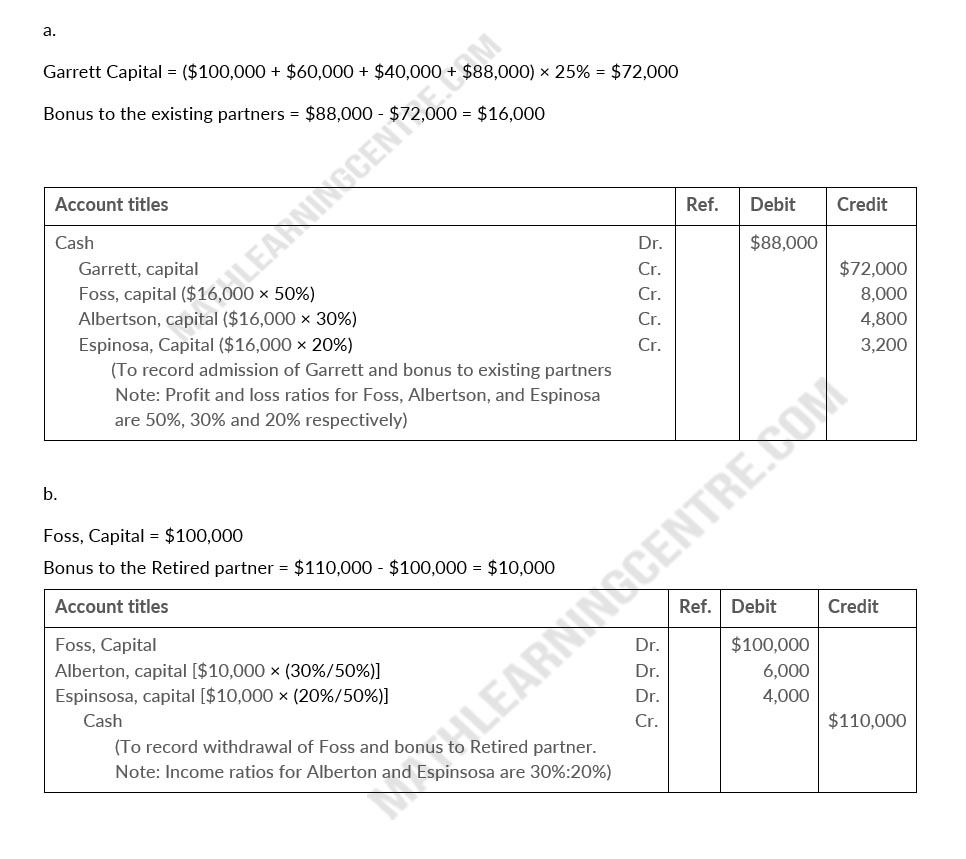

Foss, Albertson, and Espinosa are partners who share profits and losses 50%, 30% and 20% respectively. There capital balances are $100,000, $60,000, and $40,000 respectively.

Instructions

- Assume Garrett joins the partnership by investing $88,000 for a 25% interest with bonuses to the existing partners. Prepare the journal entry to record his investment.

- Assume instead that Foss leaves the partnership. Foss is paid $110,000 with a bonus to the retiring partner. Prepare the journal entry to record Foss's withdrawal.

Solution

Journal Entries