| Amount | |

| Sales | $4,800,000 |

| Cost of goods sold | 3,800,000 |

| Selling and administrative expenses | 405,000 |

| Net Income | $ 795,000 |

Fixed costs for the period were cost of goods sold $960,000, and selling and administrative expenses $225,000.

In July, normally a slack manufacturing month. ThreePoint Sports receives a special order for 10,000 basketballs at $28 each from the Greek Basketball Association (GBA). Acceptance of the order would increase variable selling and administrative expenses $0.75 per unit because of shipping costs but would not increase fixed costs and expenses.

Instructions

- Prepare an incremental analysis for the special order.

- Should ThreePoint Sports inc. accept the special order? Explain your answer

- What is the minimum selling price on the special order to produce net income of $5.00 per ball?

- What nonfinancial factors should management consider in making its decision?

Read more: Problem-1: Incremental Analysis and Capital Budgeting

The management of Shatner Manufacturing Company is trying to decide whether to continue manufacturing a part or to buy it from an outside supplier. The part, called CISCO, is component of the company's finished product.

The following information was collected from the accounting records and production data for the year ending December 31, 2023

- 8,000 units of CISCO were produced in the Machining Department

- Variable manufacturing costs applicable to the production of each CISCO unit were direct materials $4.80, direct labor $4.30, Indirect labor $0.43, utilities $0.40.

Read more: Problem-2: Incremental Analysis and Capital Budgeting

Read more: Problem-3: Incremental Analysis and Capital Budgeting

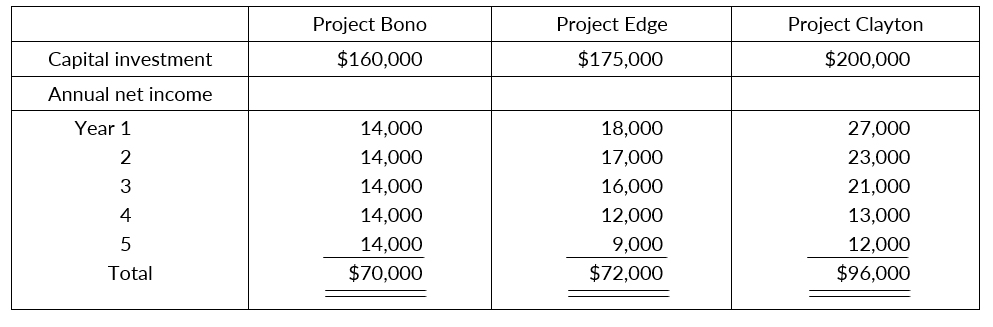

Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.)

Instructions

- Compute the cash payback period for each project. (Round to two decimals.)

- Compute the net present value for each project. (Round to nearest dollar.)

- Compute the annual rate of return for each project. (Round to two decimals.)

- Rank the projects on each of the foregoing bases. Which project do yourecommend?

- Five used vans would cost a total of $75,000 to purchase and would have a 3-year useful life with negligible salvage value. Lon plans to use straight-line depreciation.

- Ten drivers would have to be employed at a total payroll expense of $48,000. Other annual out-of-pocket expenses associated with running the commuter service would include Gasoline $16,000, Maintenance $3,300, Repairs $4,000, Insurance $4,200, and Advertising $2,500.

- Lon has visited several financial institutions to discuss funding. The best interest rate he has been able to negotiate is 15%. Use this rate for cost of capital.

- Lon expects each van to make ten round trips weekly and carry an average of six students each trip. The service is expected to operate 30 weeks each year, and each student will e charged $12,00 for a round trip ticket.

Instructions

- Determine the annual (1) net income, and (2) net annual cash flows for the commuter service.

- Compute (1) the cash payback period and (2) the annual rate of return. (Round to two decimals.)

- Compute the net present value of the computer service. (Round to the nearest dollar.)

- ------ What should Lon conclude from these computations?