Hulse Company had the following transactions pertaining to stock investments.

| Feb. 1 | Purchased 600 shares of Wade common stock (2%) for $7,200 cash |

| July 1 | Received a cash dividend of $1 per share on Wade common stock. |

| Sept. 1 | Sold 300 shares of Wade common stock for $4,300 cash. |

| Dec. 1 | Received a cash dividend of $1 per share on Wade common stock. |

Instructions

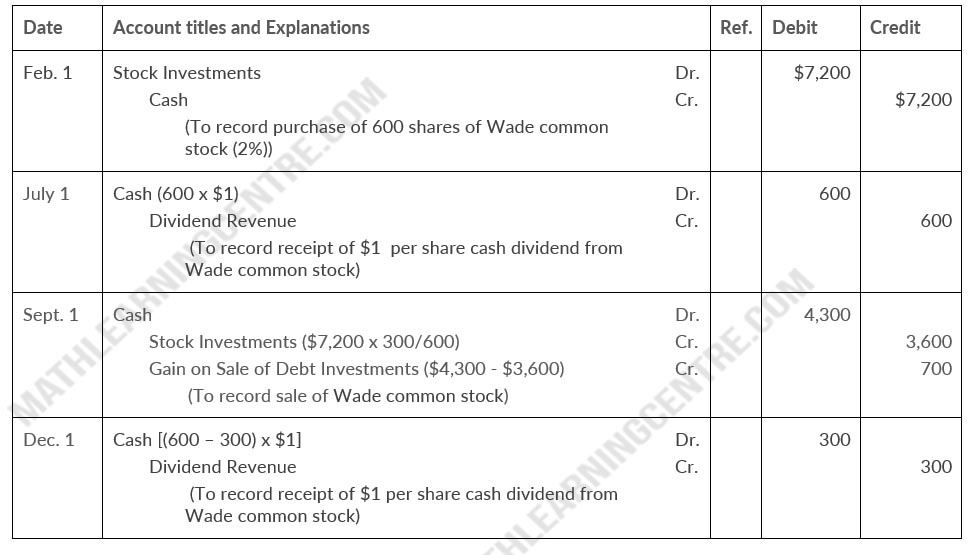

- Journalize the transactions.

- Explain how dividend revenue and the gain (loss) on sale should be reported in the income statement

Solution

a.

Hulse Company

Journal Entries

Journal Entries

b.

Dividend revenue and the gain (loss) on sale should be reported as other revenues and gains in the income statement