Kern's Book Warehouse distributes hardcover looks to retail stores and extends credit terms of 2/10, n/30 to all of its customers. At the end of May, Kern's inventory consisted of books purchased for $1,800. During June, the following merchandising transactions occurred.

| June 1 | Purchased books on account for $1,600 from Binsfeld Publishers, FOB destination, terms 2/10, n/30. The appropriate party also made a cash payment of $50 for the freight on this date. |

| 3 | Sold books on account to Reading Rainbow for $2,500. The cost of the books sold was $1,440. |

| 6 | Received $100 credit for books returned to Binsfeld Publishers. |

| 9 | Paid Binsfeld Publishers in full, less discount. |

| 15 | Received payment in full from Reading Rainbow. |

| 17 | Sold books on account to Rapp Books for $1,800. The cost of the books sold was $1,080. |

| 20 | Purchased books on account for $1,800 from McGinn Publishers, FOB destination, terms 2/15, n/30. The appropriate party also made a cash payment of $60 for the freight on this date. |

| 24 | Received payment in full from Rapp Books. |

| 26 | Paid McGinn Publishers in full, less discount. |

| 28 | Sold books on account to Baeten Bookstore for $1,600. The cost of the books sold was $970. |

| 30 | Granted Baeten Bookstore $120 credit for books returned costing $72 |

Kern's Book Warehouse's chart of accunts includes the following: No. 101 Cash, No. 112 Accounts Receivable, No. 120 Inventory, No. 201 Accounts Payable, no. 401 Sales Revenue, No. 412 Sales Returns and Allowances, No. 414 Sales Discounts, and No. 505 Cost of Goods Sold.

Instructions

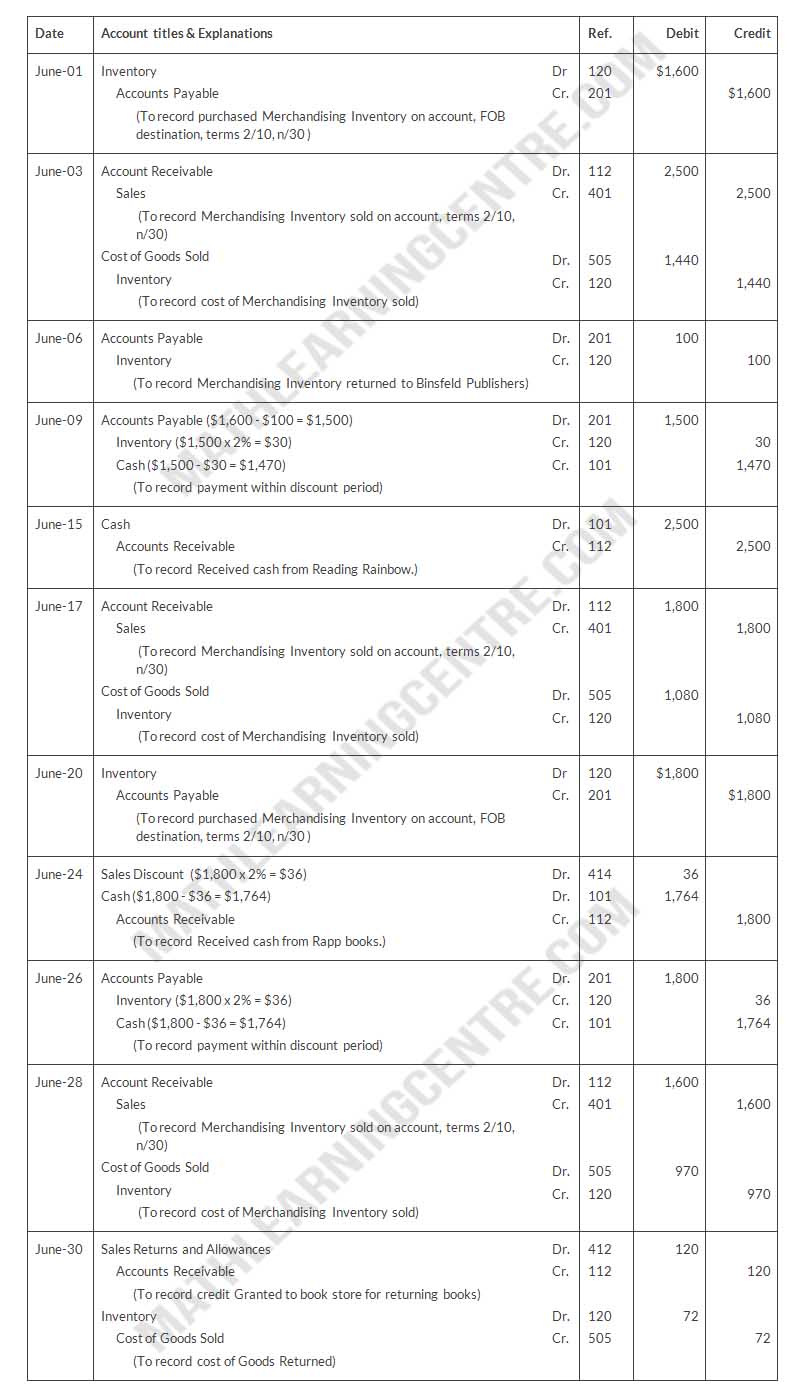

Journalize the transactions for the month of June for Kern's Book Warehouse using a perpetual inventory system.

Solution

General Entries

(Perpetual Inventory System)