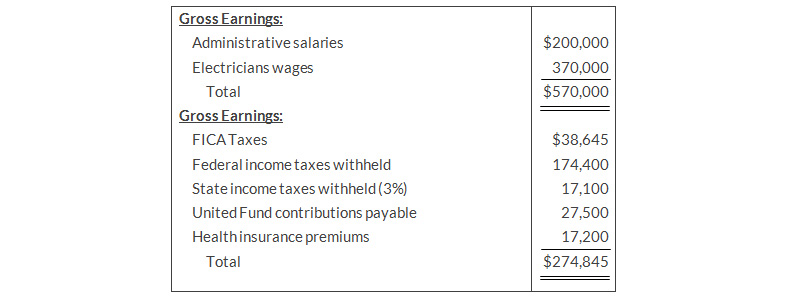

For the year ended December 31, 2019, Denkinger Electrical Repair Company reports the following summary payroll data.

Denkinger Company's payroll taxes are Social Security tax 6.2%, Medicare tax 1.45%, state unemployment 2.5% (due to a stable employment record), and 0.8% federal unemployment. Gross earnings subject to Social Security taxes of 6.2% total $490,000, and gross earnings subject to unemployment taxes total $135,000.

Instructions

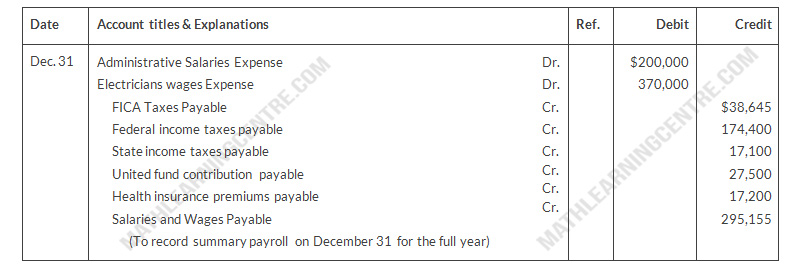

- Prepare a summary journal entry at December 31 for the full year's payroll.

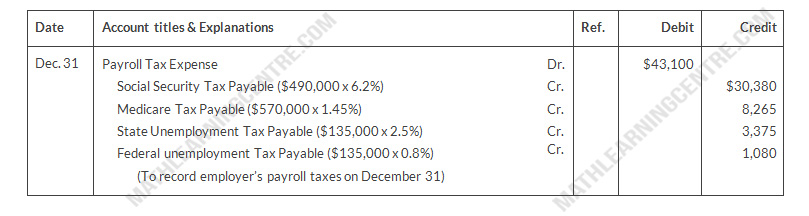

- Journalize the adjusting entry at December 31 to record the employer's payroll taxes.

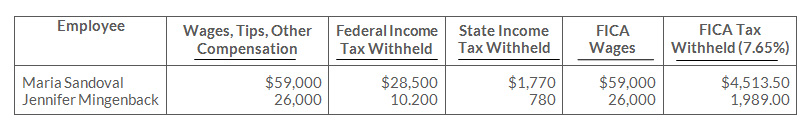

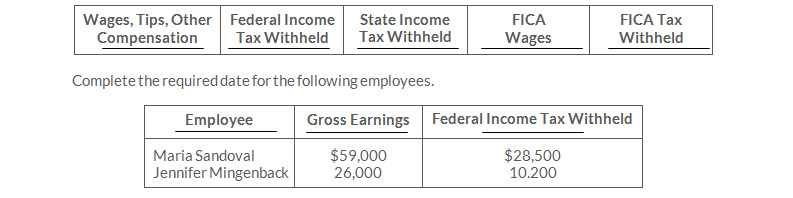

- The W-2 Wage and Tax Statement requires the following dollar data.

Solution

Summary Journal Entry

Adjusting Journal Entry