On January 1, 2020, Geffrey Corporation had the following stockholders equity accounts.

| Common Stock ($20 par value, 60,000 shares issued and outstanding) | 1,200,000 |

| Paid-in Capital in Excess par-Common Stock | 200,000 |

| Retained Earnings | 600,000 |

During the year, the following transactions occurred..

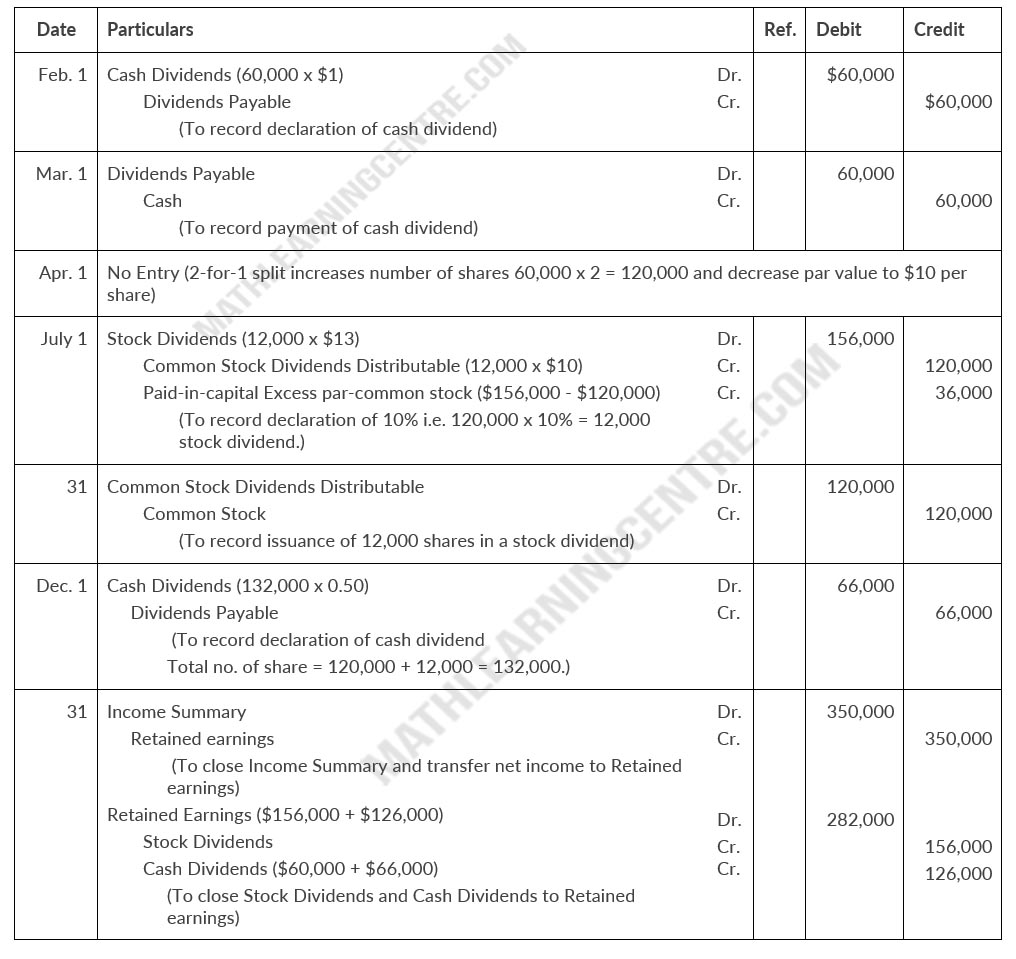

| Feb. 1 | Declared a $1 cash dividend per share to stockholders of record on February 15, payable March 1. |

| Mar. 1 | Paid the dividend declared in February. |

| Apr. 1 | Announced a 2-for-1 stock split. Prior to the split, the market price per share was $36. |

| July 1 | Declared a 10% stock dividend to stockholders of record on July 15, attributable July 31. On July 1, the market price of the stock was $13 per share |

| 31 | Issued the shares for the stock dividend. |

| Dec. 1 | Declared a $0.50 per share dividend to stockholders of record on December 15, payable January 5, 2021. |

| 31 | Determined that net income for the year was $350,000. |

Instruction

- Journalize the transactions and the closing entry for net income and dividends.

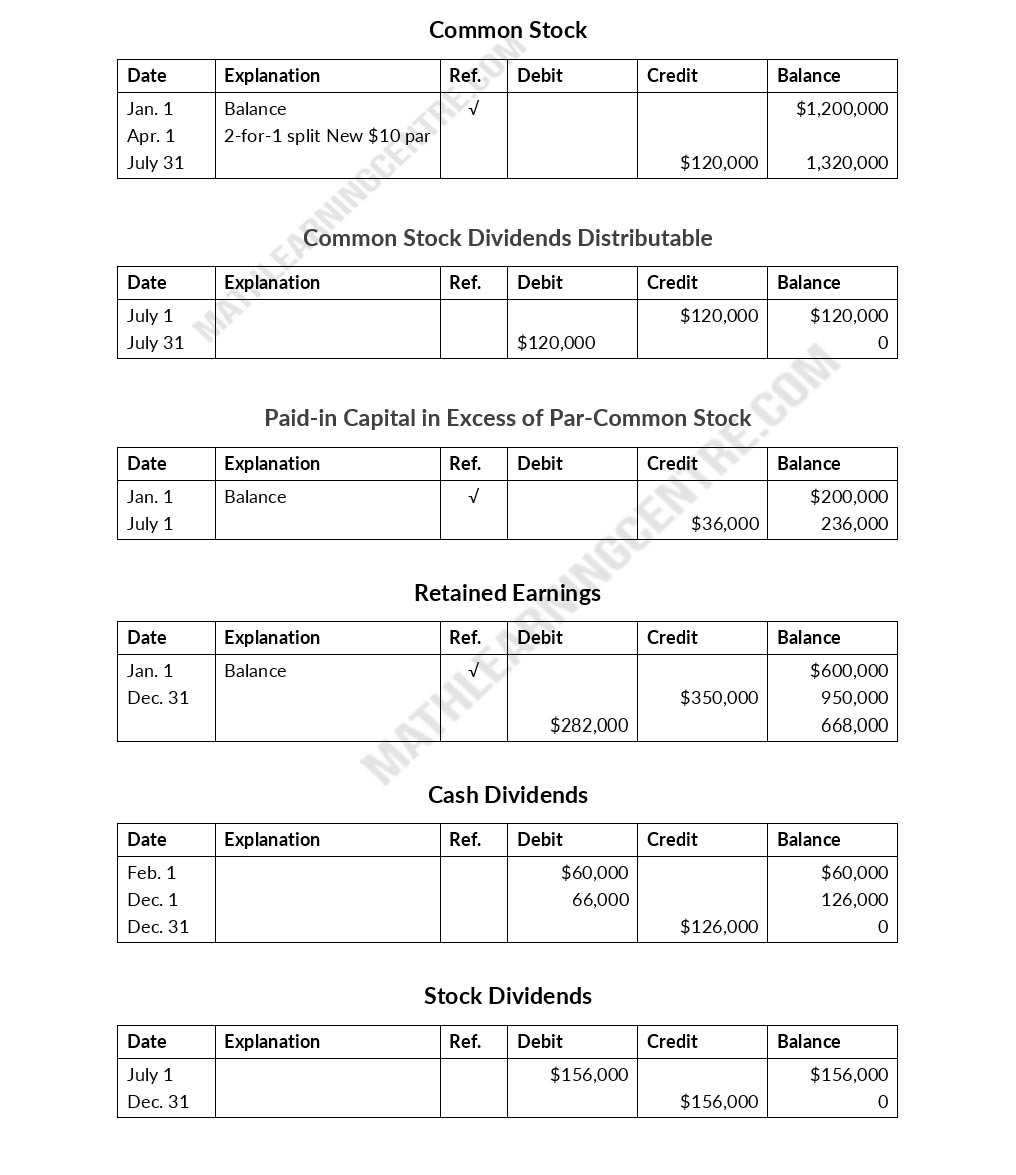

- Enter the beginning balances, and post the entries to the stockholders' equity accounts.

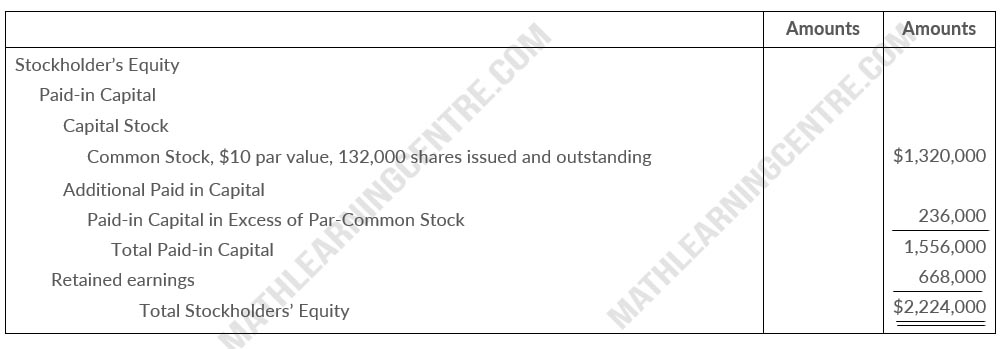

- Prepare the stockholders' equity section at December 31.

Solution

Journal Entries

Balance Sheet (Partial)

December 31, 2020