The stockholders equity accounts of Castle Corporation on January 1, 2020, were as follows

| Preferred Stock (8%, $50 par, 10,000 shares authorized) | $400,000 |

| Common Stock ($1 stated value, 2,000,000 shares authorized) | 1,000,000 |

| Paid-in Capital in Excess of Par-Preferred Stock | 100,000 |

| Paid-in Capital in Excess of Stated Value-Common Stock | 1,450,000 |

| Retained Earnings | 1,816,000 |

| Treasury Stock (10,000 common shares) | 50,000 |

During 2020, the corporation had the following transactions and events pertaining to its stockholder' equity.

| Feb. 1 | Issued 25,000 shares of common stock for $120,000. |

| Apr. 14 | Sold 6,000 shares of treasury stock - common for $33,000. |

| Sept. 3 | Issued 5,000 shares of common stock for a patent valued at $35,000.. |

| Nov. 10 | Purchased 1,000 shares of common stock for the treasury at a cost of $6,000. |

| Dec. 31 | Determined that net income for the year was $452,000. |

No dividends were declared during the year.

Instruction

- Journalize the transactions and the closing entry for net income

- Enter the beginning balances in the accounts, and post the journal entries to the stockholders' equity accounts. (Use J5 for the posting reference.)

- Prepare the stockholders' equity section at December 31, 2020.

Solution

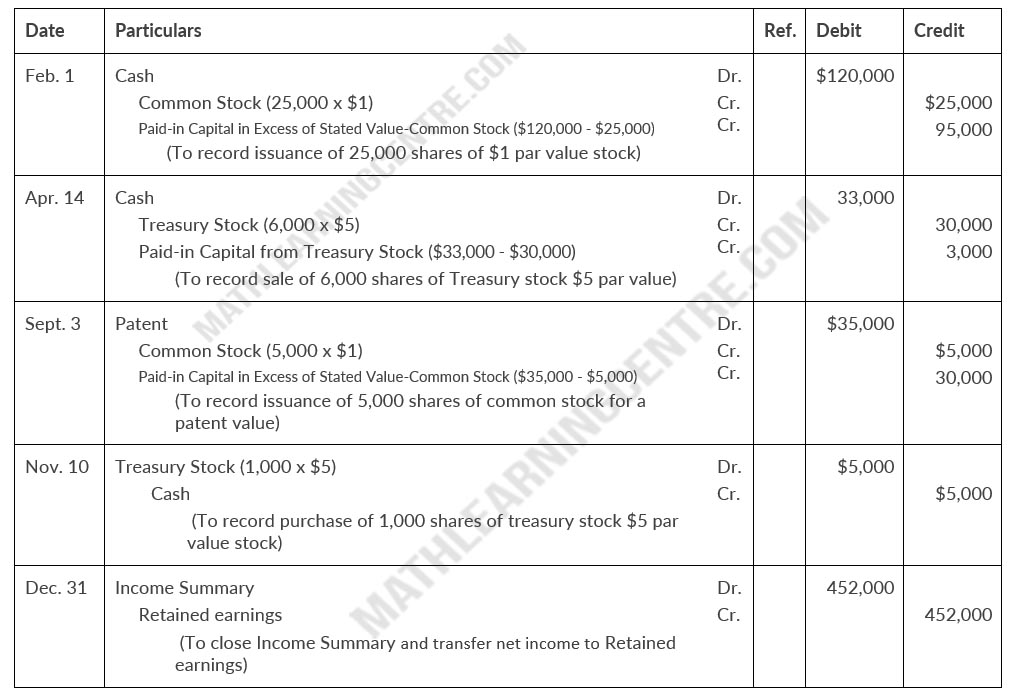

a.

Castle Corporation

Journal Entries

Journal Entries

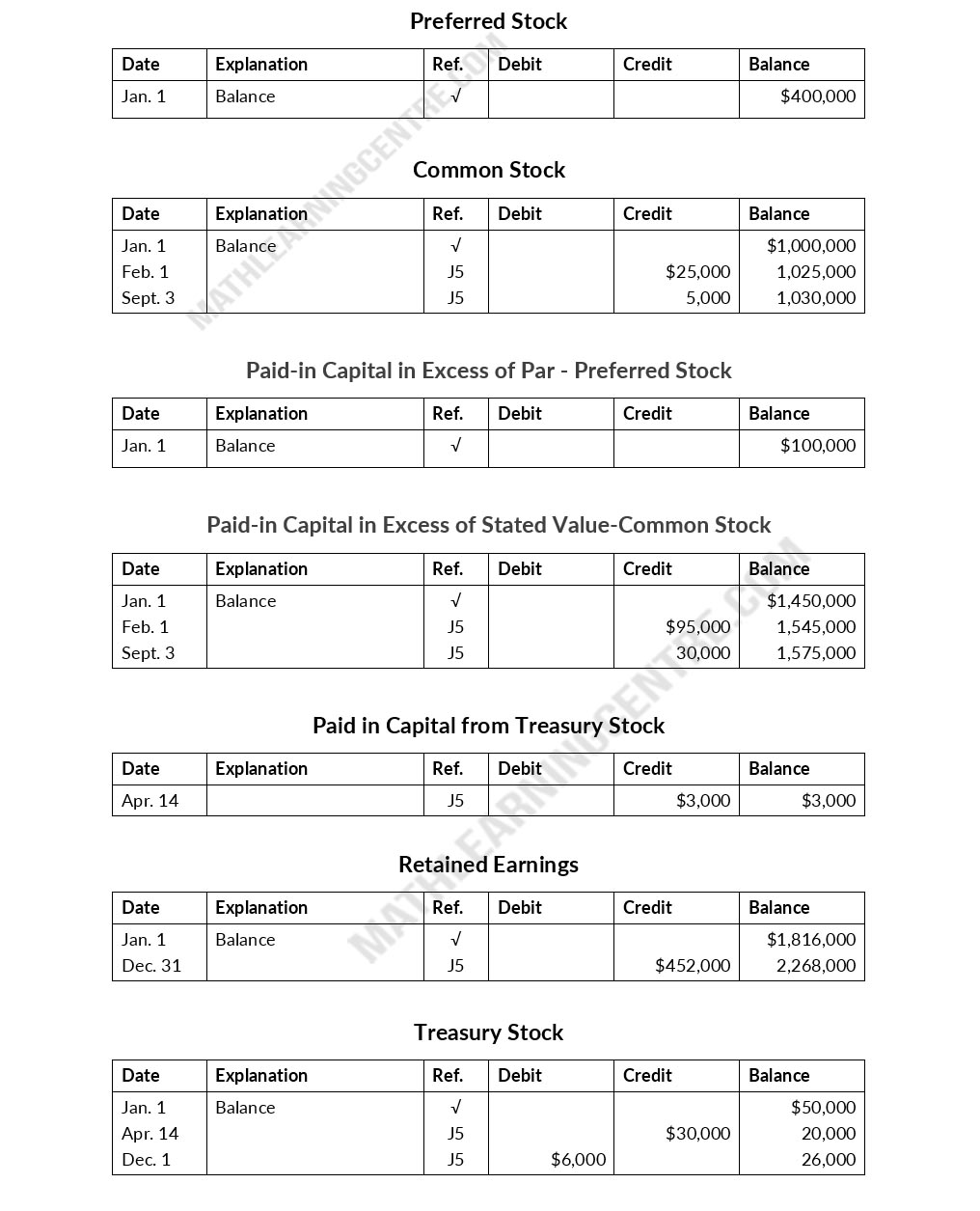

b.

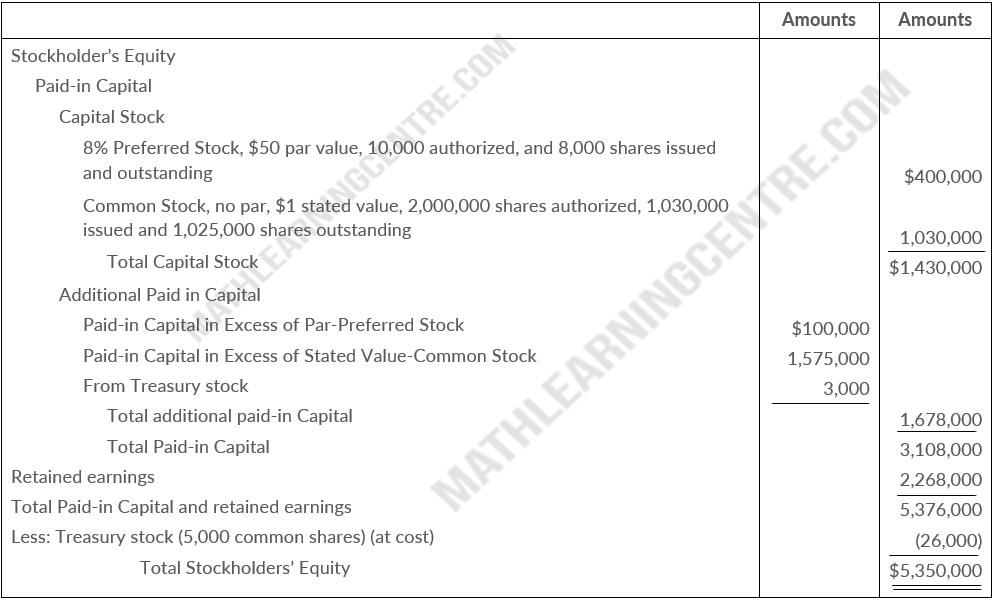

c.

Castle Corporation

Balance Sheet (Partial)

Balance Sheet (Partial)