Coburn (beginning capital, $60,000) and Webb (beginning capital $90,000) are partners. During 2019, the partnership earned net income of $80,000, and Coburn made drawings of $18,000 while Webb made drawings of $24,000.

Instructions

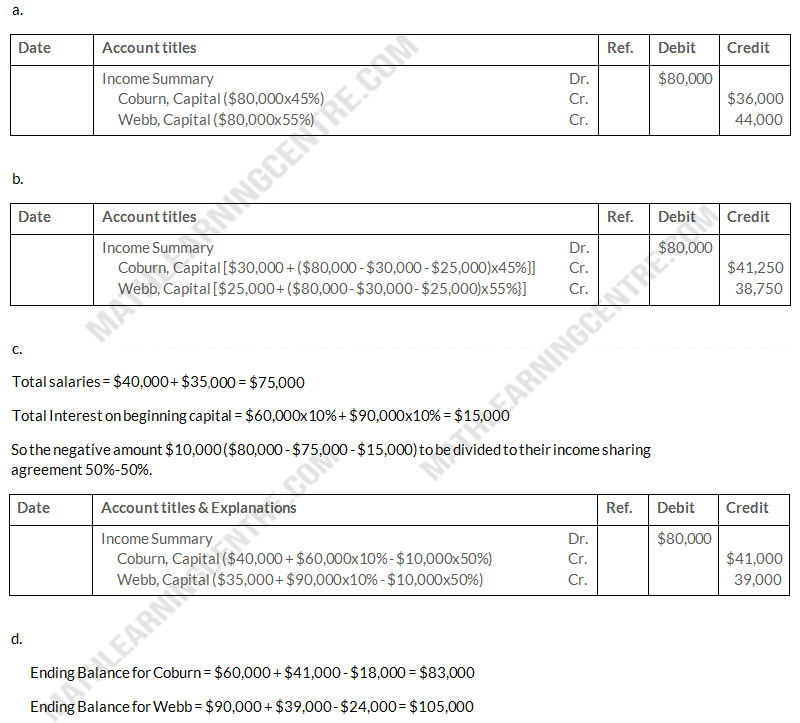

- Assume the partnership income sharing agreement calls for income to be divided 45% to Coburn and 55% to Webb. Prepare the journal entry to record the allocation of net income.

- Assume the partnership income-sharing agreement calls for income to be divided with a salary of $30000 to Coburn and $25,000 to Webb, with the remainder divided 45% to Coburn and 55% to Webb.. Prepare the journal entry to record the allocation of net income.

- Assume the partnership income-sharing agreement calls for income to be divided with a salary of $40000 to Coburn and $35,000 to Webb, interest of 10% on beginning capital, and the remainder divided 50%-50%. Prepare the journal entry to record the allocation of net income.

- Compute the partners' ending capital balances under the assumption in part (c)

Solution