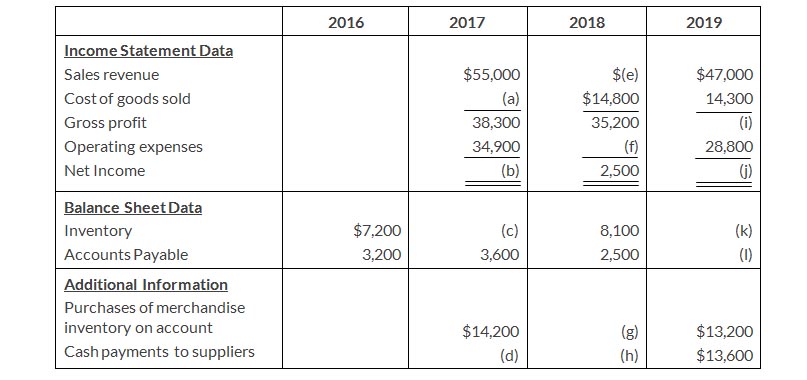

Kayla Incorporation operates a retail operation that purchases and sells home entertainment products. The company purchase all merchandise inventory on credit and uses a periodic inventory system. The Accounts Payable account is used for recording inventory purchases only; all other current liabilities are accrued in separate accounts. You are provided with the following selected information for the fiscal years 2016 through 2019, inclusive.

Instructions

- Calculate the missing amounts.

- Sales declined over the 3-year fiscal period, 2017-2019. Does that mean that profitability necessarily also declined? Explain, computing the gross profit rate and the profit margin(Net income + Sales revenue) for each fiscal year to help support your answer (Round to one decimal place.)

Solution

a.

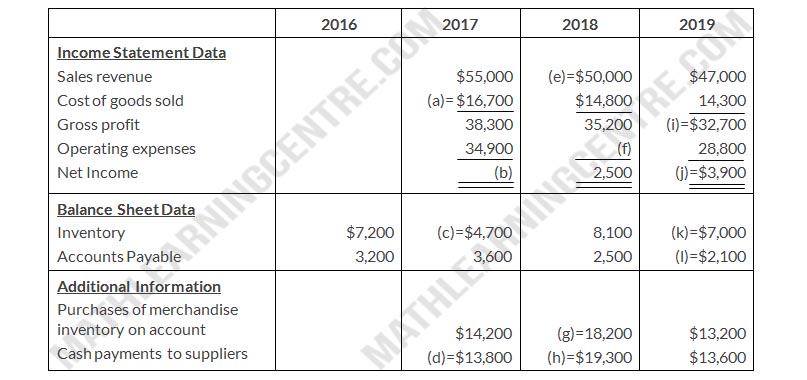

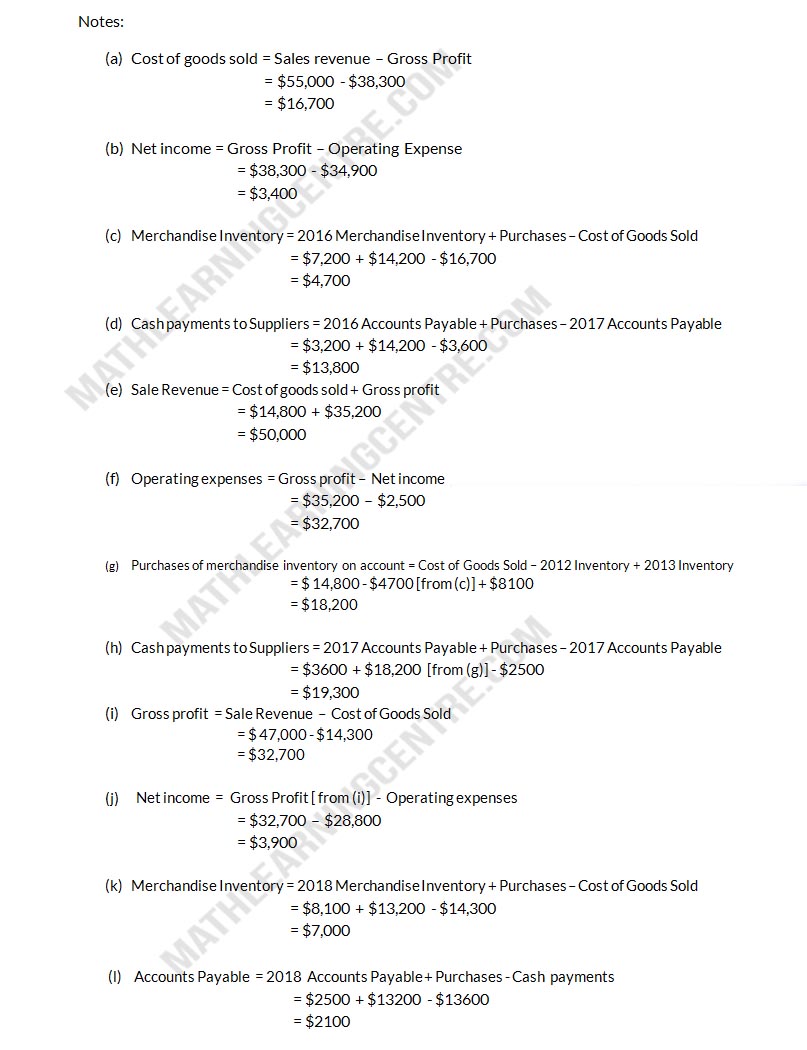

Calculating Missing Amounts

b.

According to the given data, the profitability declined as per the sales decline. The gross profit rates for 2017 to 2019 are $38,300/$55,000 = 69%, $35,200/$50,000 = 70%, and $32,700/$47,000 = 69% indicate that the profitability declined over the 3-year fiscal period.