As an auditor for the CPA firm of Hinkson and Calvert, you encounter the following situations in auditing different clients.

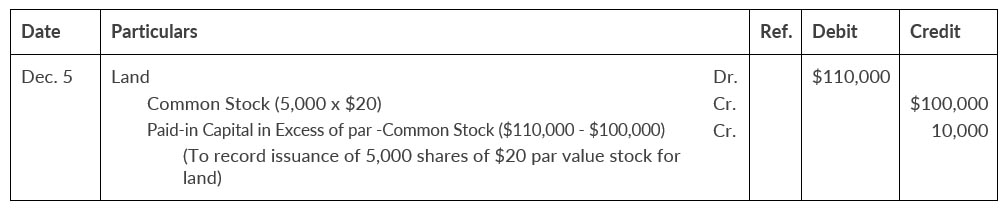

- LR Corporation is a closely held corporation whose stock is not publicly traded. On December 5, the corporation acquired land by using 5,000 shares of sites $20 par value common stock. The owner's asking price for the land was $120,000, and the fair value of the land was $110,000.

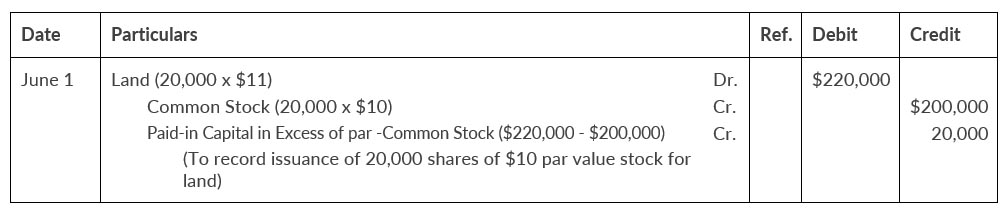

- Vera Corporation is a publicly held corporation whose common stock is traded on the securities markets. On June 1, it acquired land by issuing 20,000 shares of its $10 par value stock. at the time of the exchange, the land was advertised for sale at $250,000. the stock was selling at $11 per share.

Instruction

Prepare the journal entries for each of the situations above

Solution

LR Corporation

Journal Entry

Journal Entry

Vera Corporation

Journal Entry

Journal Entry