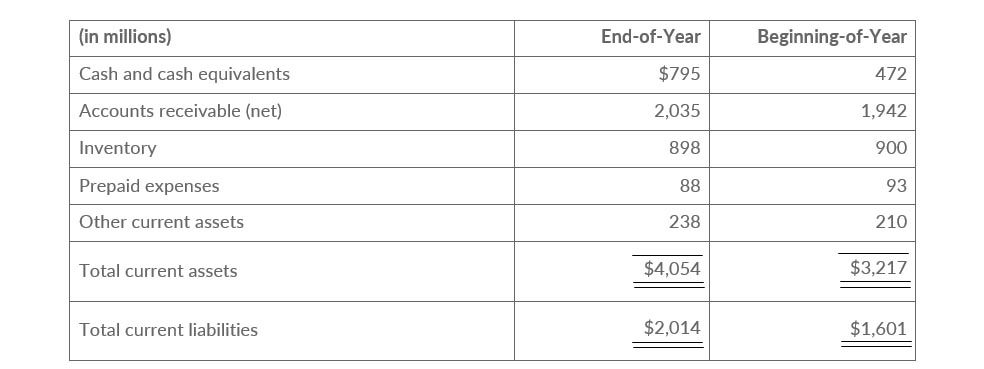

Suppose Nordstrom, Inc, which operates department stores in numerous states, has the following selected financial statement data for a recent year.

Nordstrom, Inc

Balance Sheets (partial)

Balance Sheets (partial)

For the year, net sales were $8,258 and cost of goods sold was $5,328 (in millions).

Instructions

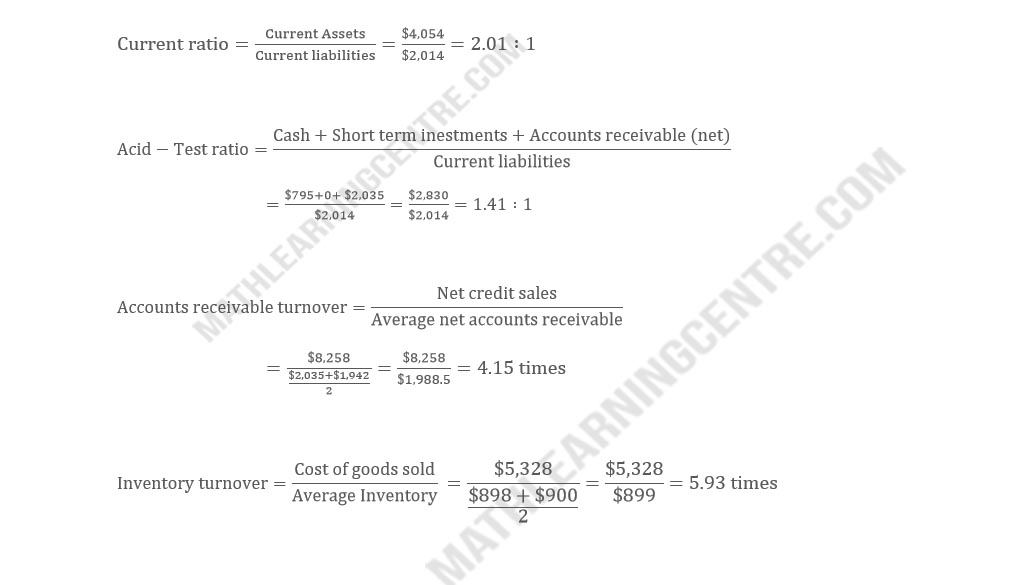

- Compute the four liquidity ratios at the end of the year.

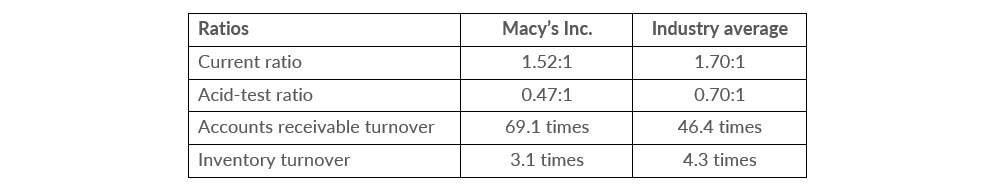

- Compare Nordstrom's liquidity with (1) Mac's Inc., and (2) the industry averages for department stores as below information

Solution

a.

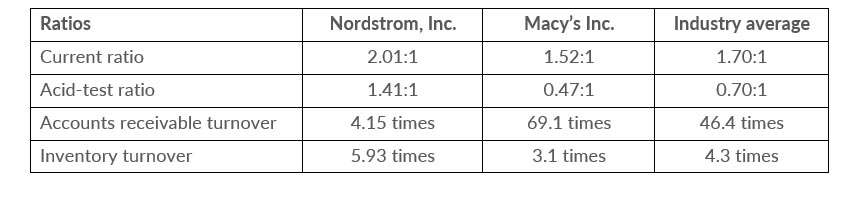

b.

Compare Nordstrom's liquidity with (1) Mac's Inc., and (2) the industry averages

Nordstrom is better than Mac's Inc. for Current and Acid-Test Ratio, significantly below in Accounts receivable turnover, and much better for the inventory turnover

Nordstrom is better than Industry Average for Current and Acid-Test Ratio, significantly below in Accounts receivable turnover, and higher for the inventory turnover