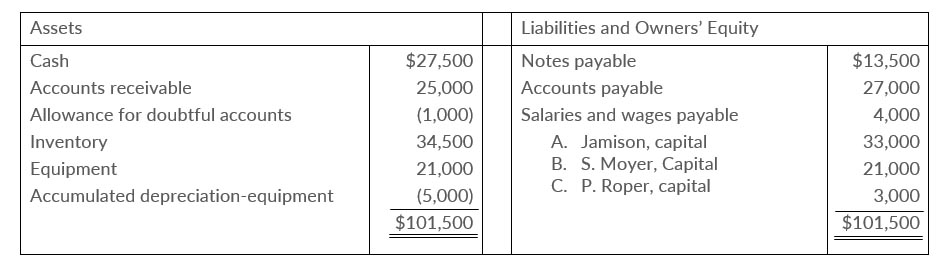

The partners in Crawford Company decide to liquidate the firm when the balance sheet shows the following.

May 31, 2021

The partners share income and loss 5:3:2. During the process of liquidation, the following transaction were competed in the following sequence.

- A total of $51,000 was received from converting noncash assets into cash.

- Gain or loss on realization was allocated to partners

- Liabilities were paid in full.

- P. Roper paid his capital deficiency.

- Cash was paid to the partners with credit balances.

Instructions

- Prepare the entries to record the transactions.

- Post to the cash and capital accounts.

- Assume that Roper is unable to pay the capital deficiency.

- Prepare the entry to allocate Roper's debit balance to Jamison and Moyer

- Prepare the entry to record the final distribution of cash.

At April 30, partners capital balances in PDL Company are G. Donley $52,000, C. Lamar $48,000, and J. Pinkston $18,000. The income sharing ratios are 5:4:1 respectively. On May 1, the PDLT Company is formed by admitting J. Terrell to the firm as a partner.

Instructions

- Journalize the admission of Terrell under each of the following independent assumption

- Terrell purchases 50% of Pinkston's ownerhsip interest by paying Pinkston $16,000 each.

- Terrell purchases 33 1/3% of Lamar's ownership interest by paying Lamar $15,000 in cash.

- Terrel invests $62,000 for a 30% ownership interest, and bonuses are given to the old partners.

- Terrell invests $42,000 for a 30% ownership interest which includes a bonus to the new partner.

- Lamar's capital balance is $32,000 after admitting Terrell to the partnership by investment. If Lamar's ownership interest is 20% of total partnership capital, what were (1) Terrell's cash investment and (2) the bonus to the new partner?.

On December 31, the capital balances and income ratios in TEP Companyare as follows.

| Partner | Capital Balance | Income Ratio |

| Brayer | $60,000 | 50% |

| Emig | 40,000 | 30% |

| Posada | 30,000 | 20% |

Instructions

- Journalize the withdrawal of Posada under each of the following assumptions.

- Each of the continuing partners agrees to pay $18,000 in cash from personal funds to purchase Posada"s ownership equity. Each receives 50% of Posada"s equity.

- Emig agrees to purchase Posada"s ownership interest for $25,000 cash.

- Posada is paid $34,000 from partnership assets, which includes a bonus to the retiring partner.

- Posada is paid $22,000 from partnership assets, and bonuses to the remaining partners are recognized.

- If Emig"s capital balance after Posada"s withdrawal is $43,600, what were (1) the total bonus to the remaining partners and (2) the cash paid by the partnership to Posada?

Mark Rensing has prepared the following list of statements about partnerships

- A partnership is an association of three or more persons to carry on as co-owners of a business for profit.

- The legal requirements for forming a partnership can be quite burdensome.

- A partnership is not an entity for financial reporting purposes.

- The net income of a partnership is taxed as a separate entity.

- The act of any partner is binding on all other partners, even when partners perform business acts beyond the scope of their authority.

- Each partner is personally and individually liable for all partnership liabilities

- When a partnership is dissolved, the assets legally revert to the original contributor.

- In a limited partnership, one or more partners have unlimited liability and one or more partners have limited liability for the debts of the firm.

- Mutual agency is a major advantage of the partnership form of business.

Instructions

K. decker, S. Rosen, and E. toso are forming a partnership. Decker is transferring $50,000 of personal cash to the partnership. Rosen owns land worth $15,000 and a small building worth $80,000, which she transfers to the partnership. Toso transfers to the partnership cash of $9,000, accounts receivable of $32,000, and equipment worth $39,000. The partnership expects to collect $29,000 of the accounts receivable.

Instructions

- Prepare the journal entries to record each of the partners investments.

- What amount would be reported as total owner's equipty immediately after the investments?

Suzy Vopat has owned and operated a proprietorship for several years. On January 1, She decides to terminate this business and become a partner in the firm of Vopat and Sigma. Vapar's investment in the partnership consists of $12,000 in cash, and he following assets of the proprietorship; accounts receivable $14,0000 less allowance for doubtful accounts of $2,000, and equipment $30,000 less accumulated depreciation of $4,000. It is agreed that tthe allowance for doubtful accounts should be $3,000 for the partnership. The fair value of the equipment is $23,500.

Instructions

Journalize Vapat's admission to the firm of Vopat and Sigma.

McGill and Smyth have capital balances on January 1 of $50,000 and $40,000, respectively. The partnership income-sharing agreement provides for () annual salaries of $22,000 for McGill and $13,000 for Smyth, (2) interest at 10% on beginning capital balances, and (3) remaining income or loss to be shares 60% by McGill and 40% by Smyth.

Instructions

- Prepare a schedule showing the distribution of net income, assuming net income is (1) $50,000 and (2) $36,000.

- Journalize the allocation of net income in each of the situations above.

Coburn (beginning capital, $60,000) and Webb (beginning capital $90,000) are partners. During 2019, the partnership earned net income of $80,000, and Coburn made drawings of $18,000 while Webb made drawings of $24,000.

Instructions

- Assume the partnership income sharing agreement calls for income to be divided 45% to Coburn and 55% to Webb. Prepare the journal entry to record the allocation of net income.

- Assume the partnership income-sharing agreement calls for income to be divided with a salary of $30000 to Coburn and $25,000 to Webb, with the remainder divided 45% to Coburn and 55% to Webb.. Prepare the journal entry to record the allocation of net income.

- Assume the partnership income-sharing agreement calls for income to be divided with a salary of $40000 to Coburn and $35,000 to Webb, interest of 10% on beginning capital, and the remainder divided 50%-50%. Prepare the journal entry to record the allocation of net income.

- Compute the partners' ending capital balances under the assumption in part (c)