Reineke Company's chart of accounts includes the following selected accounts.

On October 1, the accounts payable ledger of Reineke Company showed the following balances: Uggla Company $2,700, Orr Co. $2,500, Rosenthal Co. $1,800, and Clevenger Company $3,700. The October transactions involving the payment of cash were as follows.

| Oct. 1 | Purchased merchandise, check no. 63, $300. |

| 3 | Purchased equipment, check no. 64, $800. |

| 5 | Paid Uggla Company balance due of $2,700, less 2% discount, check no. 65, $2,646. |

| 10 | Purchased merchandise, check no. 66, $2,550. |

| 15 | Paid Rosenthal Co. balance due of $1,800, check no. 67. |

| 16 | Reineke, the owner, pays his personal insurance premium of $400, check no. 68. |

| 19 | Paid Orr Co. in full for invoice no. 610, $2,000 less 2% discount, check no. 69, $1,960. |

| 29 | Paid Clevenger Company in full for invoice no. 264, $2,500, check no. 70. |

Instructions

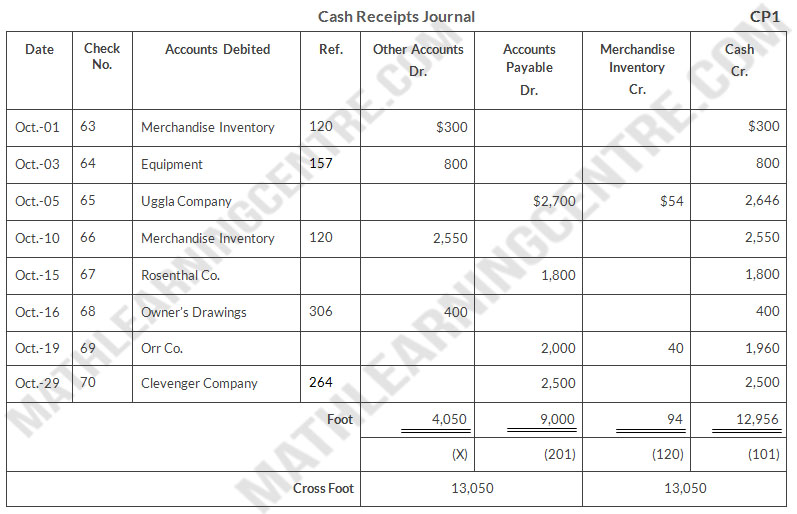

- Journalize the transactions above in a four-column cash payments journal with columns for Other Accounts Dr., Accounts Payable Dr., Inventory Cr., and Cash Cr. Foot and cross-foot the Journal.

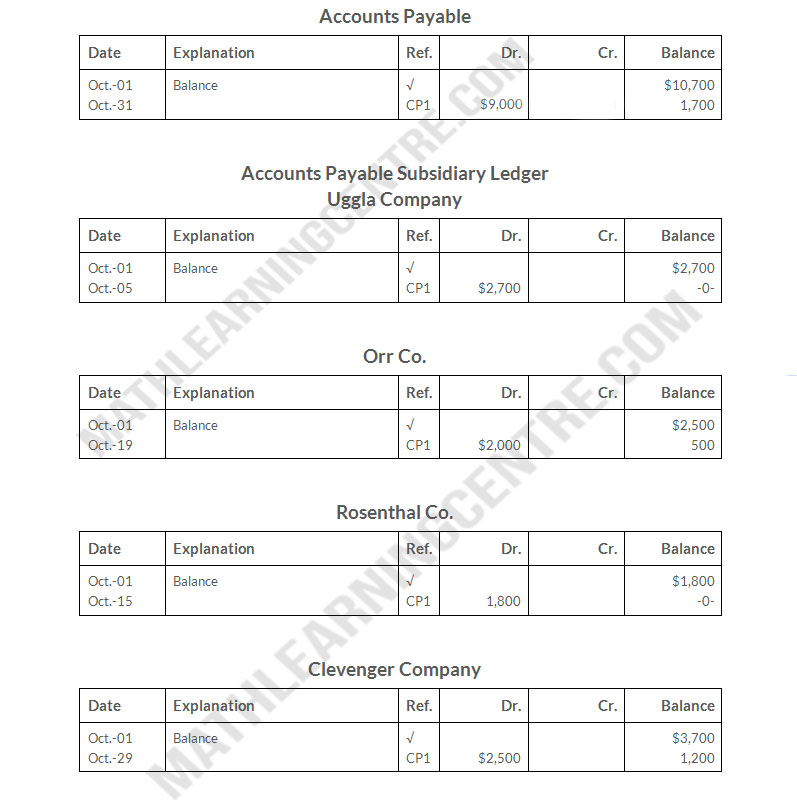

- Insert the beginning balances in the Accounts Payable control and subsidiary accounts, and post the October transactions to these accounts.

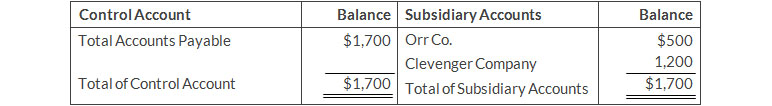

- Prove the agreement of the control account and subsidiary account balances.

Solution

a.

Reineke Company

b.

Reineke Company

General Ledger

General Ledger

c.

Proof of Agreement