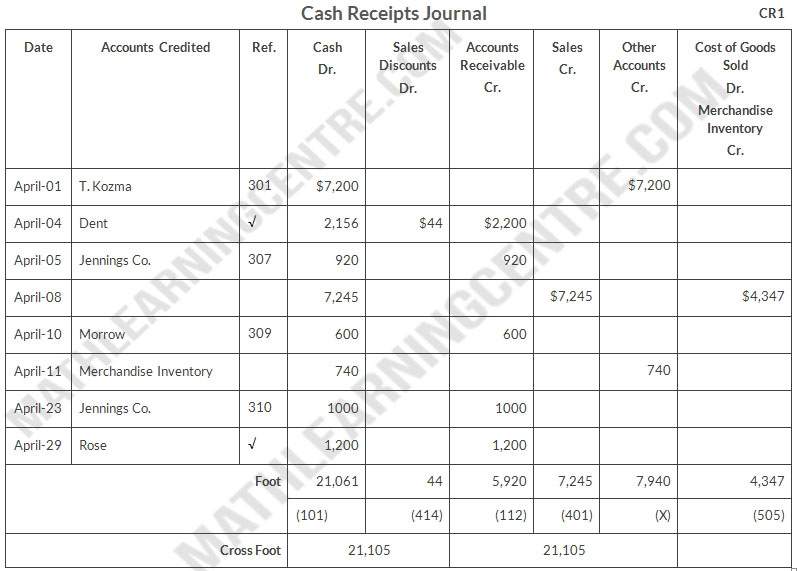

On April 1, the accounts receivable ledger of Kozma Company showed the following balances: Morrow $1,550, Rose $1,200, Jennings Co. $2,900, and Dent $2,200. The April transactions involving the receipt of cash were as follows.

| Apr. 1 | The owner, T. Kozma, invested additional cash in the business $7,200 |

| 4 | Received check for payment of account from Dent less 2% cash discount. |

| 5 | Received check for $920 in payment of invoice no. 307 from Jennings Co. |

| 8 | Made cash sales of merchandise totaling $7,245. The cost of the merchandise sold was $4,347. |

| 10 | Received check for $600 in payment of invoice no. 309 from Morrow |

| 11 | Received cash refund from a supplier for damaged merchandise $740. |

| 23 | Received check for $1,000 in payment of invoice no. 310 from Jennings Co. |

| 29 | Received check for payment of account from Rose (no cash discount allowed). |

Instructions

- Journalize the transactions above in a six-column cash receipts journal with columns for Cash Dr., Sales Discounts Dr., Accounts Receivable Cr., Sales Revenue Cr., Other Accounts Cr., and Cost of Goods Sold Dr/Inventory Cr. Foot and cross-foot the journal.

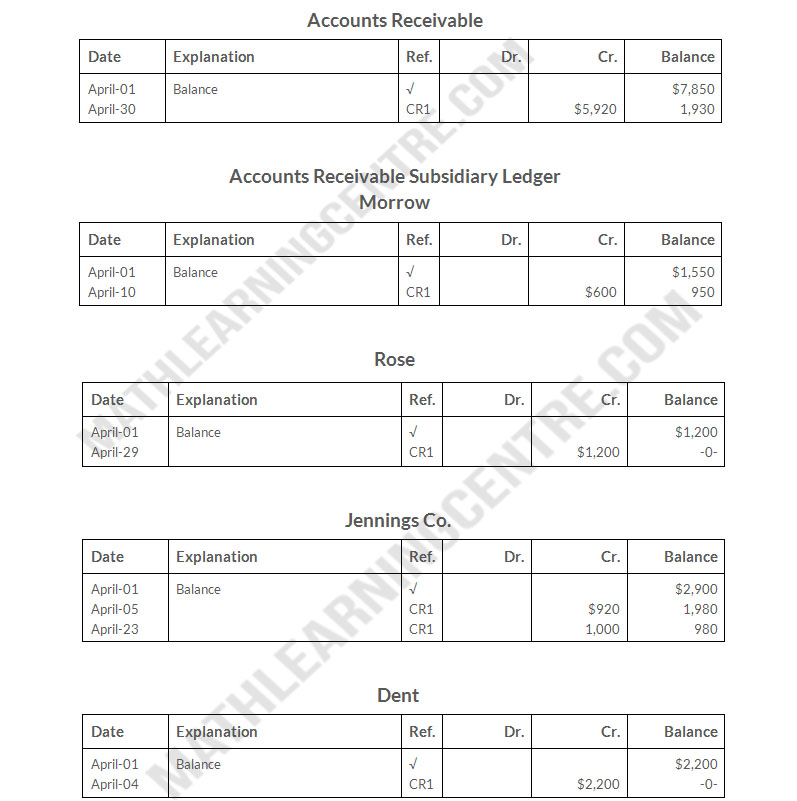

- Insert the beginning balances in the Accounts Receivable control and subsidiary accounts, and post the April transactions to these accounts.

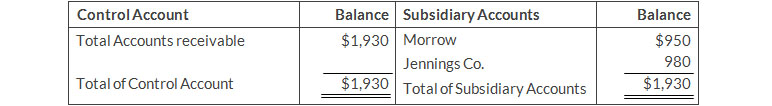

- Prove the agreement of the control account and subsidiary account balances.

Solution

General Ledger