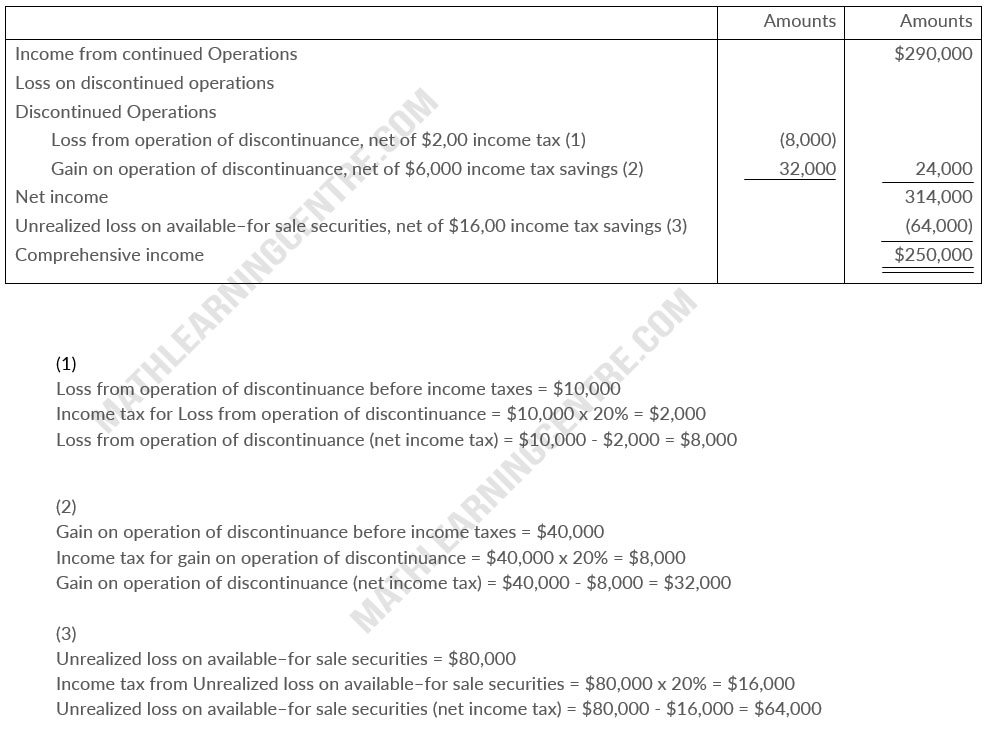

Trayer Corporation has income from continuing operations of $290,000 for the year ended December 31, 2020. It also has the following items (before considering income taxes).

- An unrealized loss of $80,000 on available-for-sale securities.

- A gain of $30,000 on the discontinuance of a division (Comprising a $10,000 loss from operations and a $40,000 gain on disposal).

- A correction of an error in last year's financial statements that resulted in a $20,000 understatement of 2019 net income

Assume all items are subject to income taxes at a 20% tax rate.

Instructions

Prepare a statement of comprehensive income, beginning with income from continuing operations.

Solution

Trayer Corporation

Partial Statement of comprehensive income

For the year ended December 31, 2020

Partial Statement of comprehensive income

For the year ended December 31, 2020