On June 10, Diaz Company purchased $8,000 of merchandise from Taylor Company, FOB shipping point, terms 2/10, n/30. Diaz pays the freight costs of $400 on June 11. Damaged goods totaling $300 are returned to Taylor for credit on June 12. The fair value of these goods is $70. On June 19, Diaz pays Taylor Company in full, less the purchased discount. Both companies use a perpetual inventory system.

Instructions

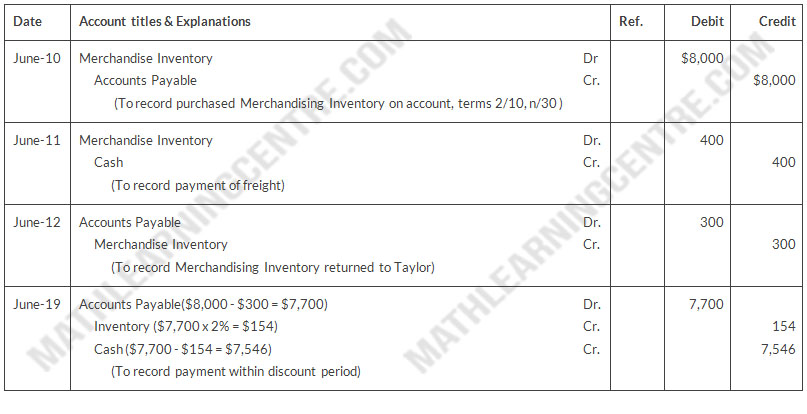

- Prepare separate entries for each transaction on the books of Diaz Company.

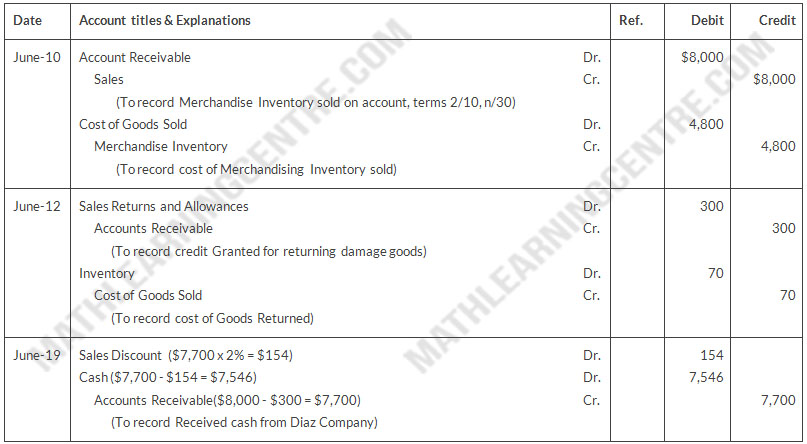

- Prepare separate entries for each transaction for Taylor Company. The merchandise purchased by Diaz on June 10 had cost Taylor $4,800.

Solution

a.

Diaz Company

Journal Entries

(Perpetual Inventory System)

Journal Entries

(Perpetual Inventory System)

b.

Taylor Company

Journal Entries

(Perpetual Inventory System)

Journal Entries

(Perpetual Inventory System)