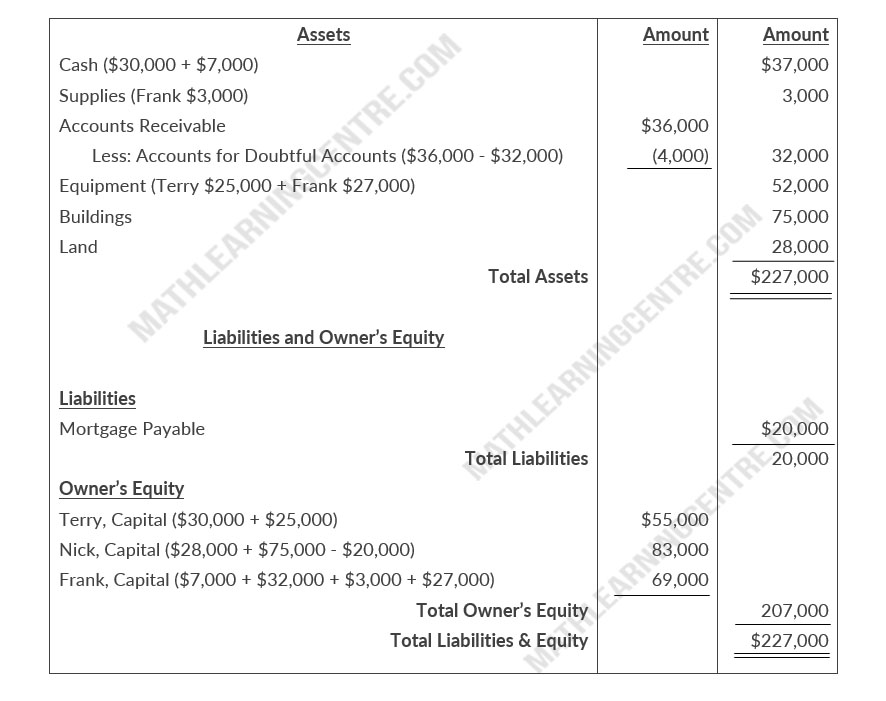

Terry, Nick, and Frank are forming the Doctor Partnership. Terry is transferring $30,000 of personal cash and equipment worth $25,000 to the partnership. Nick owns land worth $28,000 and a small building worth $75,000, which he transfers to the partnership. There is a long term mortgage of $20,000 on the land and building. which the partnership assumes. Frank transfers cash of $7,000, accounts receivable of $36,000, supplies worth $3,000, and equipment worth $27,000 to their partnership. the partnership expects to collect $32,000 of the accounts receivable.

Instructions

Prepare a classified balance sheet for the partnership after the partners' investments on December 31, 2020.

Solution

December 1, 2020