The following are selected transactions of Blanco Company. Blanco prepares financial statements quarterly.

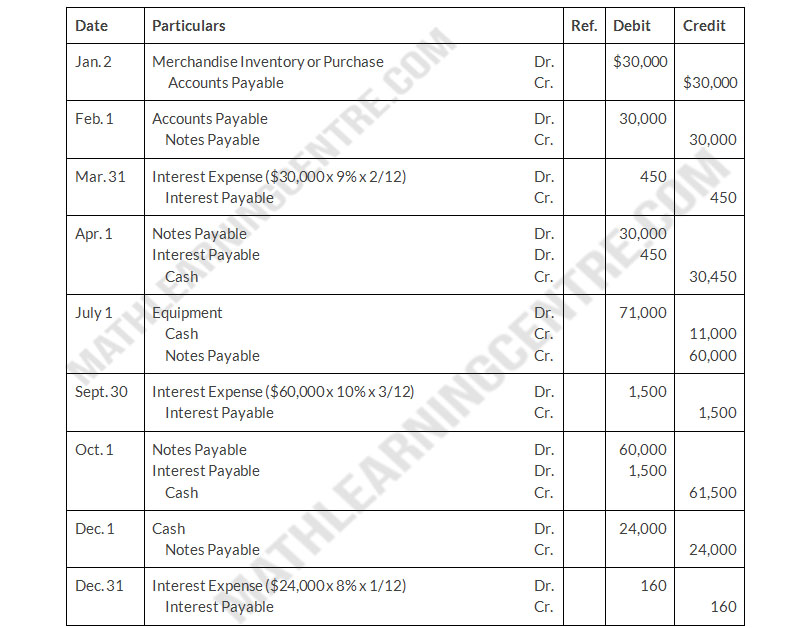

| Jan. 2 | Purchased merchandise on account from Nunez Company, $30,000, terms 2/10, n/30. (Blanco uses the perpetual inventory system.) |

| Feb. 1 | Issued a 9%, 2-month, $30,000 note to Nunez in payment of account. |

| Mar. 31 | Accrued interest for 2 months on Nunez note. |

| Apr. 1 | Paid face value and interest on Nunez note. |

| July 1 | Purchased equipment from Marson Equipment paying $11,000 in cash and signing a 10%, 3-month, $60,000 note. |

| Sept. 30 | Accrued interest for 3 months on Marson note. |

| Oct. 1 | Paid face value and interest on Marson note. |

| Dec. 1 | Borrowed $24,000 from the Paola Bank by issuing a 3-month, 8% note with a face value of $24,000. |

| Dec. 31 | Recognized interest expense for 1 month on Paola Bank note |

Instructions

- Prepare journal entries for the listed transactions and events.

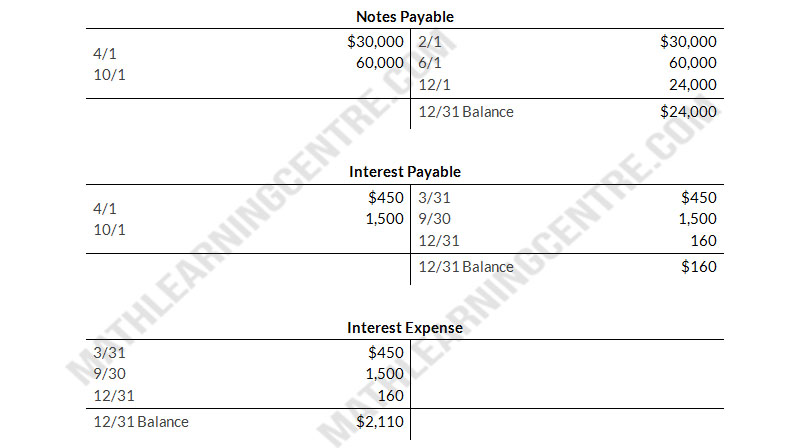

- Post to the accounts Notes Payable, Interest Payable, and Interest Expense.

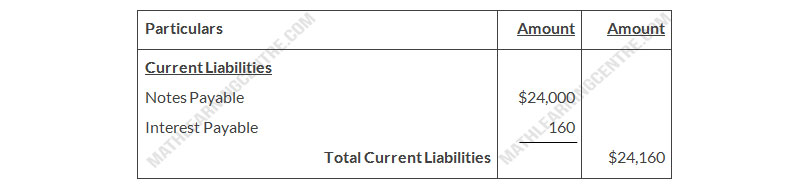

- Show the balance sheet presentation of notes and interest payable at December 31.

- What is total interest expense for the year?

Solution

a.

Blanco Company

Journal Entries

Journal Entries

b.

c.

d.

Total Interest expense for the year = $2,110