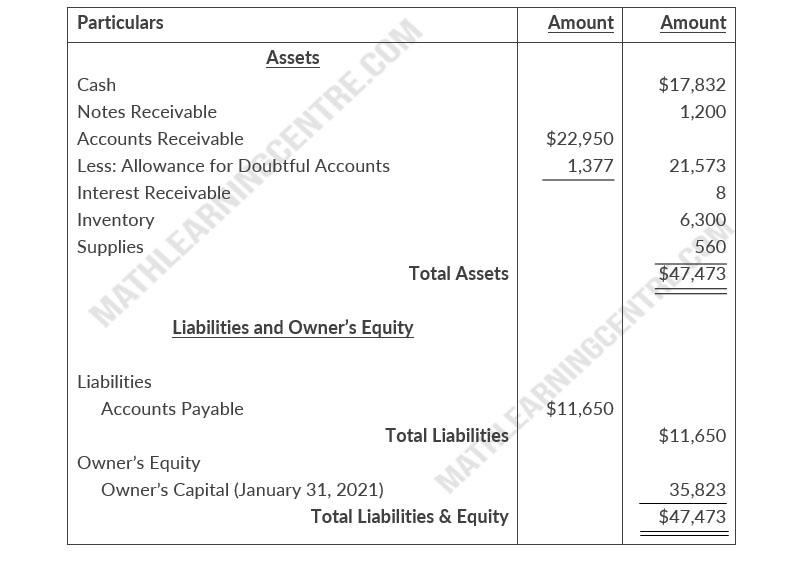

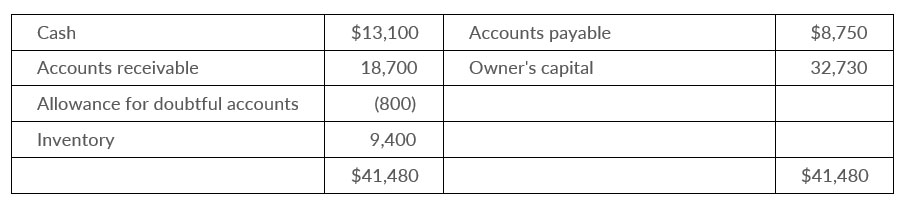

Winter Company's balance sheet at December 31, 2020, is presented below.

During January 2021, the following transactions occurred. Winter uses the perpetual inventory method.

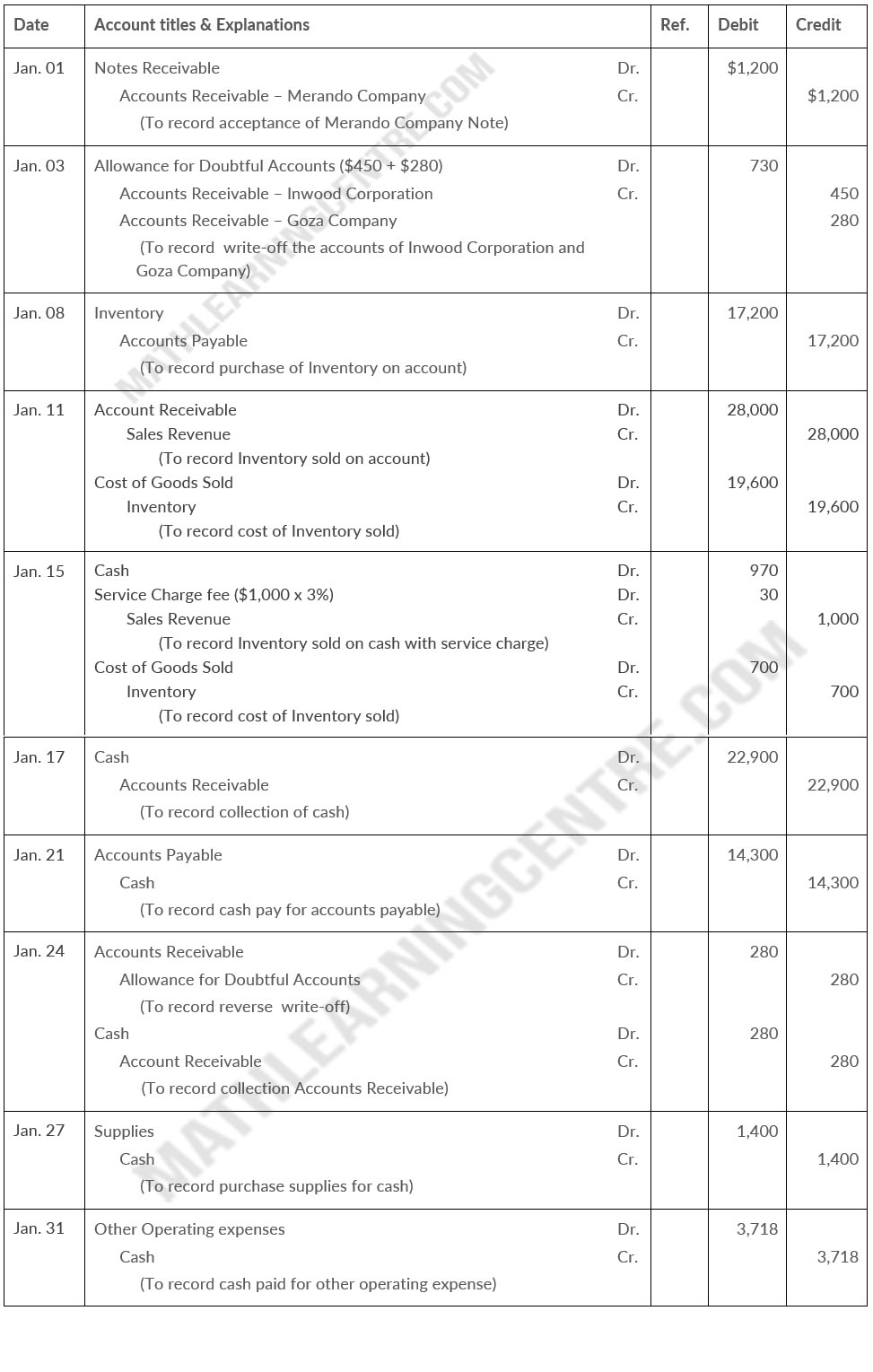

| Jan. 1 | Winter accepted a 4-month, 8% note from Merando Company in payment of Merando's $1,200 account |

| 3 | Winter wrote off as uncollectible the accounts of Inwood Corporation ($450) and Goza Company ($280). |

| 8 | Winter purchased $17,200 of inventory on account. |

| 11 | Winter sold for $28,000 on account inventory hat cost $19,600. |

| 15 | Winter sold inventory that cost $700 to Mark Lauber for $1,000. Lauber charged this amount on his Visa First Bank card. The service free charged Winter by First Bank is 3% |

| 17 | Winter collected $22,900 from customers on account. |

| 21 | Winter paid $14,300 on accounts payable. |

| 24 | Winter received payment in full ($280) from Goza Company on the account written off an January 3. |

| 27 | Winter purchased supplies for $1,400 cash. |

| 31 | Winter paid other operating expenses $3,718. |

Instructions

- Prepare journal entries for the transactions listed above and adjusting entries.(Include entries for cost of goods sold using the perpetual system.

- Prepare an adjusted trial balance at January 31,2021.

- Prepare an income statement and an owner's equity statement for the month ending January 31, 2021, and a classified balance sheet as of January 31, 2021.

Solution

a.

Winter Company

Journal Entries

Journal Entries

Winter Company

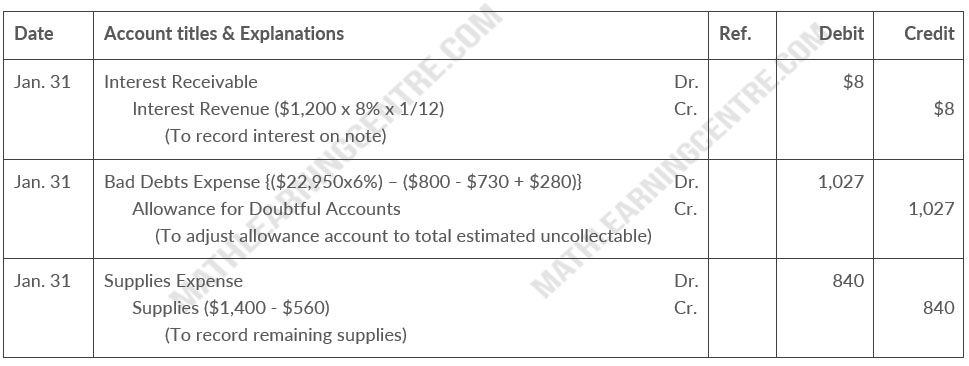

Adjusting Journal Entries

Adjusting Journal Entries

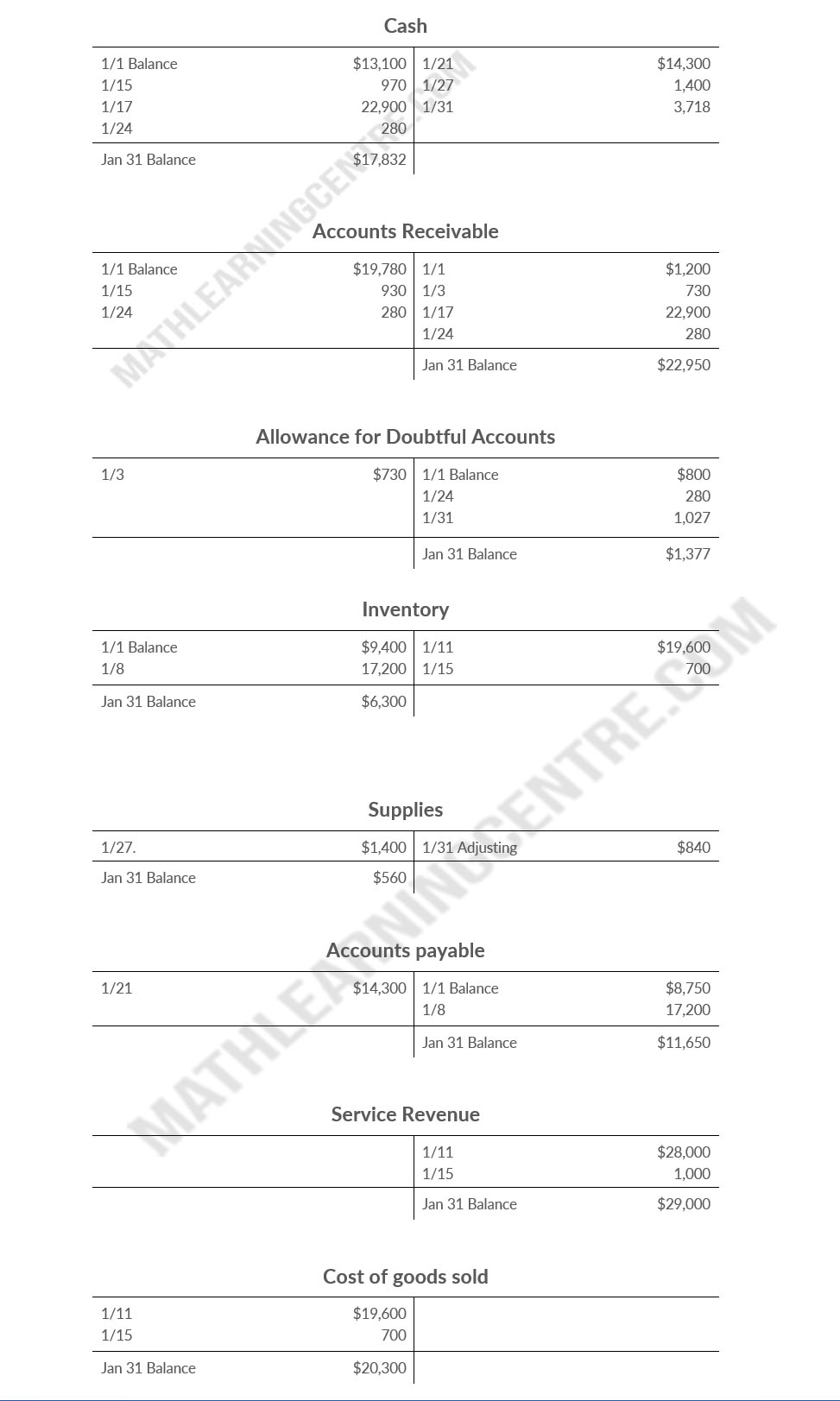

Winter Company

Optional T-Accounts

Optional T-Accounts

b.

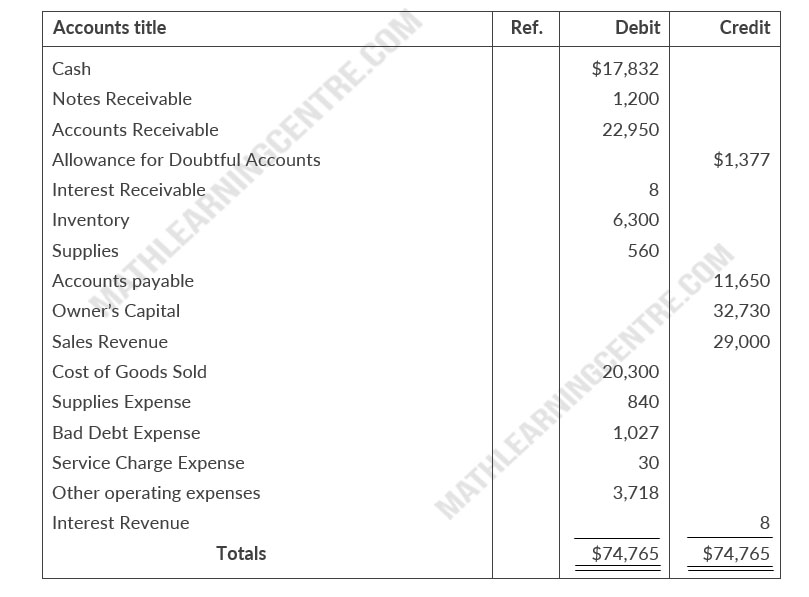

Winter Company

Adjusted Trial Balance

January 31, 2021

Adjusted Trial Balance

January 31, 2021

c.

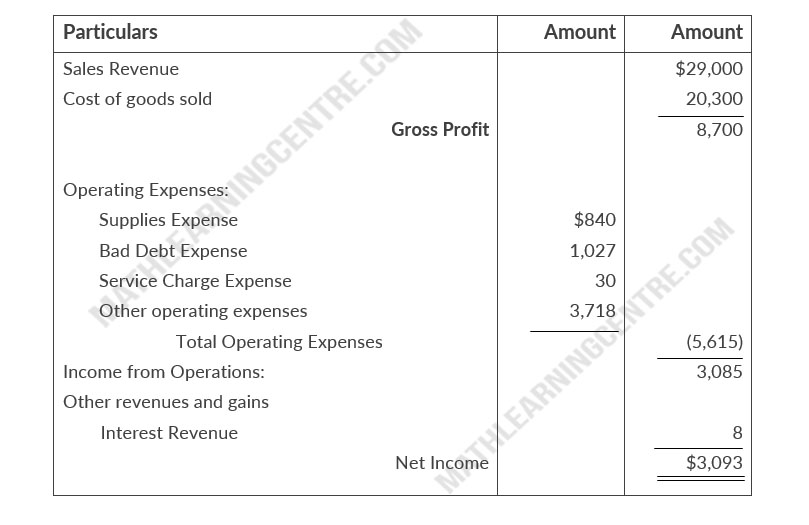

Winter Company

Income Statement

For the Month ended January 31, 2021

Income Statement

For the Month ended January 31, 2021

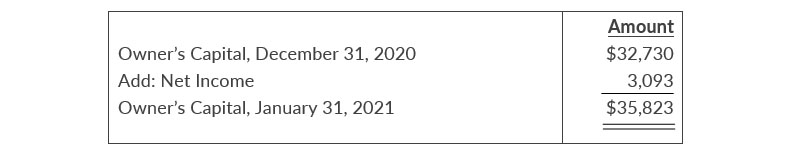

Winter Company

Owner's equity Statement

For the Month ended January 31, 2021

Owner's equity Statement

For the Month ended January 31, 2021

Winter Company

Classified Balance sheet

January 31, 2021

Classified Balance sheet

January 31, 2021