Peck Corporation is authorized to issue 20,000 shares of $50 par value, 10% preferred-stock and 125,000 shares of $5 par value common stock. On January 1, 2019, the ledger contained the following stockholders equity balances

| Preferred Stock (10,000 shares) | $500,000 |

| Paid-in Capital in Excess of Par-Preferred Stock | 75,000 |

| Common Stock (70,000 shares) | 350,000 |

| Paid-in Capital in Excess of Par-Common Stock | 700,000 |

| Retained Earnings | 300,000 |

During 2020, the following transactions occurred.

| Feb. 1 | Issued 2,000 shares of preferred stock for land having a fair value of $120,000 |

| Mar. 1 | Issued 1,000 shares of preferred stock for cash at $65 per share. |

| July 1 | Issued 16,000 shares of common stock for cash at $7 per share. |

| Sept. 1 | Issued 400 shares of preferred stock for a patent. The asking price for the patent was $30,000. Market price for the preferred stock was $70 and the fair value for the parent was indeterminable. |

| Dec. 1 | Issued 8,000 shares of common stock for cash at $7.50 per share. |

| Dec. 31 | Net income for the year was $260,000. No dividends were declared |

Instruction

- Journalize the transactions and the closing entry for net income

- Enter the beginning balances in the accounts, and post the journal entries to the stockholders' equity accounts. (Use J2 for the posting reference.)

- Prepare the stockholders' equity section at December 31, 2020.

Solution

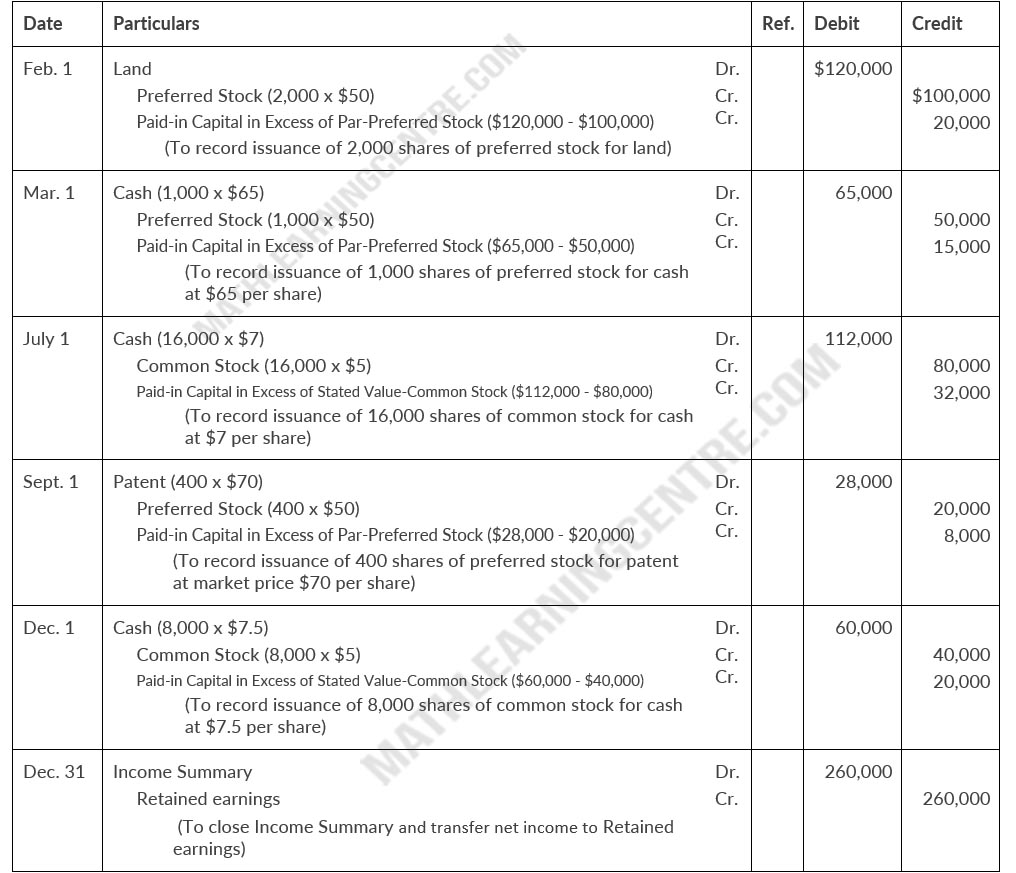

a.

Peck Corporation

Journal Entries

Journal Entries

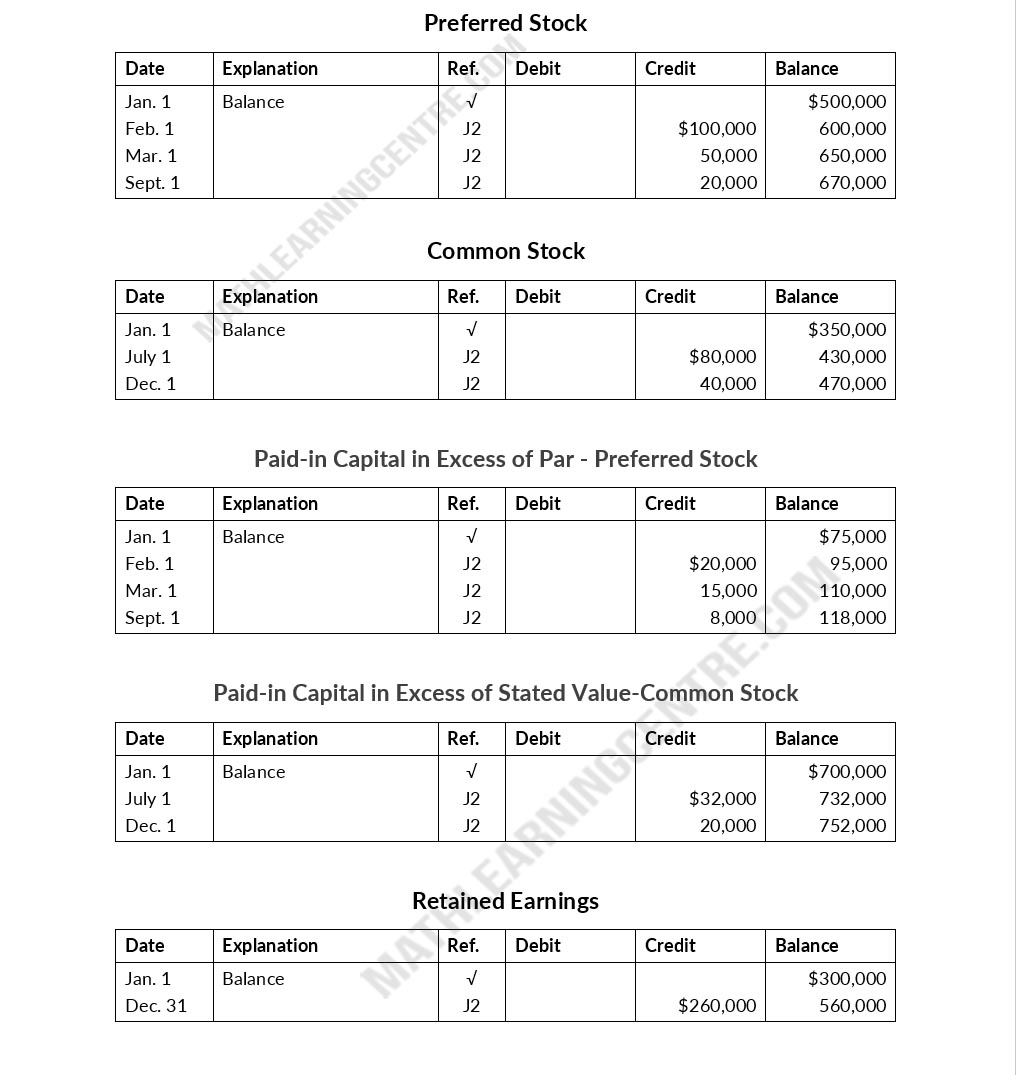

b.

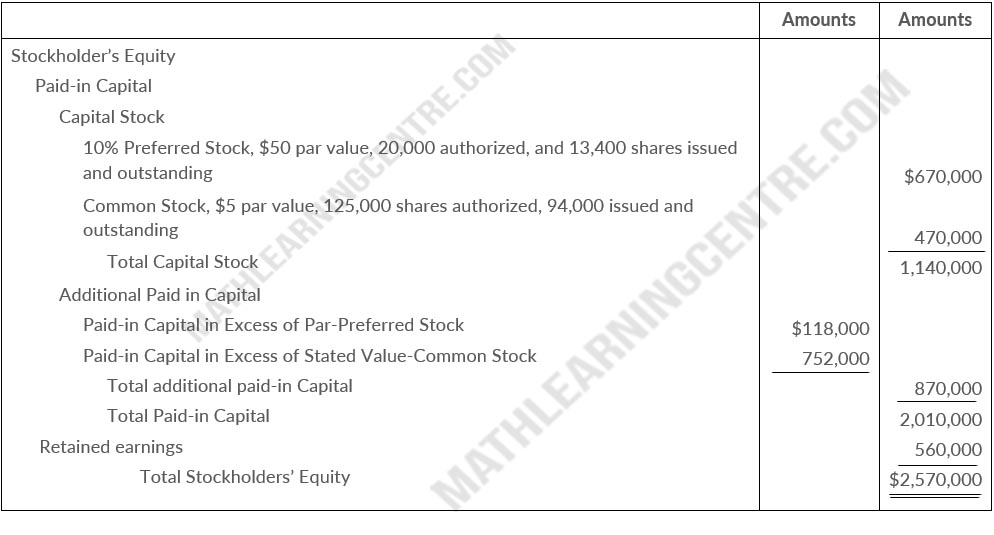

c.

Peck Corporation

Balance Sheet (Partial)

Balance Sheet (Partial)