- On February 26, Houghton shipped goods costing $800 to a customer and charged the customer $1,000. the goods were shipped with terms FOB shipping point and the receiving report indicates that the customer received the goods on March 2.

- On February 26, Crain Inc. shipped goods to Houghton under terms FOB shipping point. The invoice price was $450 plus $30 for freight. The receiving report indicates taht the goods were received by Houghton on March 2.

- Houghton had $720 of inventory isolated in the warehouse. The inventory is designated for a customer who as requested that the goods be shipped on March 10.

- Also included in Houghton's warehouse is $700 of inventory that Korenic Producers shipped to Houghton on consignment.

- On February 26, Houghton issued a purchase order to acquire goods costing $900. The goods were shipped with terms FOB destination on February 27. Houghton received the goods on March 2.

- On February 26, Houghton shipped goods to a customer under terms FOB destination. The invoice price was $390; the cost of the items was $240. The receiving report indicates that the goods were received by the customer on March 2.

Instructions

| Oct. 3 | 2,500 @ $8 | Oct. 19 | 3,000 @ $10 |

| Oct. 9 | 3,500 @ $9 | Oct. 25 | 4,000 @ $11 |

During October, 10,900 units were sold, Glee uses a periodic inventory system.

Instructions

- Determine the cost of goods available for sale

- Determine (1) the ending inventory, and (2) the cost of goods sold under each of the assumed cost flow methods (FIFO, LIFO, and average-cost). Prove the accuracy of the cost of goods under the FIFO and LIFO methods.

- Which cost flow method results in (1) the highest inventory amount for the balance sheet, and (2) the highest cost o goods sold for the income statement?

| Mar. 15 | 400 units at $23 | Sept. 4 | 330 units at $26 |

| July 20 | 250 units at $24 | Dec. 2 | 100 units at $29 |

1,000 units were sold. Sekhon Company uses a periodic inventory system

Instructions

- Determine the cost of goods available for sale

- Determine (1) the ending inventory, and (2) the cost of goods sold under each of the assumed cost flow methods (FIFO, LIFO, and average-cost). Prove the accuracy of the cost of goods under the FIFO and LIFO methods.

- Which cost flow method results in (1) the highest inventory amount for the balance sheet, and (2) the highest cost o goods sold for the income statement?

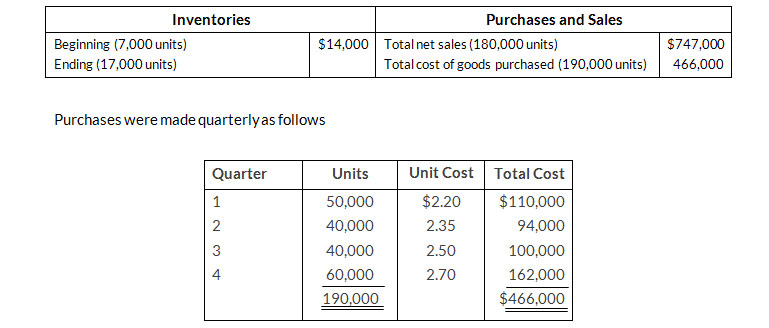

Operating expenses were $130,000, and the company's income tax rate is 40%.

Instructions

- Prepare comparative condensed income statements for 2019 under FIFO and LIFO(Show computations of ending inventory)

- Answer the following operations for management.

- Which cost flow method (FIFO or LIFO) produces the more meaningful inventory amount for the balance sheet? Why?

- Which cost flow method (FIFO or LIFO) produces the more meaningful net income? Why?

- Which cost flow method (FIFO or LIFO) is more likely to approximate the actually physical flow of goods? Why?

- How much more cash will be available for management under LIFO than under FIFO? Why?

- Will gross profit under the average-cost method be higher or lower than FIFO? Than LIFO? (Note: It is not necessary to quantify your answer)

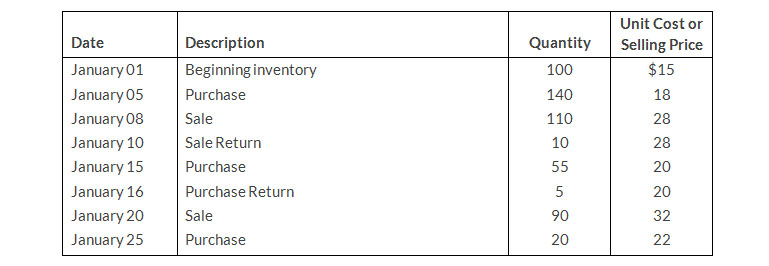

Instructions

- Calculate (i) ending inventory, (ii) cost of goods sold, (iii) gross profit, and (iv) gross profit rate under each of the following methods.

(1) LIFO (2) FIFO (3) Average-cost - Compare results for the three cost flow assumptions.

| March 1 | Beginning inventory 2,000 liters at a cost of 60¢ per liter. |

| March 3 | Purchased 2,500 liters at a cost of 65¢ per liter. |

| March 5 | Sold 2,300 liters for $1.05 per liter. |

| March 10 | Purchased 4,000 liters at a cost of 72¢ per liter. |

| March 20 | Purchased 2,500 liters at a cost of 80¢ per liter. |

| March 30 | Sold 5,200 liters for $1.25 per liter. |

Instructions

- Prepare partial income statements through gross profit, and calculate the value of ending inventory that would be reported on the balance sheet, under each of the following cost flow assumptions. (Round ending inventory and cost of goods sold to the nearest dollar.)

- Specific identification method assuming:

- The March 5 sale consisted of 1,000 liters from the March 1 beginning inventory and 1,300 liters from the March 3 purchased; and

- The March 30 sale consisted of the following number of units sold from beginning inventory and each purchase: 450 liters from March 1; 550 liters from March3; 2,900 liters from March 10; 1,300 liters from March 20.

- FIFO

- LIFO

- Specific identification method assuming:

- How can companies use a cost flow method to justify price increases? Which cost flow method would best support an argument to increase prices?

| Inventory, January 1 (10,000 units) | $47,000 |

| Cost of 100,000 units purchased | 532,000 |

| Selling price of 84,000 units sold | 735,000 |

| Operating expenses | 140,000 |

Units purchased consisted of 35,000 units at $5.10 on May 10: 35,000 units at $5.30 on August 15; and 30,000 units at $5.60 on November 20. Income taxes are 30%.

Instructions

- Prepare comparative condensed income statements for 2019 under FIFO and LIFO(Show computations of ending inventory)

- Answer the following operations for management.

- Which cost flow method (FIFO or LIFO) produces the most meaningful inventory amount for the balance sheet? Why?

- Which cost flow method (FIFO or LIFO) produces the most meaningful net income? Why?

- Which cost flow method (FIFO or LIFO) is most likely to approximate the actually physical flow of goods? Why?

- How much more cash will be available for management under LIFO than under FIFO? Why?

- How much of the gross profit under FIFO is illusory in comparison with the gross profit under LIFO?

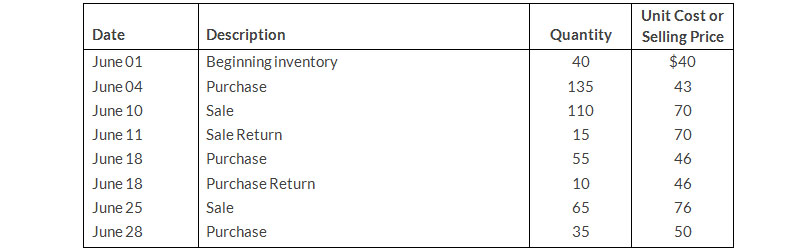

Instructions

- For each of the following cost flow assumptions, Calculate (i) cost of goods sold, (ii) ending inventory, and (iii) gross profit.

- LIFO

- FIFO

- Average-cost

- Compare results for the three cost flow assumptions.

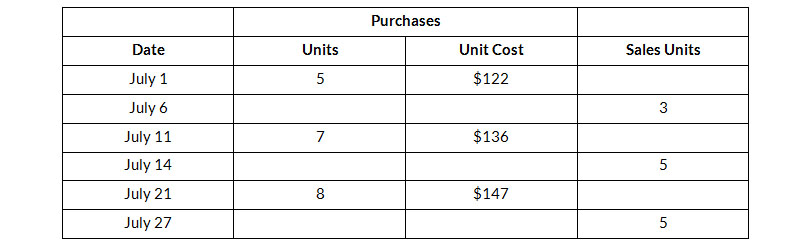

Instructions

- Determine the ending inventory under a perpetual inventory system using (1) FIFO, (2) moving-average cost, and (3) LIFO.

- Which cost flow method produces the highest ending inventory valuation?

| November | December (to 12/26) | |

| Net Sales | $600,000 | $700,000 |

| Beginning inventory | 32,000 | 36,000 |

| Purchases | 389,000 | 420,000 |

| Purchase returns and allowances | 13,300 | 14,900 |

| Purchase discounts | 8,500 | 9,500 |

| Freight-in | 8,800 | 9,900 |

| Ending inventory | 36,000 | ? |

Instructions

- Compute the gross profit rate for November.

- Using the gross profit rate for November, determine the estimated cost of inventory lost in the fire