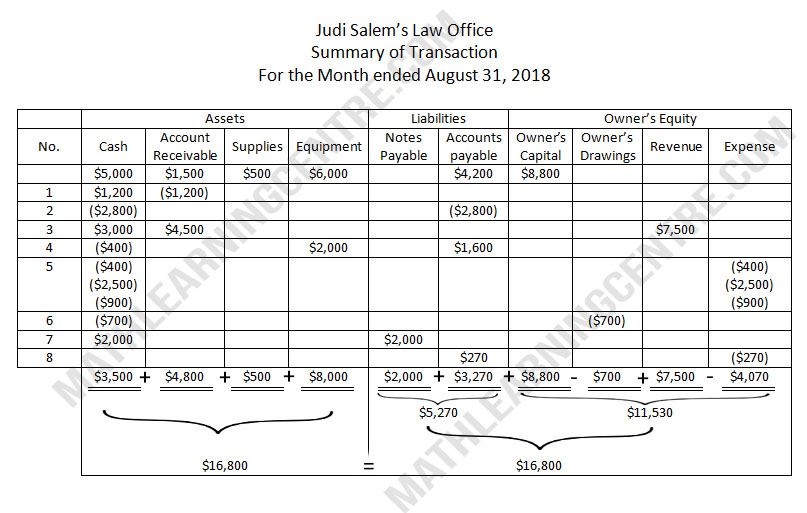

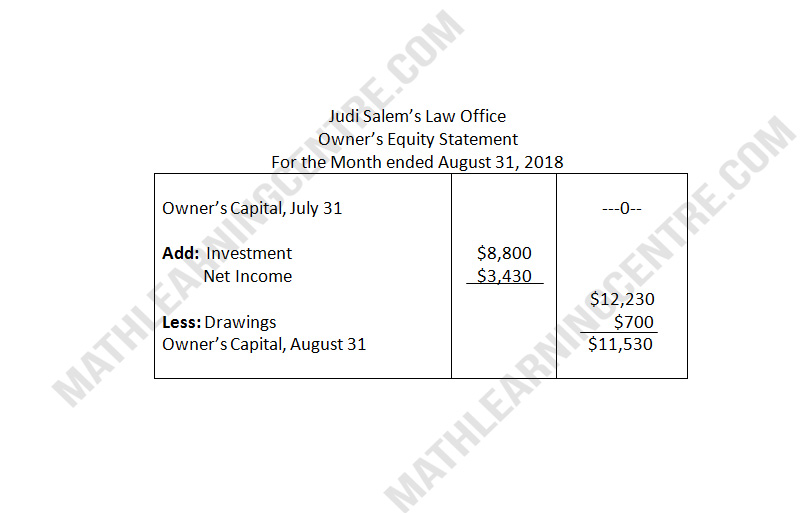

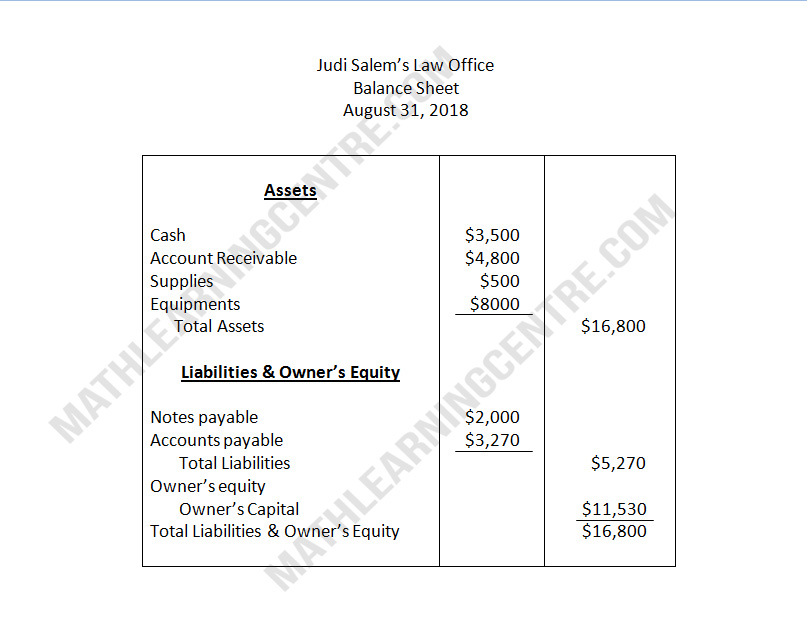

Judi Salem opened a law office on July 1, 2018. On July 31, the balance sheet showed Cash $5,000, Account Receivable $1,500, Supplies $500, Equipment $6,000, Accounts Payable $4,200 and Owner's Capital $8,800. During August, the following transactions occurred:

- Collected $1,200 of accounts receivable.

- Paid $2,000 cash on accounts payable.

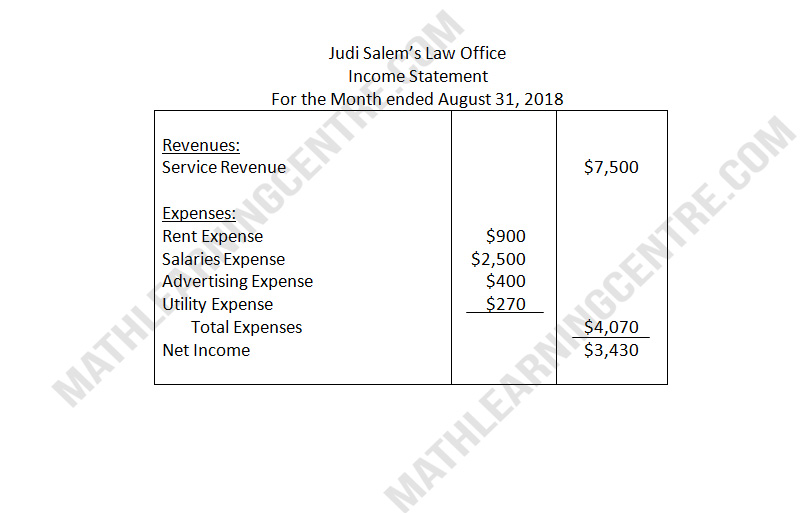

- Recognized revenue of $7,500 of which $3,000 is collected in cash and the balance is due in September

- Purchased additional equipment for $2,000, paying $400 in cash and the balance on account.

- Paid Salaries $2,500 rent for August $900, and advertising expenses $400.

- Withdrew $700 cash for personal use

- Received $2,000 from Standard Federal Bank--money borrowed on a note payable.

- Incurred utility expenses for month on account $270.