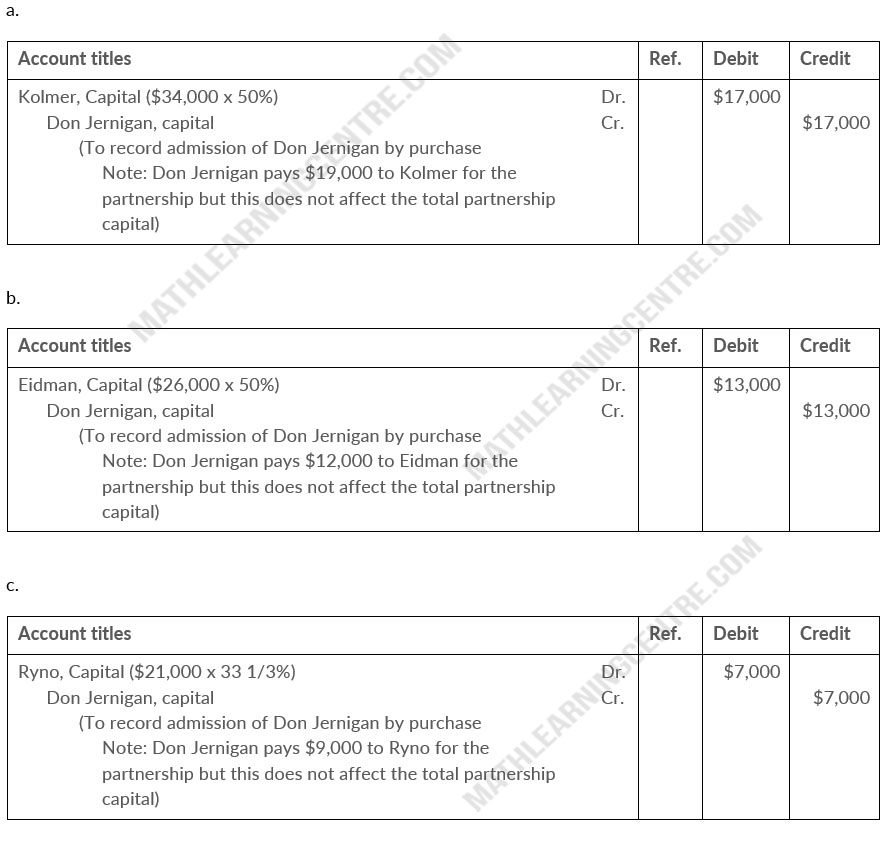

K.Kolmer, C Eidman, and C. Ryno share income on a 5:3:2 basis. They have capital balances of $34,000, $26,000, and $21,000, respectively, when Don Jernigan is admitted to the partnership.

Instructions

Prepare the journal entry to record the admission of Don Jernigan under each of the following assumptions.

- Purchase of 50% of Kolmer's equity for $19,000.

- Purchase of 50% of Eidman's equity for $12,000.

- Purchase of 33 1/3% of Ryno's equity for $9,000

Solution

Journal Entries