On January 1, 2020, the ledger of Accardo Company contains the following liability accounts.

| Accounts Payable | $52,000 |

| Sales Taxes Payable | 7,700 |

| Unearned Service Revenue | 16,000 |

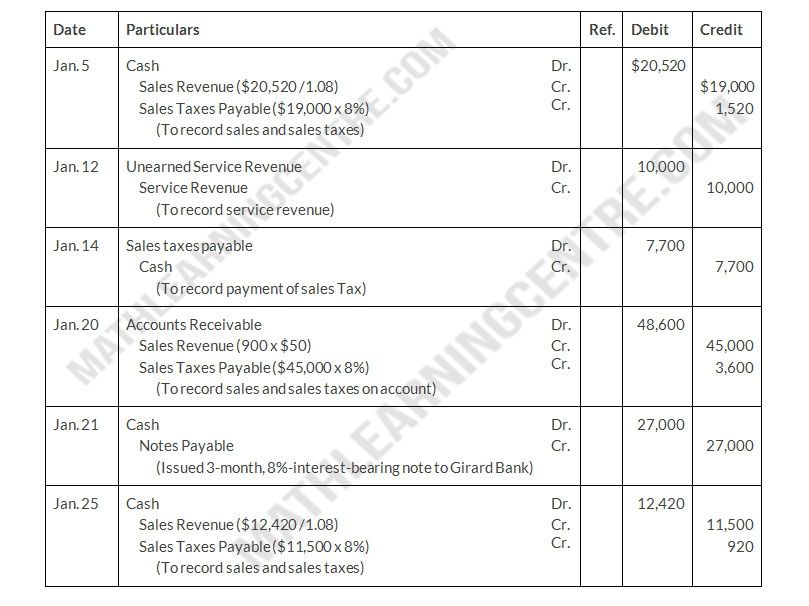

During January, the following selected transactions occurred.

| Jan. 5 | Sold merchandise for cash totaling $20,520, which includes 8% sales taxes. |

| 12 | Performed services for customers who had made advance payments of $10,000. (Credit Service Revenue.) |

| 14 | Paid state revenue department for sales taxes collected in December 2019 ($7,700). |

| 20 | Sold 900 units of a new product on credit at $50 per unit, plus 8% sales tax. This new product is subject to a 1-year warranty. |

| 21 | Borrowed $27,000 from Girard Bank on a 3-month, 8%, $27,000 note. |

| 25 | Sold merchandise for cash totaling $12,420, which includes 8% sales taxes. |

Instructions

- Journalize the January transactions.

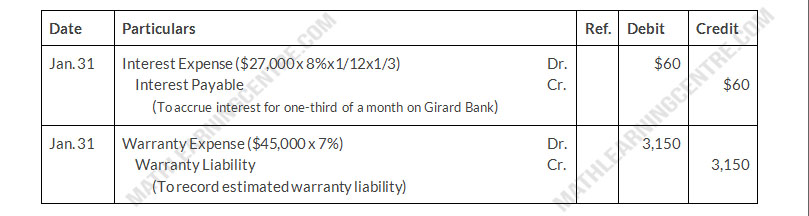

- Journalize the adjusting entries at January 31 for (1) the outstanding notes payable, and (2) estimated warranty liability, assuming warranty costs are expected to equal 7% of sales of the new product. ( Hint: Use one-third of a month for the Girard Bank note.)

- Prepare the current liabilities section of the balance sheet at January 31, 2020. Assume no charge in accounts payable.

Solution

a.

Accardo Company

Journal Entries

Journal Entries

b.

Accardo Company

Adjusting Entries

Adjusting Entries

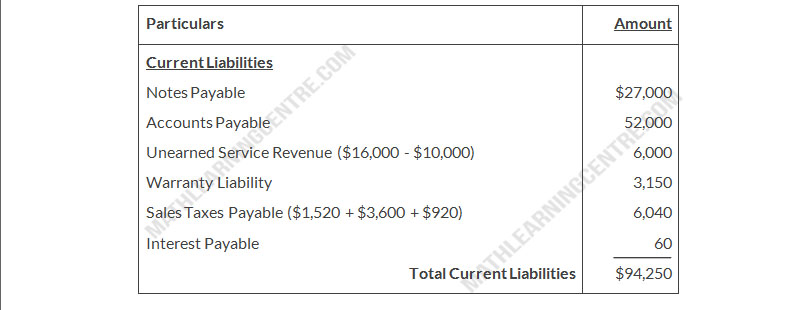

c.

Accardo Company

Partial Balance Sheet

Partial Balance Sheet