At December 31, 2018, House Co. reported the following information on its balance sheet.

| Accounts receivable | $960,000 |

| Less: Allowance for doubtful accounts | 80,000 |

During 2019, the company had the following transactions related to receivables.

| 1 | Sales on account | $3,700,000 |

| 2 | Sales returns and allowances | 50,000 |

| 3 | Collections of accounts receivable | 2,810,000 |

| 4 | Write-offs of accounts receivable deemed noncollectable | 90,000 |

| 5 | Recovery of bad debts previously written off as noncollectable | 29,000 |

Instructions

- Prepare the journal entries to record each of these five transactions. Assume that no cash discounts were taken on the collections of accounts receivable.

- Enter the January 1,2019, balances in Accounts Receivable and Allowances for Doubtful Accounts, post the entries to the tow accounts (use T-accounts), and determine the balances.

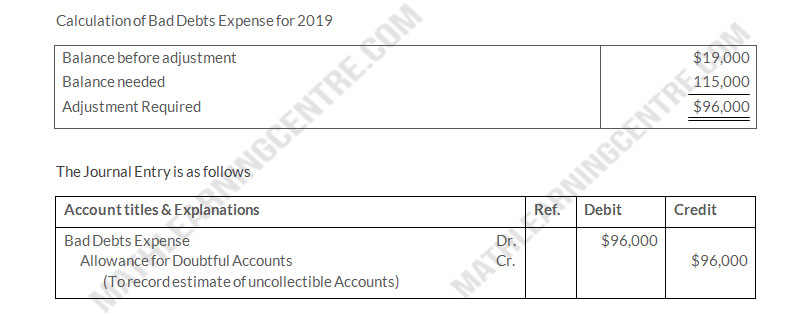

- Prepare the journal entry to record bad dbt expense for 2019, assuming that an aging of accounts receivable indicates that expected bad debts are $115,000.

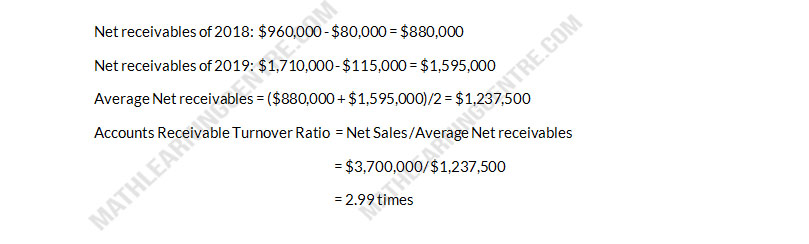

- Compute the accounts receivable turnover for 2019 assuming the expected bad debt information provided in (c).

Solution

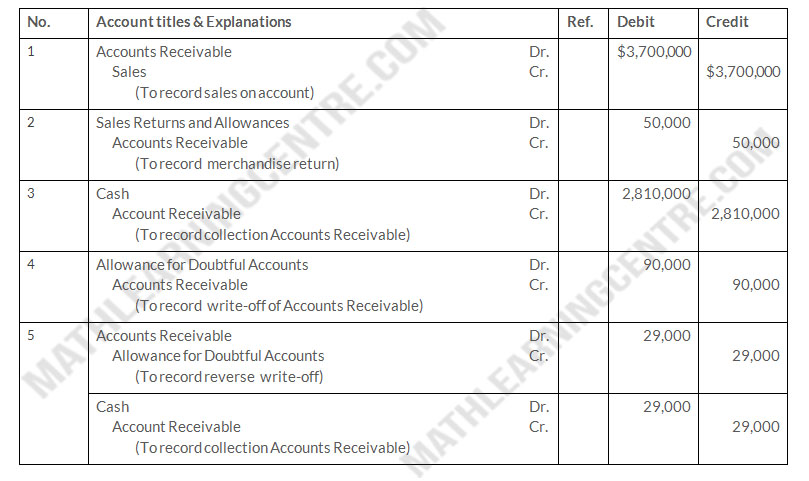

a.

House Co.

Journal Entries

Journal Entries

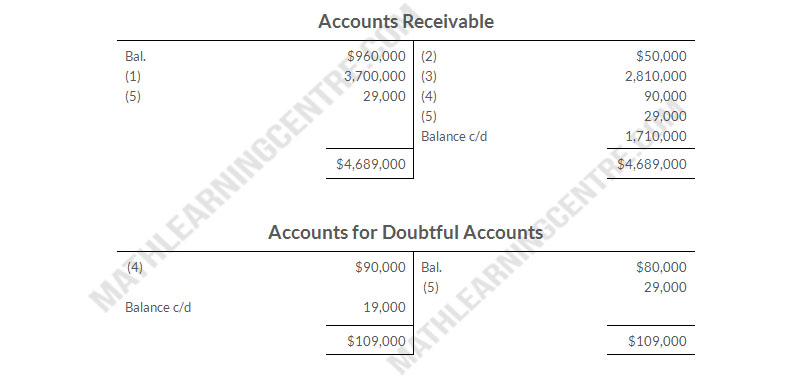

b.

House Co

T-Accounts

T-Accounts

c.

d.