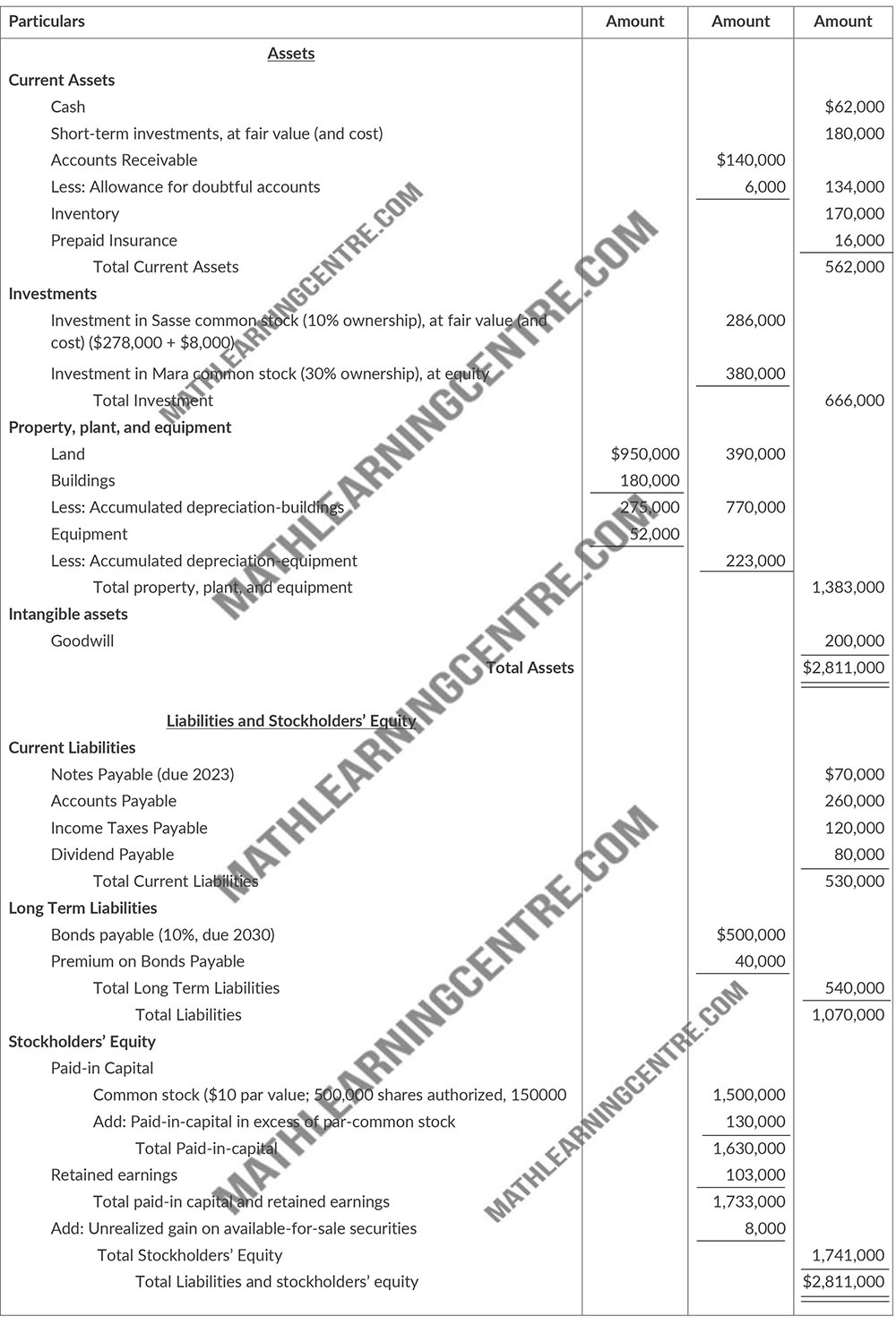

The following data, presented in alphabetical order, are taken from the records of Nieto Corporation.

| Accounts Payable | $260,000 |

| Accounts Receivable | 140,000 |

| Accumulated depreciation-buildings | 180,000 |

| Accumulated depreciation-equipment | 52,000 |

| Allowance for doubtful accounts | 6,000 |

| Bonds payable(10%, due 2030) | 500,000 |

| Buildings | 950,000 |

| Cash | 62,000 |

| Common stock ($10 par value; 500,000 shares authorized, 150000 shares issued) | 1,500,000 |

| Dividends payable | 80,000 |

| Equipment | 275,000 |

| Fair value adjustment-available-for-sale securities (Dr.) | 8,000 |

| Goodwill | 200,000 |

| Income taxes payable | 120,000 |

| Inventory | 170,000 |

| Investment in Mara common stock (30% ownership), at equity | 380,000 |

| Investment in Sasse common stock (10% ownership), at cost | 278,000 |

| Land | 390,000 |

| Notes payable (due 2023) | 70,000 |

| Paid-in-capital in excess of par-common stock | 130,000 |

| Premium on bonds payable | 40,000 |

| Prepaid insurance | 16,000 |

| Retained earnings | 103,000 |

| Short-term investments, at fair value (and cost) | 180,000 |

| Unrealized gain-available-for-sale securities | 8,000 |

The investment in Sasse common stock is considered to be a long-term available-for-sale security.

Instructions

Prepare a classified balance sheet at December 31, 2022

Solution

Balance Sheet

December 31, 2022