The Jedger of Costello Company at the end of the current year shows Accounts Receivable $110,000, Sales Revenue $840,000, and Sales Returns and Allowances $20,000.

Instructions

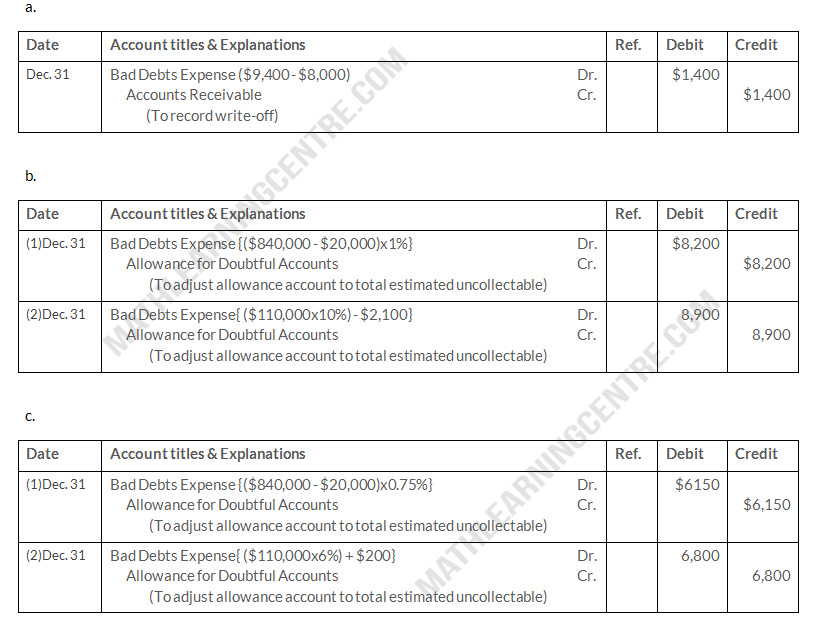

- If Costello uses the direct write-off method to account for uncollectible accounts, journalize the adjusting entry at December 31, assuming Costello determines that L. Dole's $1,400 balance is uncollectible.

- If Allowance for doubtful Accounts has a credit balance of $2,100 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be (1) 1% of net sales, and (2) 10% of acconts receivable

- If Allowance for Doubtful Accounts has a debit balance of $200 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be (1) 0.75% of net sales and (2) 6% of accounts receivable.

Solution