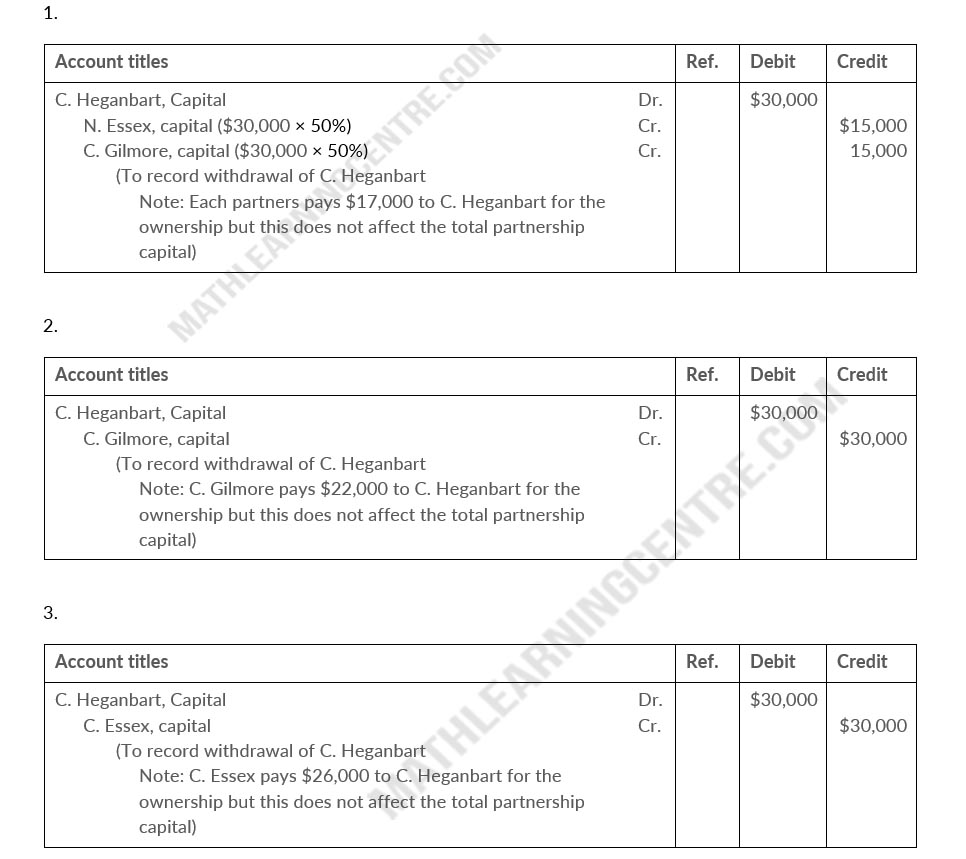

N. Essex, Cgilmore, and C. Heganbart have capital balances of $50,000, $50,000, and $30,000 respectively. Their income ratios are 4:4:2. Heganbart withdraws from the partnership under each of the following independent conditions.

- Essex and Gillmore agree to purchase Heganbart's equity by paying $17,000 each from their personal assets. Each purchaser receives 50% of Heganbar's equity.

- Gillmore agrees to purchase all of heganbart's equity by paying $22,000 cash from here personal assets.

- Essex agrees to purchase all of Heganbart's equity by paying $26,000 cash from his personal assets.

Instructions

Journalize the withdrawal of Heganbart under each of the assumptions above.

Solution