On December 31, the capital balances and income ratios in TEP Companyare as follows.

| Partner | Capital Balance | Income Ratio |

| Brayer | $60,000 | 50% |

| Emig | 40,000 | 30% |

| Posada | 30,000 | 20% |

Instructions

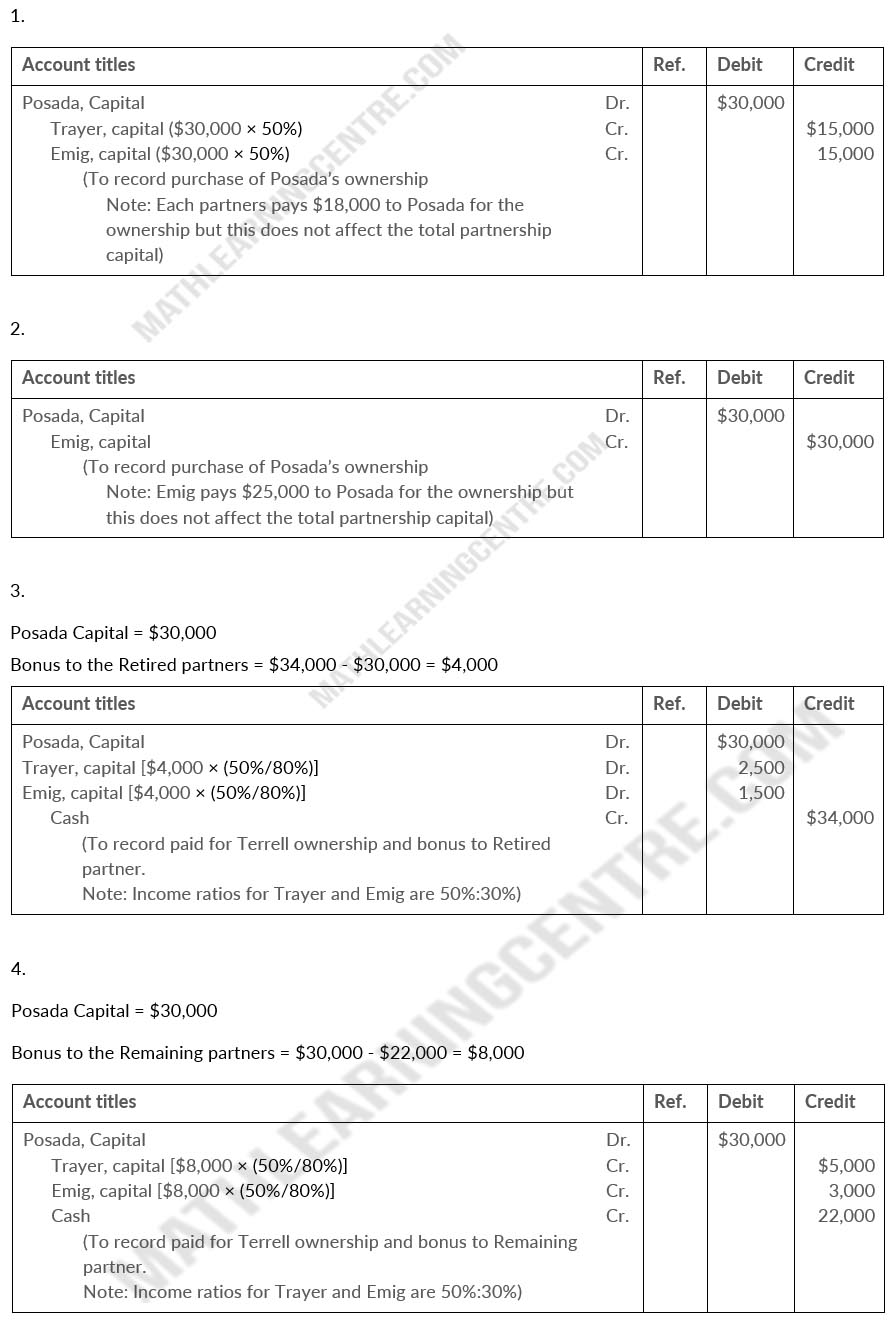

- Journalize the withdrawal of Posada under each of the following assumptions.

- Each of the continuing partners agrees to pay $18,000 in cash from personal funds to purchase Posada"s ownership equity. Each receives 50% of Posada"s equity.

- Emig agrees to purchase Posada"s ownership interest for $25,000 cash.

- Posada is paid $34,000 from partnership assets, which includes a bonus to the retiring partner.

- Posada is paid $22,000 from partnership assets, and bonuses to the remaining partners are recognized.

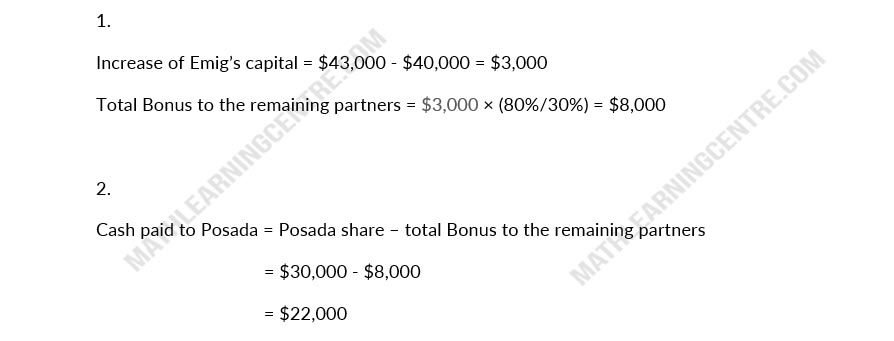

- If Emig"s capital balance after Posada"s withdrawal is $43,600, what were (1) the total bonus to the remaining partners and (2) the cash paid by the partnership to Posada?

Solution