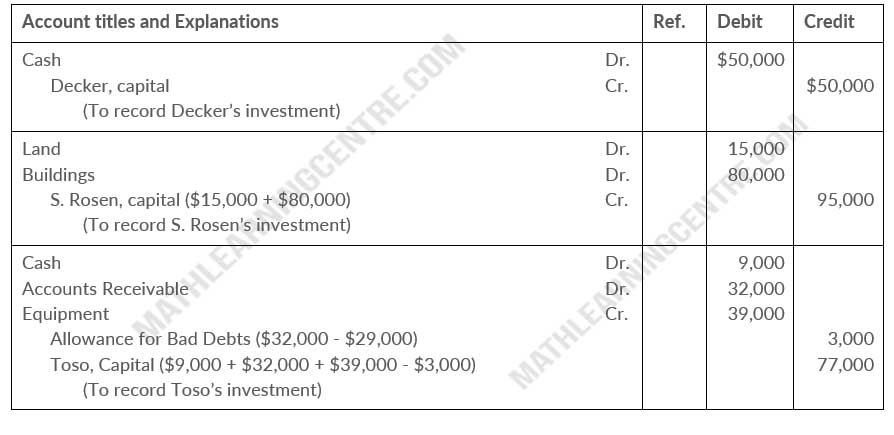

K. decker, S. Rosen, and E. toso are forming a partnership. Decker is transferring $50,000 of personal cash to the partnership. Rosen owns land worth $15,000 and a small building worth $80,000, which she transfers to the partnership. Toso transfers to the partnership cash of $9,000, accounts receivable of $32,000, and equipment worth $39,000. The partnership expects to collect $29,000 of the accounts receivable.

Instructions

- Prepare the journal entries to record each of the partners investments.

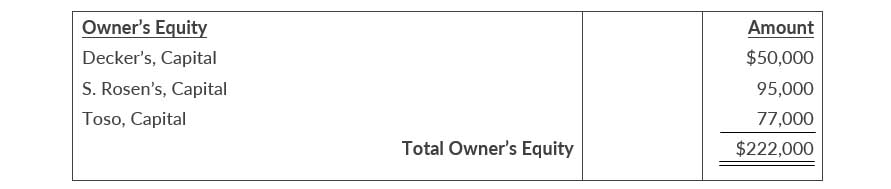

- What amount would be reported as total owner's equipty immediately after the investments?

Solution