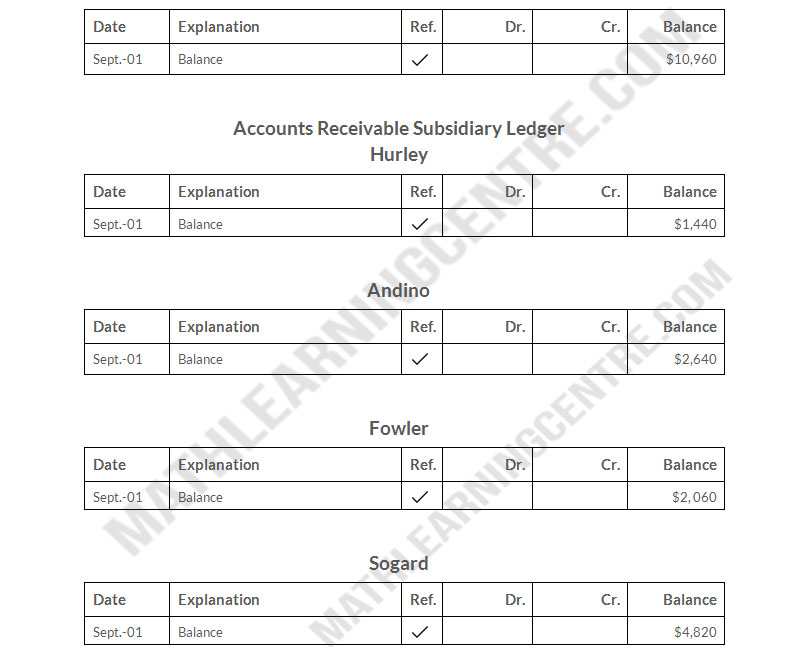

On September 1, the balance of the accounts Receivable control account in the general ledger of Montgomery company was $10,960. The customers' subsidiary ledger contained account balance as follows: Hurley $1,440, Andino $2,640, Fowler $2,060, and Sogard $4,820. At the end of September, the various journals contained the following information.

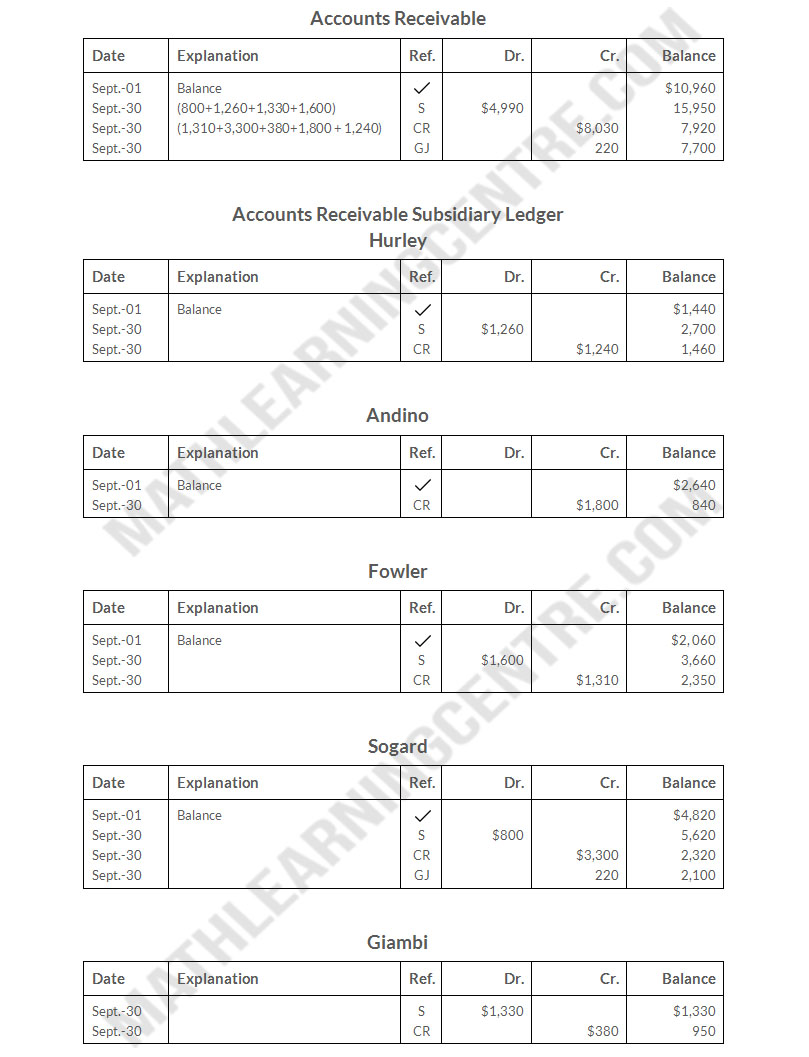

Sales journal: Sales to Sogard $800, to Hurley $1,260, to Giambi $1,330, and to Fowler $1,600

Cash Receipt journal: Cash received from Fowler $1,310, from Sogard $3,300, from Giami $380, from Andino $1,800, and from Hurley $1,240.

General Journal journal: An allowance is granted to Sogard $220.

Instructions

- Set up control and subsidiary accounts and enter the beginning balances. Do not construct the journals

- Post the various journals. Post the items as individual items or as totals, whichever would be the appropriate procedure. (No sales discounts given.)

- Prepare a schedule of accounts receivable and prove the agreement of the controlling account with the subsidiary ledger at September 30, 2019.

Solution

a.

Montgomery company

General Ledger

General Ledger

b.

Montgomery company

General Ledger

General Ledger

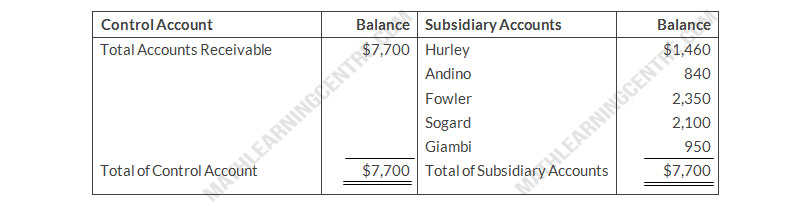

c.

Montgomery company

Schedule of Customers and Proof of Agreement

As of September 30, 2019

Schedule of Customers and Proof of Agreement

As of September 30, 2019