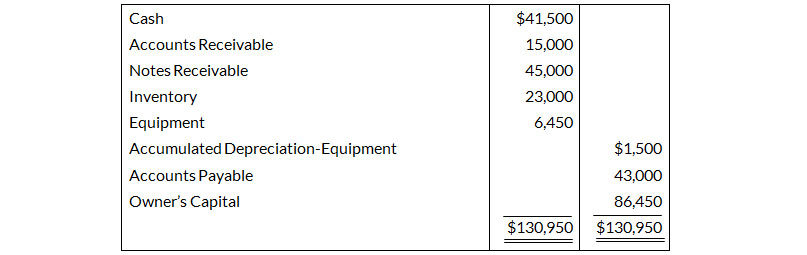

The post-closing trial balance for Horner Co. is shown below.

HORNER CO.

Post-Closing Trial Balance

December 31, 2019.

Post-Closing Trial Balance

December 31, 2019.

The subsidiary ledgers contain the following information: (1) accounts receivable - B. Hannigan $2,500, I. Kirk $7,500, and T. Hodges $5,000, (2) accounts payable - T. Igawa $12,000, D Danford $18,000, and K.Thayer $13,000. The cost of all merchandise sold was 60% of the sales price.

The transactions for January 2010 are as follows

| Jan. 3 | Sell merchandise to M. Ziesmer $8,000, terms 2/10, n/30.. |

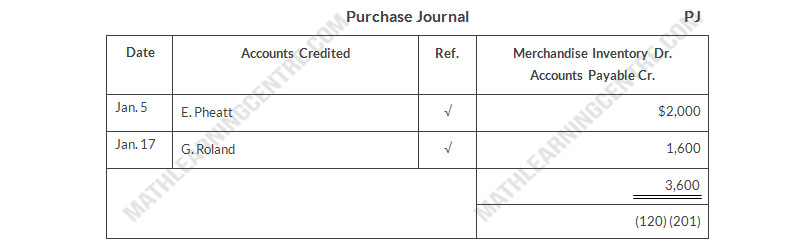

| 5 | Purchase merchandise from E. Pheatt $2,000, terms 2/10, n/30. |

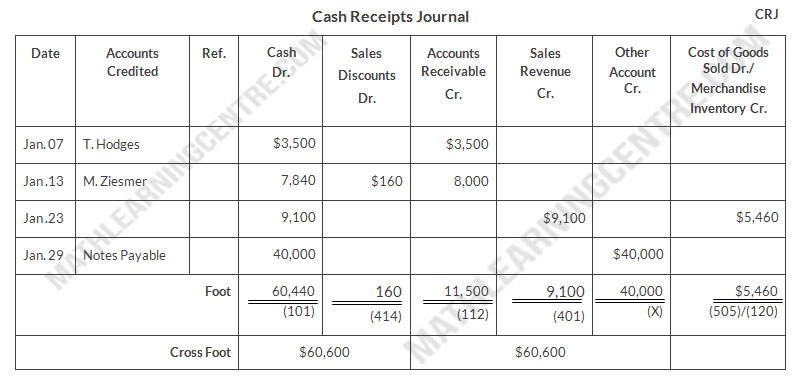

| 7 | Receive a check from T. Hodges $3,500. |

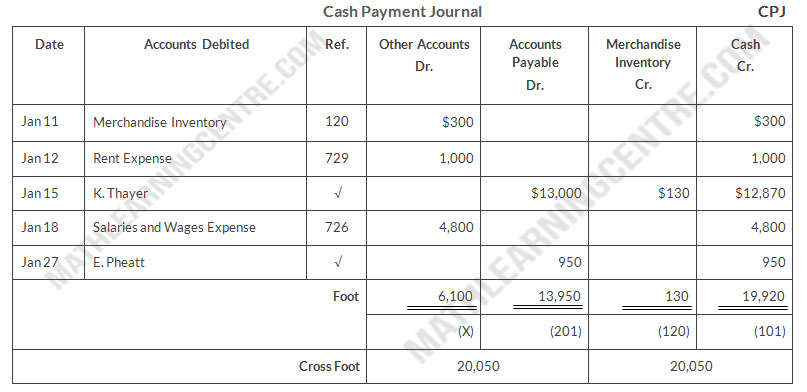

| 11 | Pay freight on merchandise purchased $300. |

| 12 | Pay rent of $1,000 for January. |

| 13 | Receive payment in full from M. Ziesmer. |

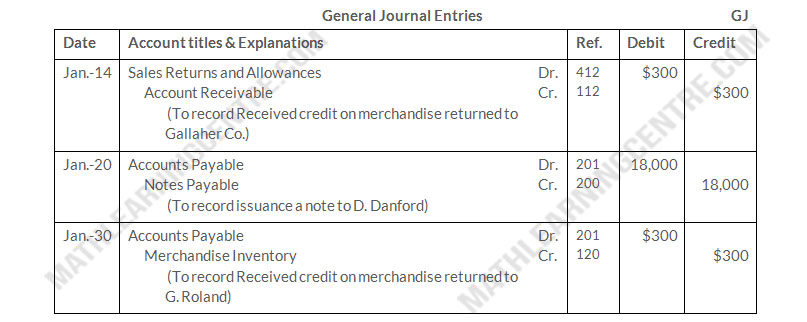

| 14 | Post all entries to the subsidiary ledgers. Issued credit of $300 to B. Hannigan for returned merchandise. |

| 15 | Send K. Thayer a check for $12,870 in full payment of account, discount $130. |

| 17 | Purchase merchandise from G. Roland $1,600, terms 2/10, n/30. |

| 18 | Pay sales salaries of $2,800 and office salaries $2,000. |

| 20 | Give D. Danford a 60-day note for $18,000 in full payment of account payable. |

| 23 | Total cash sales amount to $9,100. |

| 24 | Post all entries to the subsidiary ledgers. Sell merchandise on account to I. Kirk $7,400, terms 1/10, n/30. |

| 27 | Send E. Pheatt a check for $950. |

| 29 | Receive payment on a note of $40,000 from B. Stout. |

| 30 | Post all entries to the subsidiary legers. Return merchandise of $300 to G. Roland for credit. |

Instructions

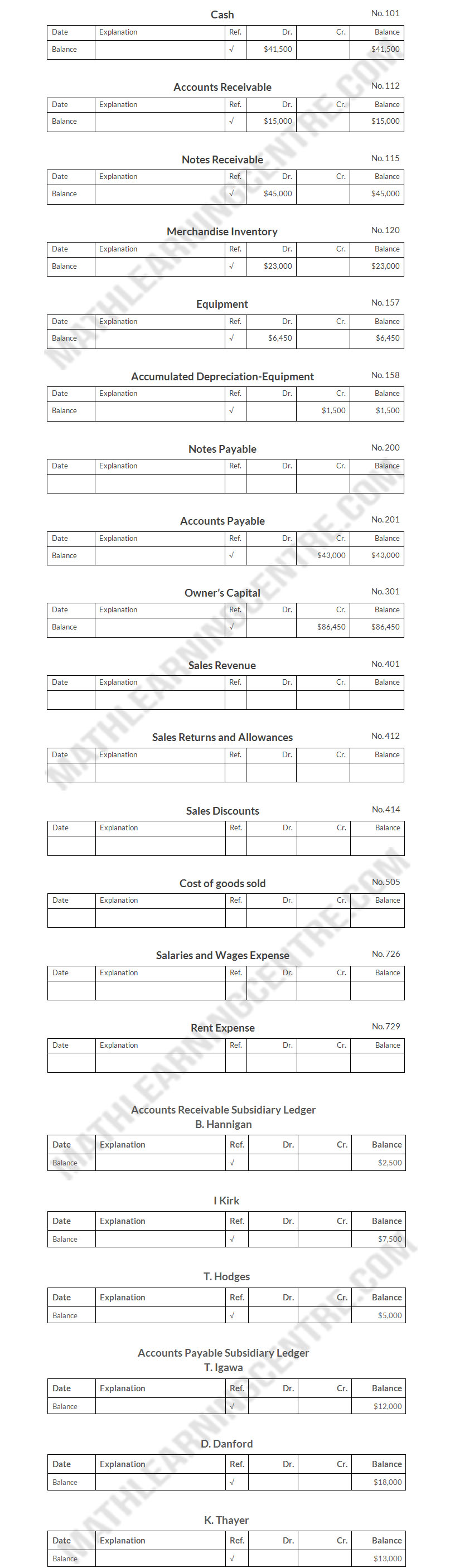

- Open general and subsidiary ledger accounts for the following.

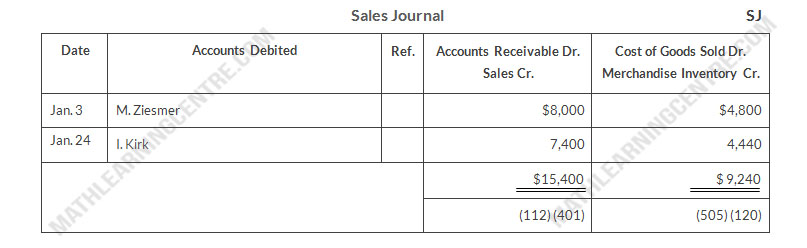

- Record the January transactions in a sales journal, a single-column purchases journal, a cash receipts journal, a cash payments journal, and a general journal.

- Post the appropriate amounts to the general ledger.

- Prepare a trial balance at January 31, 2020

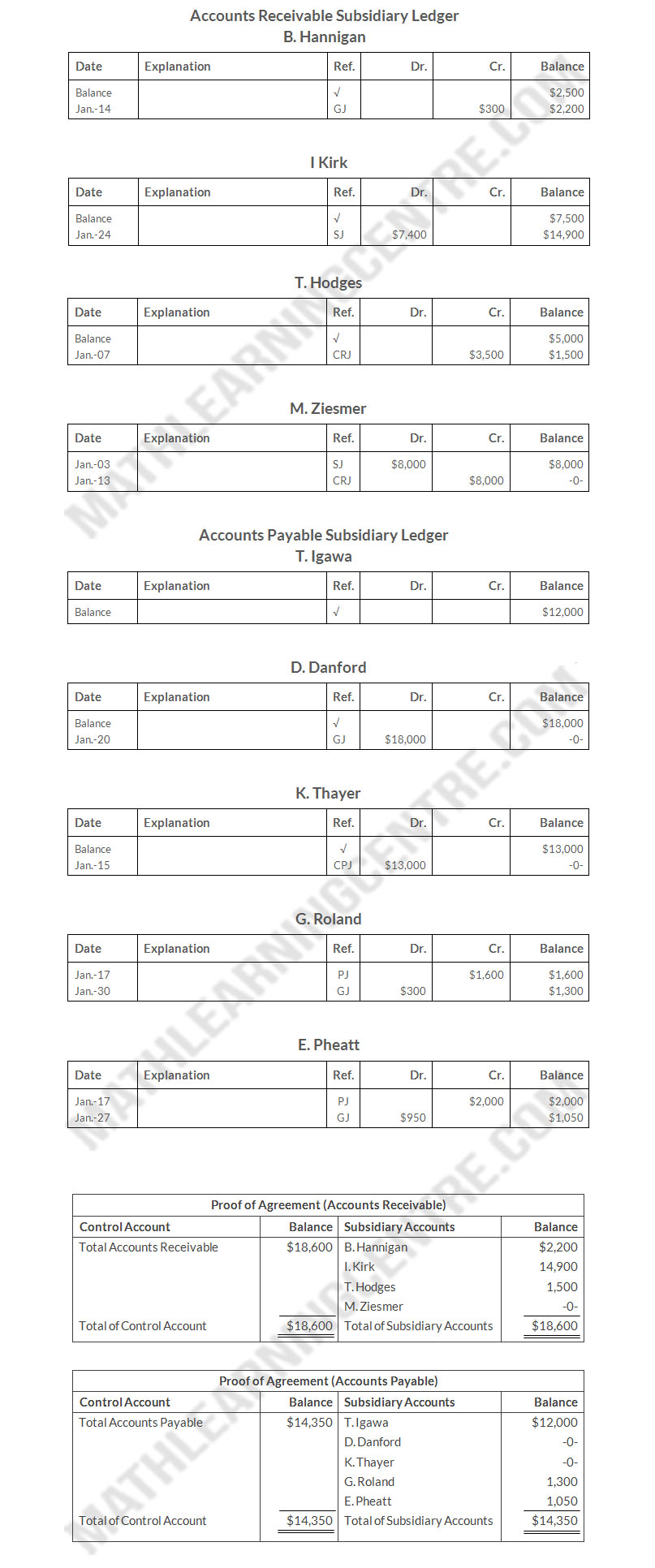

- Determine whether the subsidiary ledgers agree with controlling accounts in the general ledger.

Solution

a.

Horner Co.

General Ledger and Subsidiary Accounts

General Ledger and Subsidiary Accounts

b.

Horner Co.

Horner Co.

Horner Co.

Horner Co.

Horner Co.

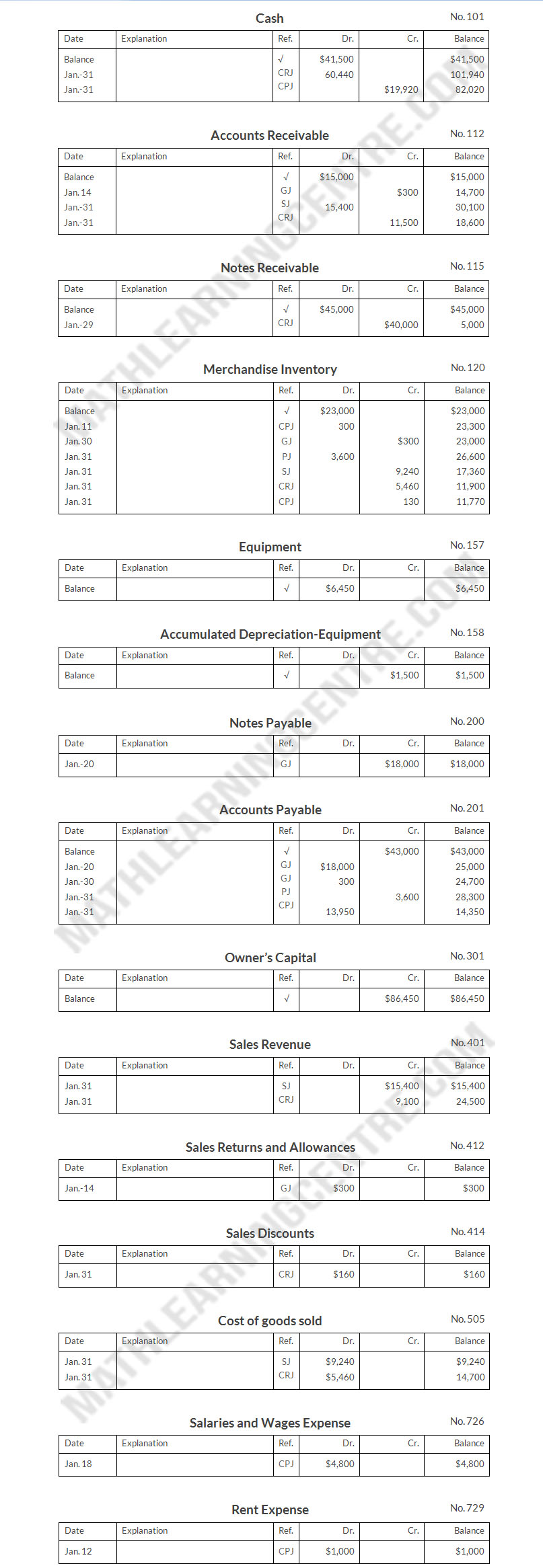

c.

Horner Co.

General Ledger

General Ledger

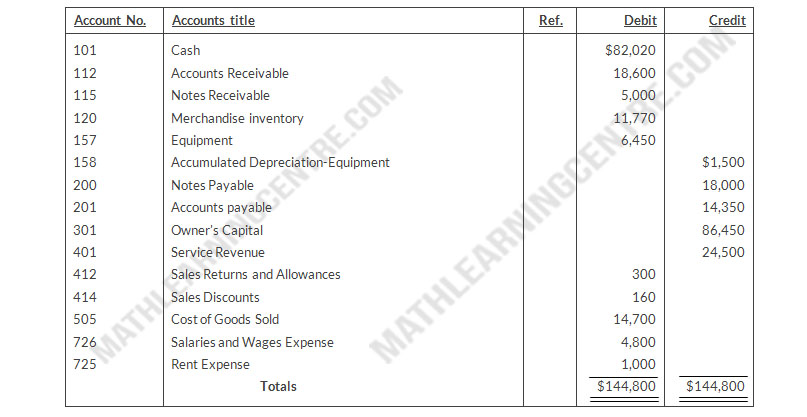

d.

Horner Co.

Trial Balance

January 31, 2020

Trial Balance

January 31, 2020

e.