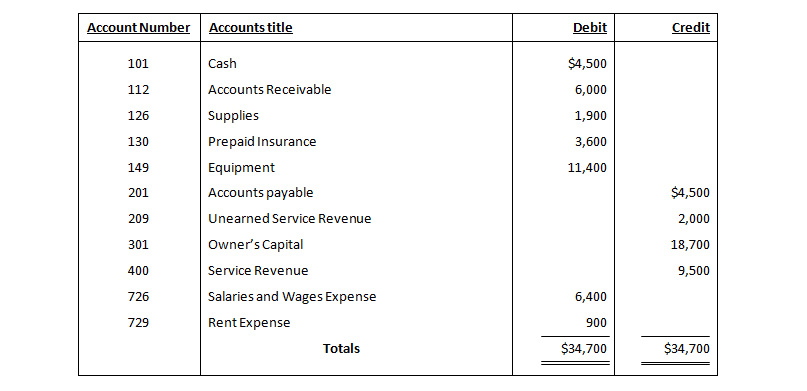

Trial Balance

May 31, 2019

Other data

- $900 of supplies have been used during the month.

- Utilities expense incurred but not paid on May 31, 2019, $250.

- The insurance policy is for 2 years.

- $400 of the balance in the unearned service revenue account remains unearned at the end of the month.

- May 31 is a Wednesday, and employees are paid on Friday, Krause Consulting has two employees, who are paid $920 each for a 5-day work week.

- The office furniture has a 5-year life with no salvage value. It is being depreciated at $190 per month for 60 months.

- Invoices representing $1,700 of services performed during the month have not been recorded as of May 31.

Instructions

- Prepare the adjusting entries for the month of May. Use J4 as the page number for your journal.

- Post the adjusting entries to the ledger accounts. Enter the totals from the trial balance as beginning account balances and place a check mark in the posting reference column.

- Prepare an adjusted trial balance at May 31, 2019

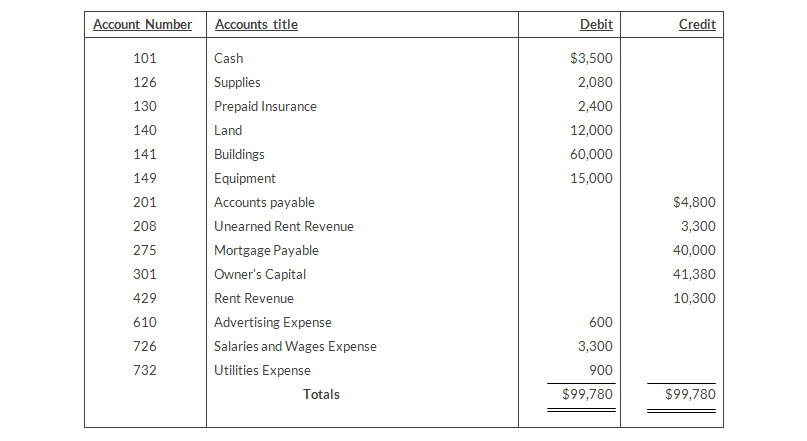

Trial Balance

May 31, 2019

Other data

- Prepaid insurance is a 1-year policy starting May 1, 2019.

- A count of supplies shows $750 of unused supplies on May 31.

- Annual depreciation is $3,000 on the buildings and $1,500 on equipment.

- The mortgage interest rate is 12%. (the mortgage was taken ot on May 1.)

- Two-thirds of the unearned rent revenue has been earned.

- Salaries of $750 are accrued and unpaid at May 31.

Instructions

- Prepare the adjusting entries on May 31.

- Prepare a ledger using the three-column form of account. Enter the trial balance amounts and post the adjusted entries. (Use J1 as the posting reference.)

- Prepare an adjusted trial balance at May 31, 2019

- Prepare an income statement and an owner's equity statement for the month of May and a balance sheet at May 31.