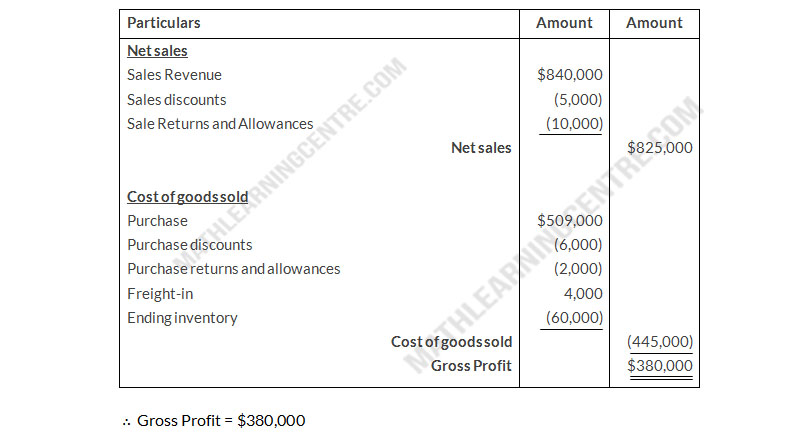

| Freight-in | $4,000 |

| Purchases | 509,000 |

| Purchase discounts | 6,000 |

| Purchase returns and allowances | 2,000 |

| Sales Revenue | 840,000 |

| Sales discounts | 5,000 |

| Sales returns and allowances | 10,000 |

At December 31, 2019, Brooke Hanson determines that its ending inventory is $60,000.

Instructions

- Compute Brooke Hanson's 2019 gross profit.

- Compute Brooke Hanson's 2019 operating expenses if net income is $130,000 and there are no non operating activities.

Solution

Gross Profit

For the Year Ended December 31, 2019