Prior to the distribution of cash to the partners, the accounts in the VUP company are Cash $24,000; Vogel Capital (Cr.) $17,000; Utech, Capital (Cr.) $15,000; and Pens, Capital (Dr.) $8,000. The income ratios are 5:3:2, respectively. VUP Company decides to liquidate the company.

Instructions

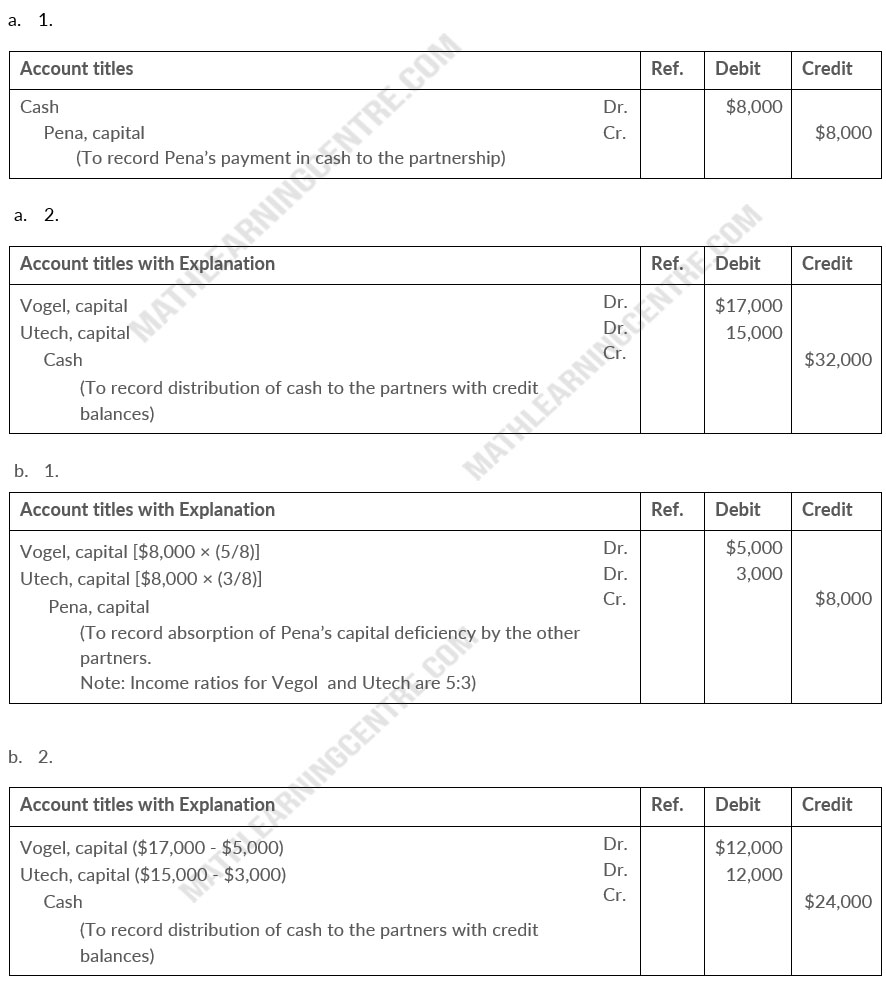

- Prepare the entry to record (1) Pena's payment of $8,000 in cash to the partnership and (2) the distribution of cash to the partners with credit balances.

- Prepare the entry to record (1) the absorption of Pena's capital deficiency bye the other partners and (2) the distribution of cash to the partners with credit balances.

Solution