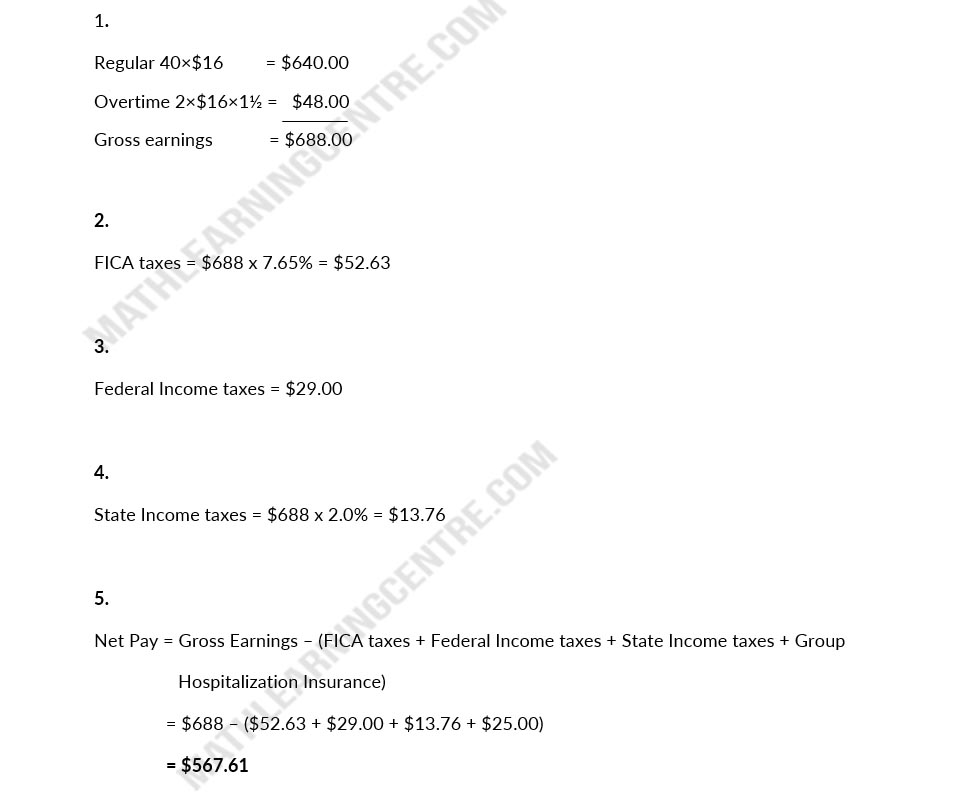

Maria Garza's regular hourly wage rate is $16, and she receives a wage of 1 1/2 times the regular hourly rate for work in excess of 40 hours. During a March weekly pay period, Maria worked 42 hours. Her gross earnings prior to the current week were $6,000. Maria is married and claims three withholding allowances. Her only voluntary deduction is for group hospitalization insurance at $25 per week

Instructions

- Compute the following amounts for Maria's wages for the current week.

- Gross earnings.

- FICA taxes. (Assume a 7.65% rate on maximum of $117,000.)

- Federal income taxes withheld. (Use the withholding table)

- State income taxes withheld. (Assume a 2.0% rate.)

- Net Pay

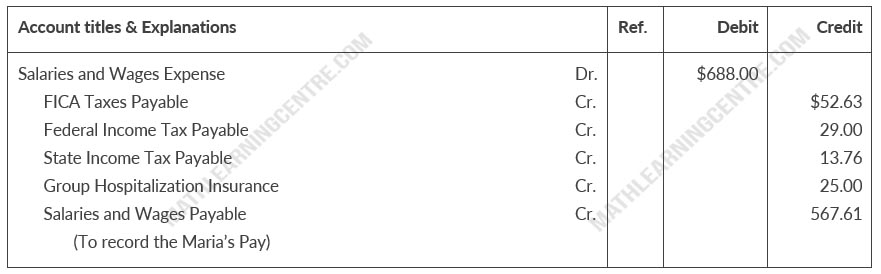

- Record Maria's Pay.

Solution

a.

b.