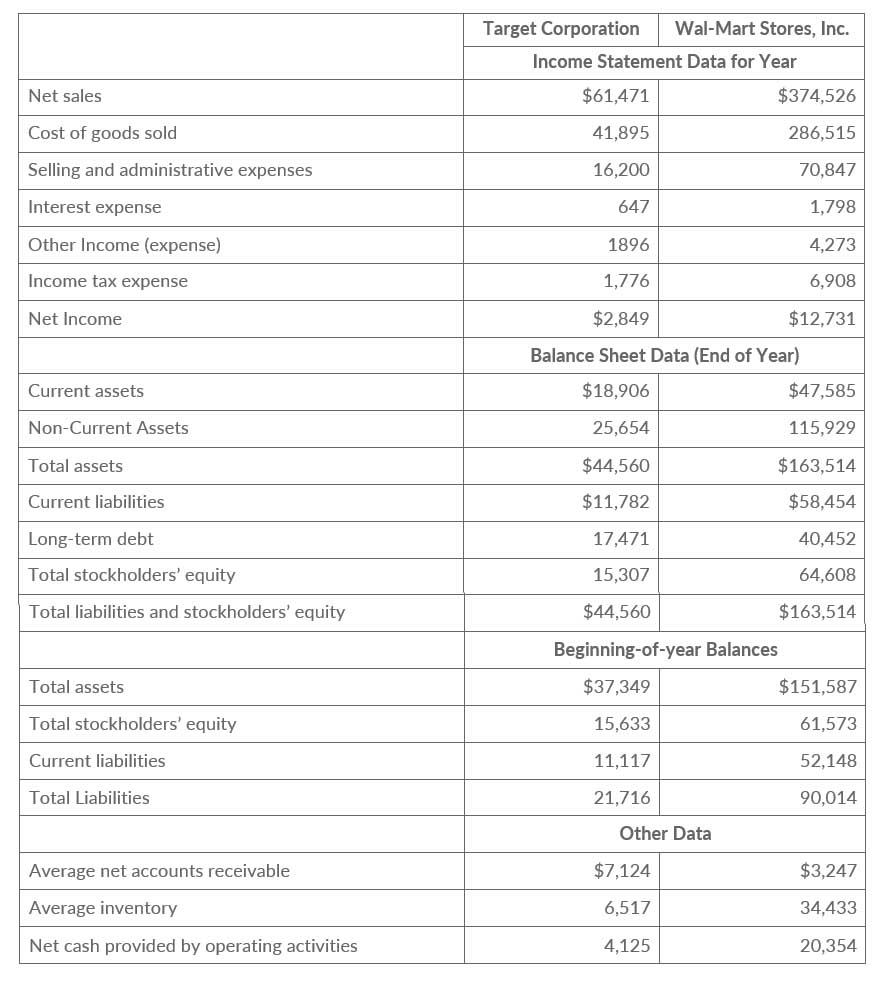

Selected financial data of Target Corporation and Wal-Mart Stores, Inc. for a recent year are presented here (in millions)

Instructions

- For each company, compute the following ratios.

- Current.

- Receivables turnover.

- Average collection period.

- Inventory turnover.

- Days in inventory.

- Profit margin.

- Asset turnover.

- Return on assets.

- Return on common stockholders' equity.

- Debt to total assets.

- Times interest earned.

- Compare the liquidity, profitability, and solvency of the two companies.

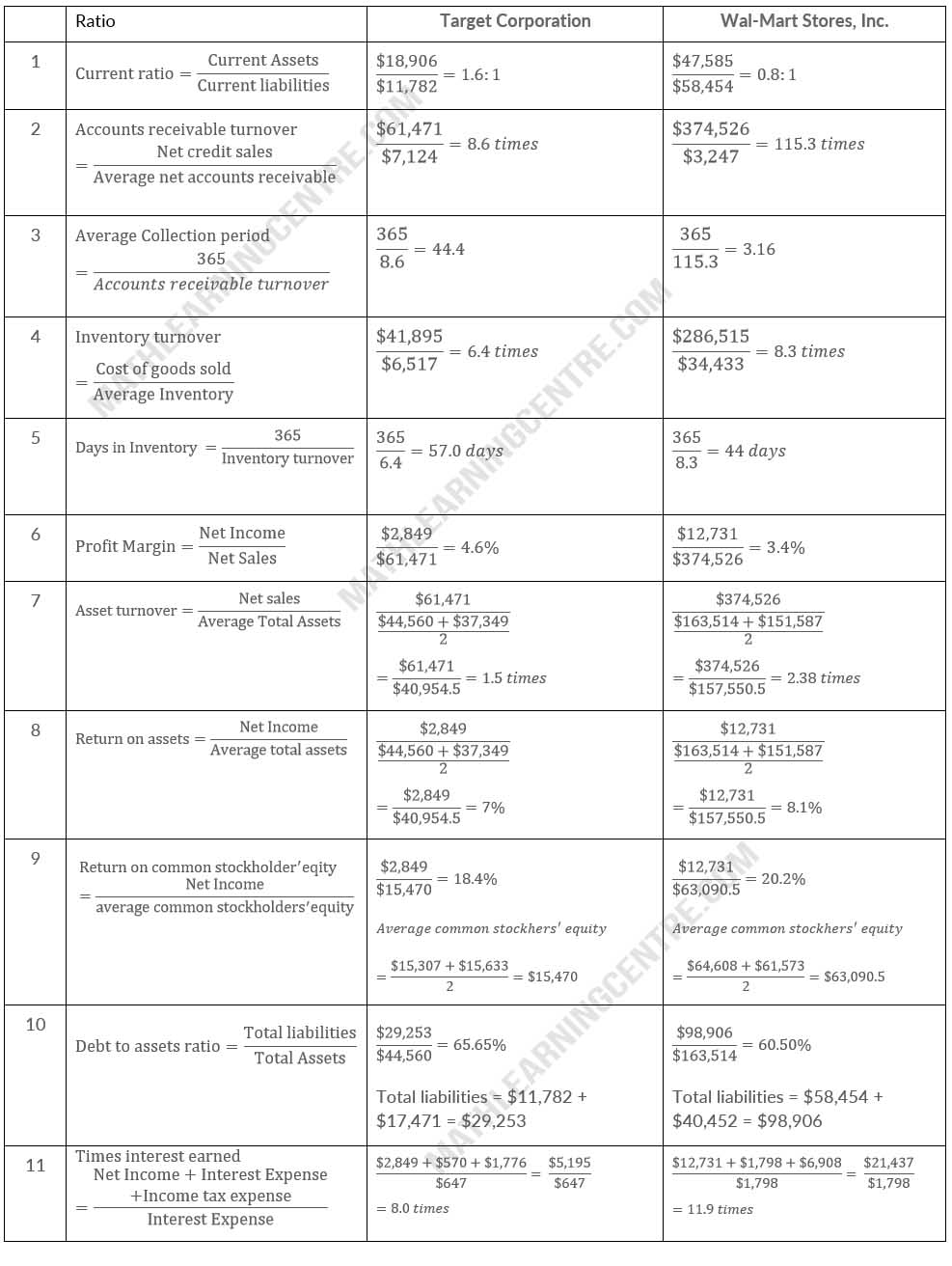

a. Computation of the Ratios.

b.

The comparison of the two companies shows the following:

Liquidity: Target's current ratio of 1.6:1 is significantly better than Wal-mart's .8:1. But Wal-mart inventory turnover and Accounts receivable turnover are better than Target's.

Profitability All of the profitability ratios except profit margin of Wal-mart's are better than Target's so that Wal-mart's is more profitable than Target's

Solvency: Both of the solvency ratios of Wal-mart's are better than Target's so that Wal-mart's is more solvent than Target's