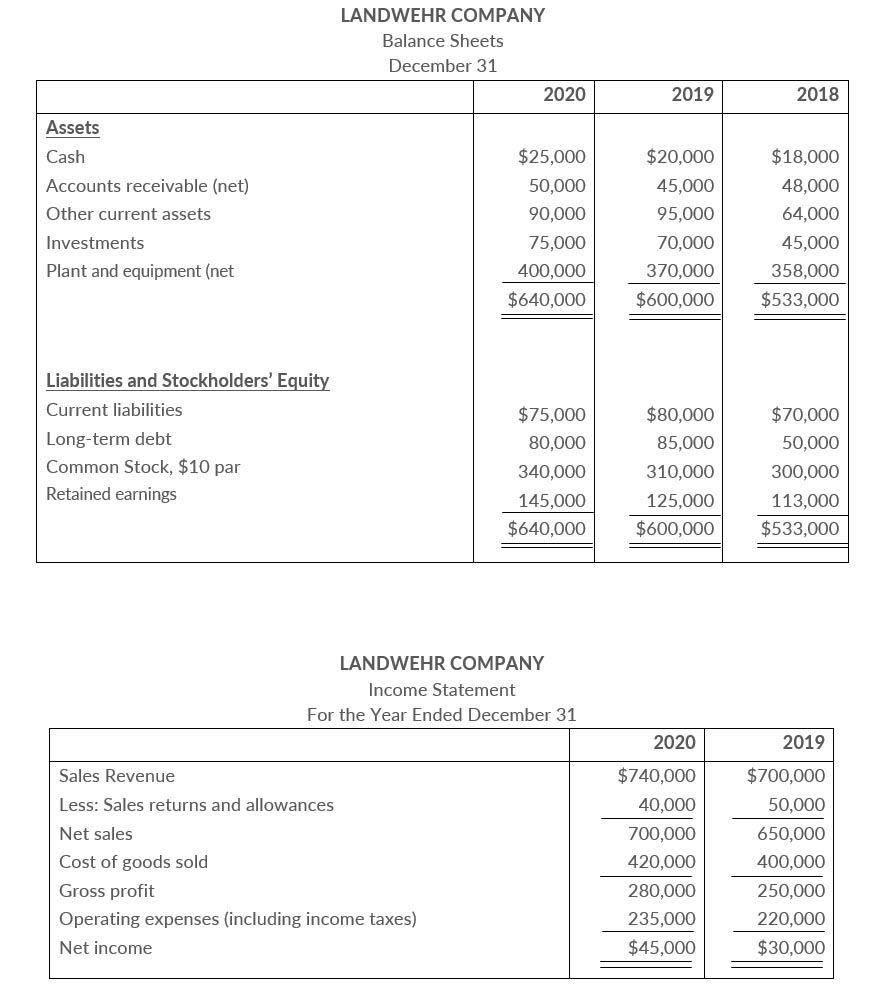

Condensed balance sheet and income statement data for Landwehr Corporation appear below.

Additional Information

- The market price of Landwehr's common stock was $4.00, $5,00, and $8,00 for 2018, 2019, and 2020, respectively.

- All Dividends wer paid in cash

Instructions

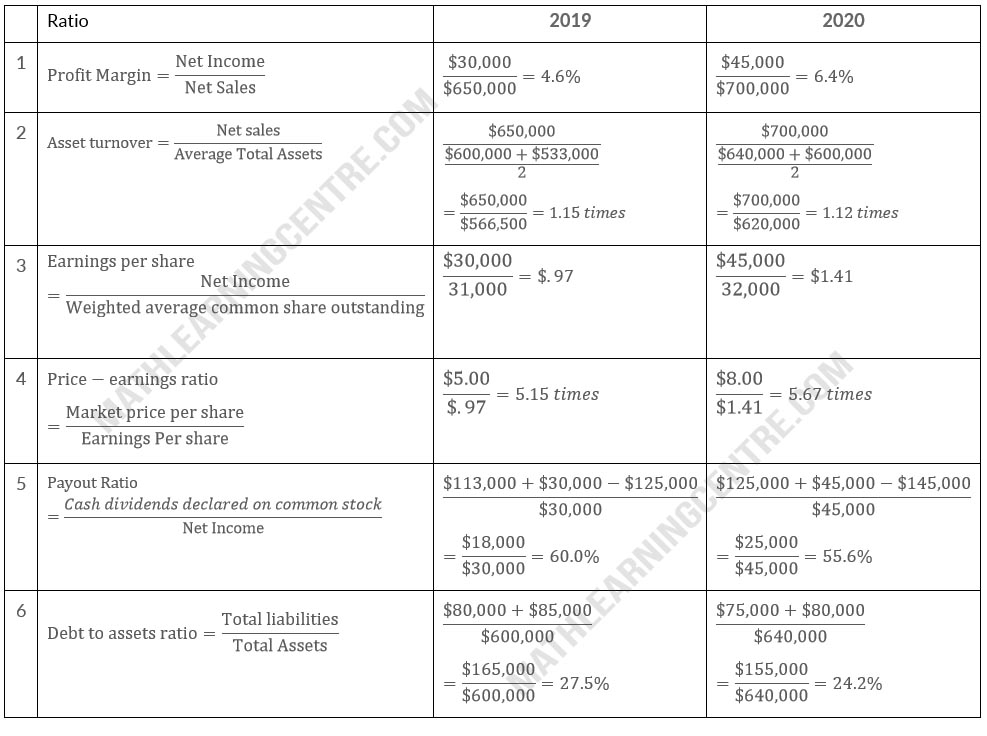

- Compute the following ratios for 2019, and 2020.

- Profit margin.

- Asset turnover.

- Earnings per share (Weighted average common shares in 2020 were 32,000 and in 2019 were 31,000.)

- Price-earning ratio.

- Payout ratio..

- Debt to assets ratio.

- Based on the ratios calculated, discuss briefly the improvement or lack thereof in financial position and operating results from 2019 to 2018 of Landwehr Corporation.

Solution