On December 31, 2020, Turnball Associates owned the following securities held as a long-term investment. The securities are not held for influence or control of the investee.

| Common Stock | Shares | Cost |

| Gehring Co. | 2,000 | $60,000 |

| Wooderson Co. | 5,000 | 45,000 |

| Kitselton Co. | 1,500 | 30,000 |

On December 31, 2020, the total fair value of the securities was equal to its cost. In 2021, the following transactions occurred.

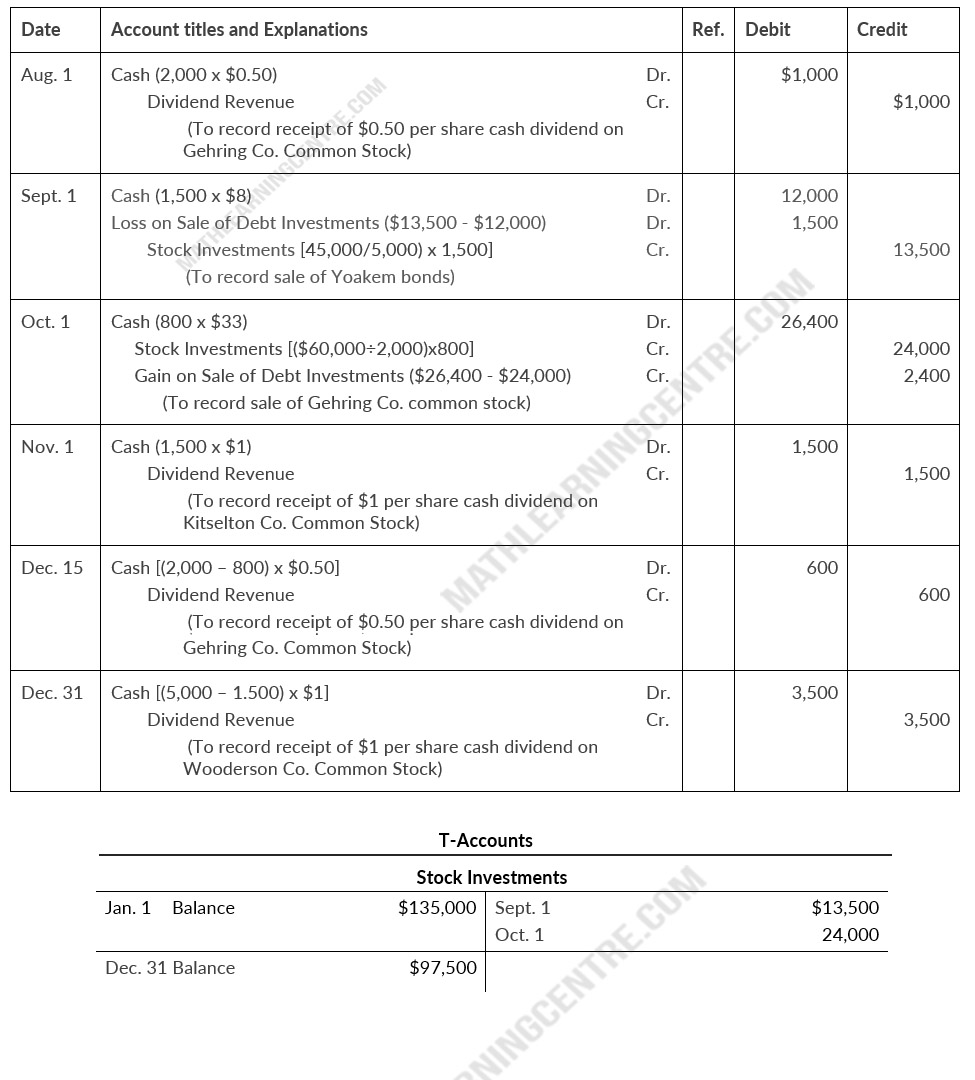

| Aug. 1 | Received $0.50 per share cash dividend on Gehring Co. common stock |

| Sept. 1 | Sold 1,500 shares of Wooderson Co. common stock for cash at $8 per share |

| Oct. 1 | Sold 800 shares of Gehring Co. common stock for cash at 433 per share |

| Nov. 1 | Received $1 per share cash dividend on Kitselton Co. common stock |

| Dec. 15 | Received $0.50 per share cash dividend on Gehring co. Common Stock |

| 31 | Received $1 per share annual cash dividend on Wooderson Co. Common Stock. |

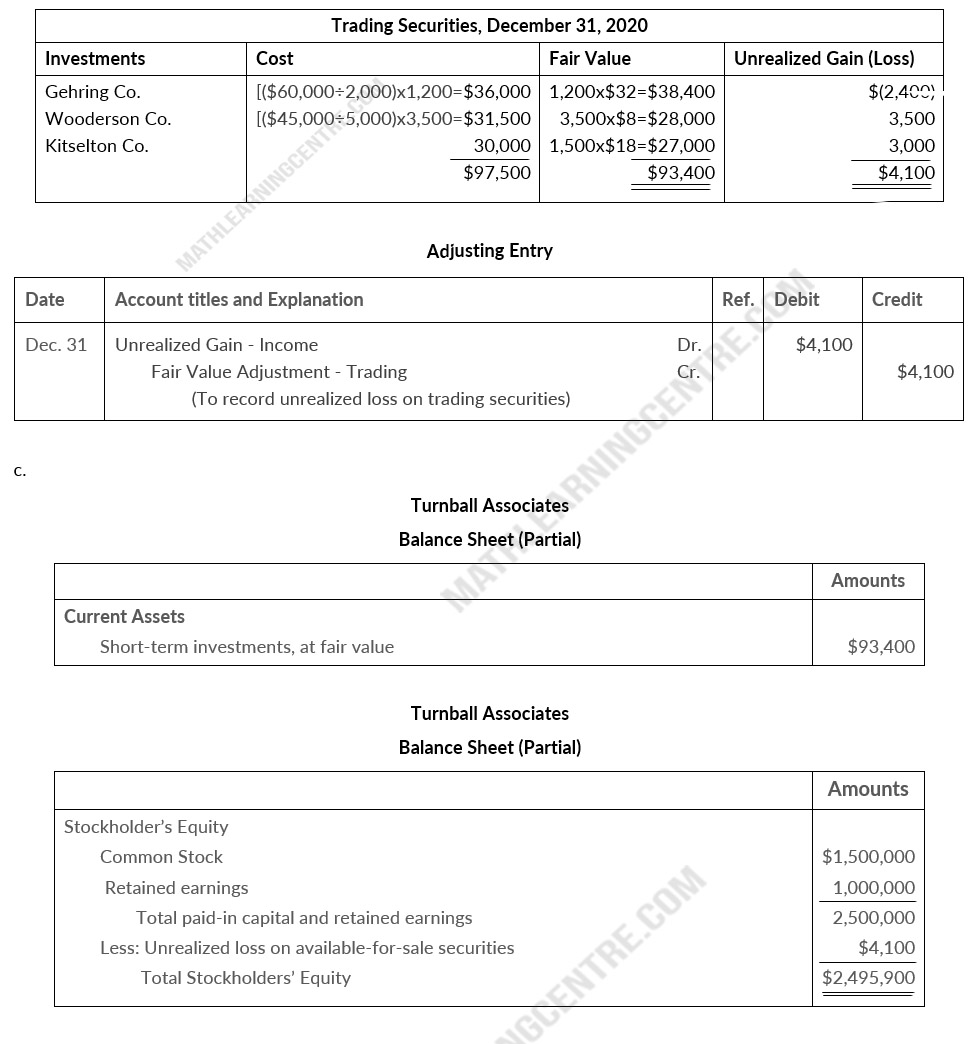

At December 31, the fair value per share of the common stocks were Gehring Co. $32, Wooderson Co. $8, and Kitselton Co. $18

Instructions

- Journalize the 2021 transactions and post to the account Stock Investments. (Use T-Account form.)

- Prepare the adjusting entry at December 31, 2021, to show the securities at fair value. The stock should be classified as available-for-sale securities..

- Show the balance sheet presentation of investment securities at December 31, 2021. At this date, Turnball Associates has common stock $1,500,000 and retained earnings $1,000,000.

Solution

a.

Turnball Associates

Journal Entries

Journal Entries

b.