At April 30, partners capital balances in PDL Company are G. Donley $52,000, C. Lamar $48,000, and J. Pinkston $18,000. The income sharing ratios are 5:4:1 respectively. On May 1, the PDLT Company is formed by admitting J. Terrell to the firm as a partner.

Instructions

- Journalize the admission of Terrell under each of the following independent assumption

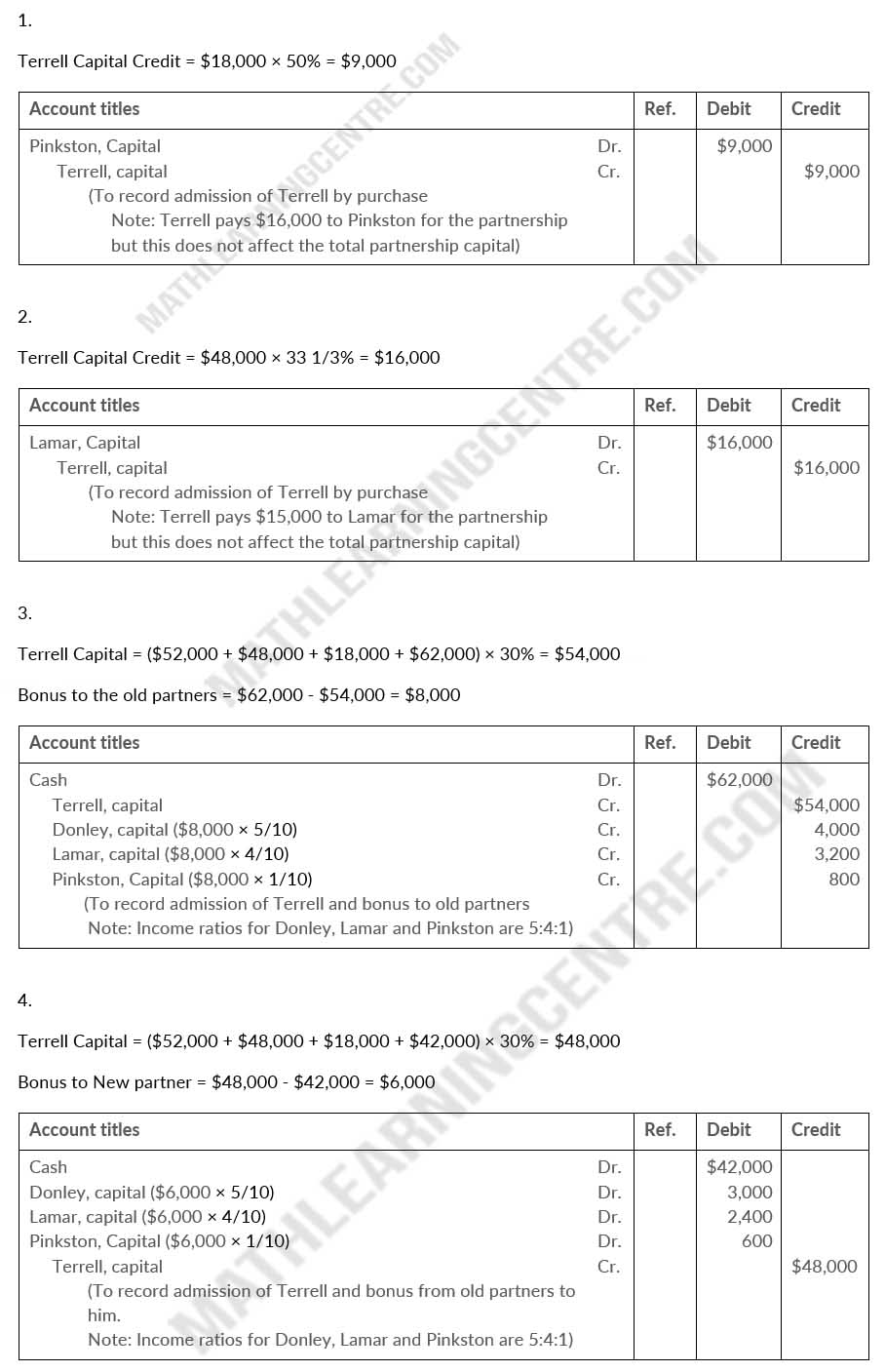

- Terrell purchases 50% of Pinkston's ownerhsip interest by paying Pinkston $16,000 each.

- Terrell purchases 33 1/3% of Lamar's ownership interest by paying Lamar $15,000 in cash.

- Terrel invests $62,000 for a 30% ownership interest, and bonuses are given to the old partners.

- Terrell invests $42,000 for a 30% ownership interest which includes a bonus to the new partner.

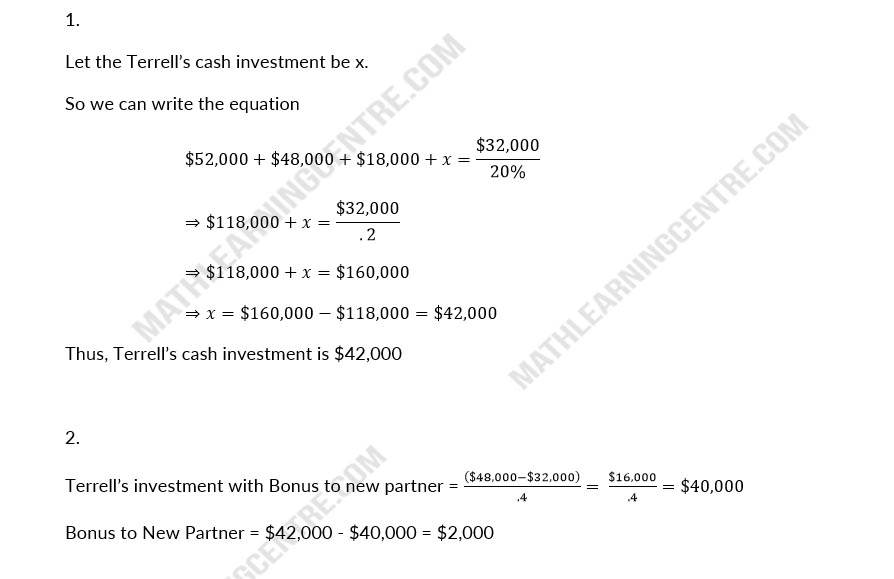

- Lamar's capital balance is $32,000 after admitting Terrell to the partnership by investment. If Lamar's ownership interest is 20% of total partnership capital, what were (1) Terrell's cash investment and (2) the bonus to the new partner?.

Solution

a.

Journal Entries

b.