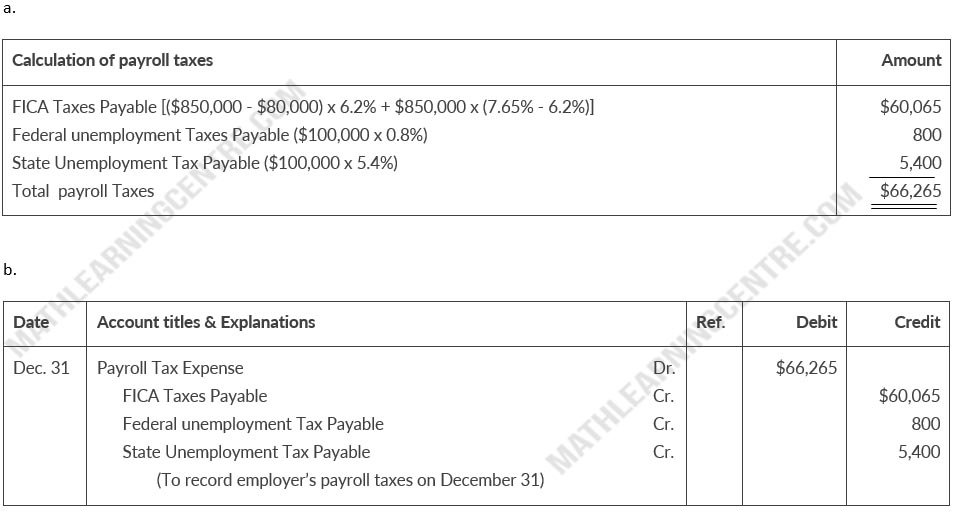

According to a payroll register summary of Frederickson Company, the amount of employees, gross pay in December was $850,000, of which $80,000 was not subject to Social Security taxes of 6.2% and $750,000 was not subject to state and federal unemployment taxes.

Instructions

- Determine the employer's payroll tax expense for the month, using the following rates: FICA 7.65%, state unemployment 5.4%, and federal unemployment 0.8%

- Prepare the journal entry to record December payroll tax expense.

Solution