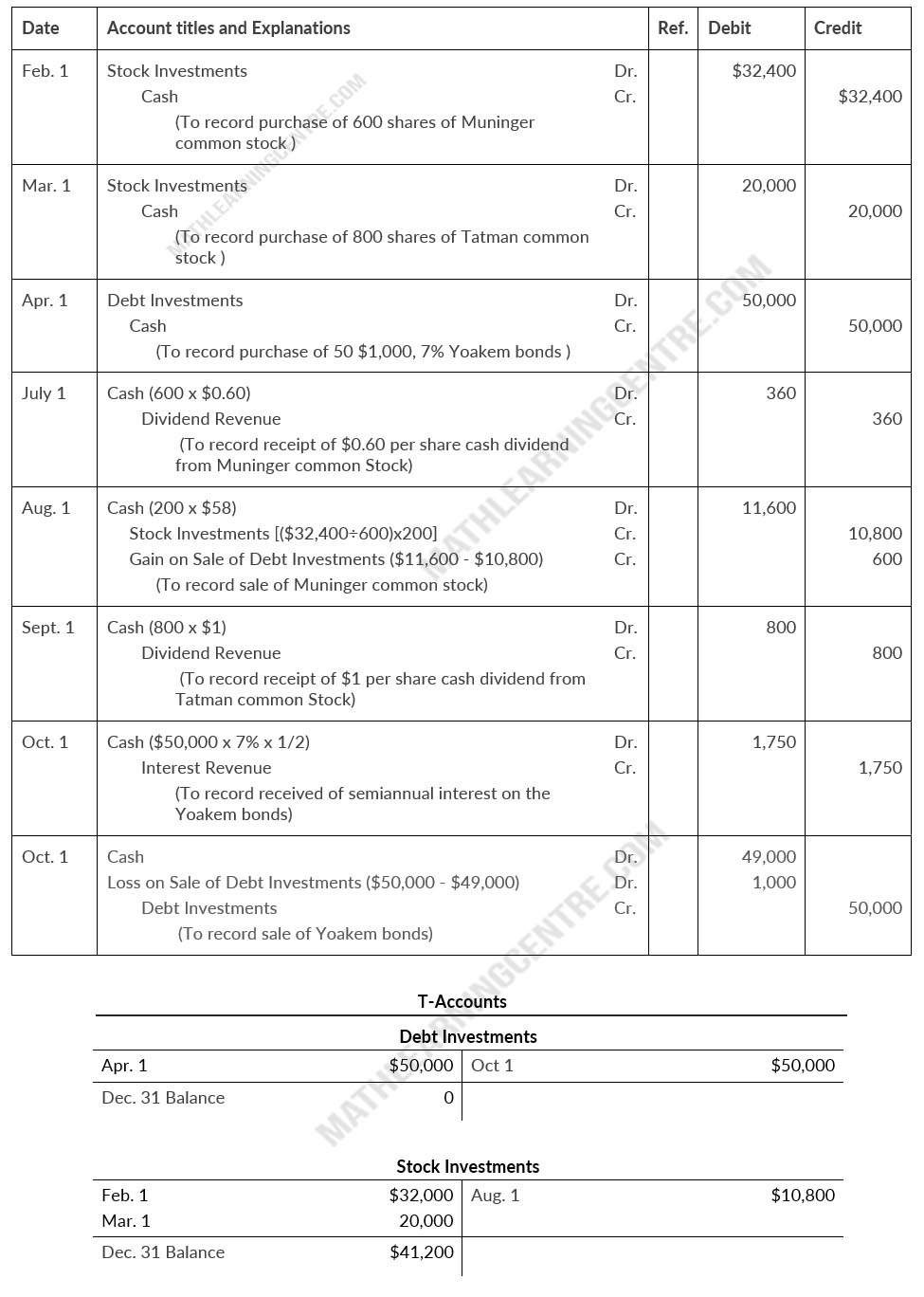

In January 2020, the management of Kinzie Company concludes that it has sufficient cash to permit some short-term investments in debt and stock securities. During the year, the following transactions occurred.

| Feb. 1 | Purchased 600 shares of Muninger common stock for $32,400 |

| Mar. 1 | Purchased 800 shares of Tatman common stock for $32,400 |

| Apr. 1 | Purchased 50 $1,000, 7% Yoakem bonds for $50,000. Interest is payable semiannually on April 1 and October 1. |

| July 1 | Received a cash dividend of $0.60 per share on the Muninger common stock |

| Aug. 1 | Sold 200 shares of Muninger common stock at $58 per share. |

| Sept.r. 1 | Received a $1 per share cash dividend on the Tatman common stock. |

| Oct. 1 | Received the semiannual interest on the Yoakem bonds. |

| Oct. 1 | Sold the Yoakem bonds for $49,000. |

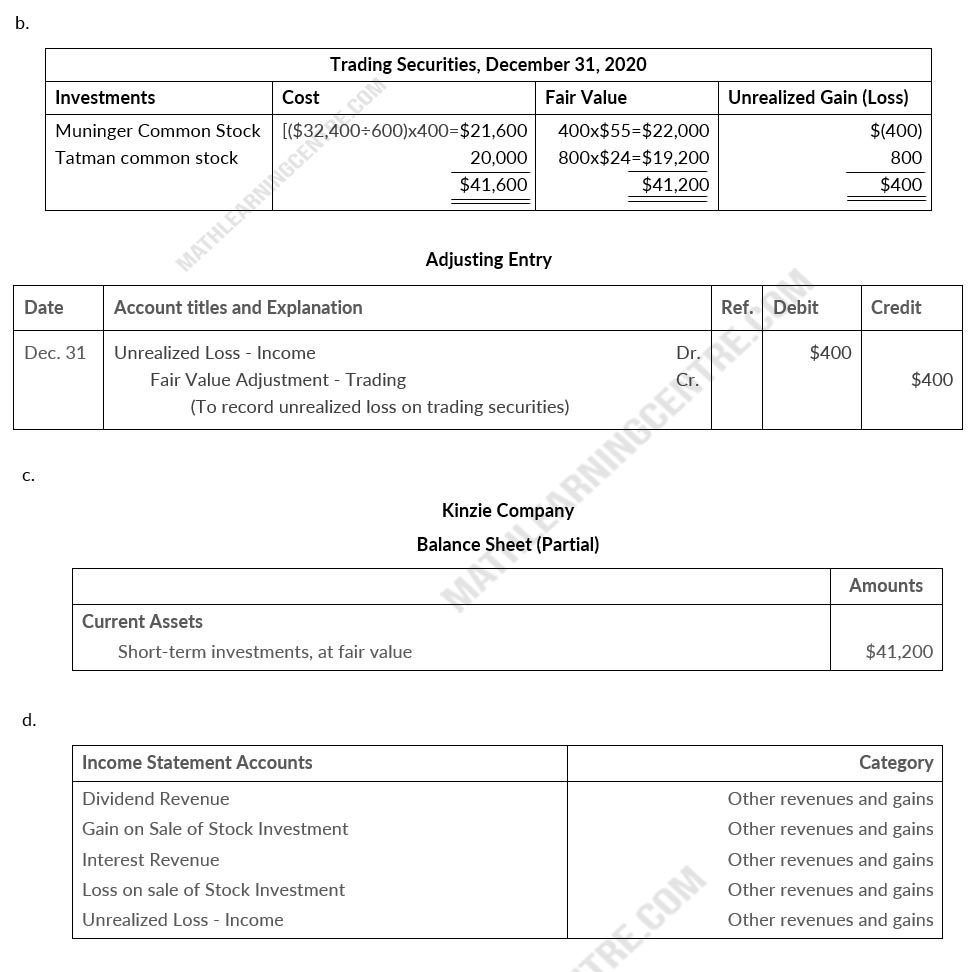

At December 31, the fair value of the Munnger common stock was $55 per share. The fair value of the Tatman common stock was $24 per share

Instructions

- Journalize the transactions and post to the accounts Debt Investments and Stock Investments. (Use T-Accounts form.)

- Prepare the adjusting entry at December 31, 2020, to report the investment securities at fair value. All securities are considered to be trading securities.

- Show the balance sheet presentation of investment securities at December 31, 2020

- Identify the income statement accounts and give the statement classification of each account.

Solution

a.

Kinzie Company

Journal Entries

Journal Entries