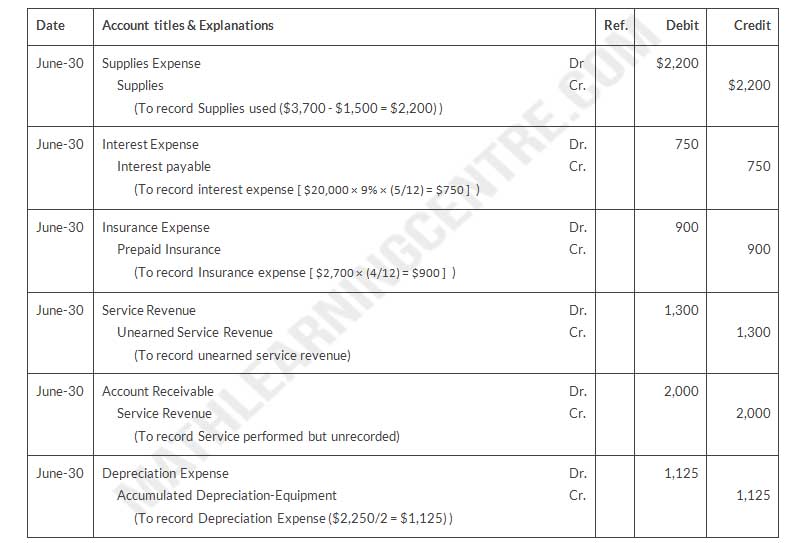

- The $3,700 balance in Supplies Expense represents supplies purchased in January. At June 30, $1,500 of supplies are on had.

- The note payable was issued on February 1. It is a 9%, 6-month note.

- The balance in Insurance Expense is the premium on a one-year policy, dated March 1, 2019.

- Service revenues are credited to revenue when received. At June 30, services revenue of $1,300 are unearned.

- Revenue for services performed but unrecorded at June 30 totals $2,000.

- Depreciation is $2,250 per year.

Instructions

- Journalize the adjusting entries at June 30. (Assume adjustments are recorded every 6 months.)

- Prepare an adjusted trial balance.

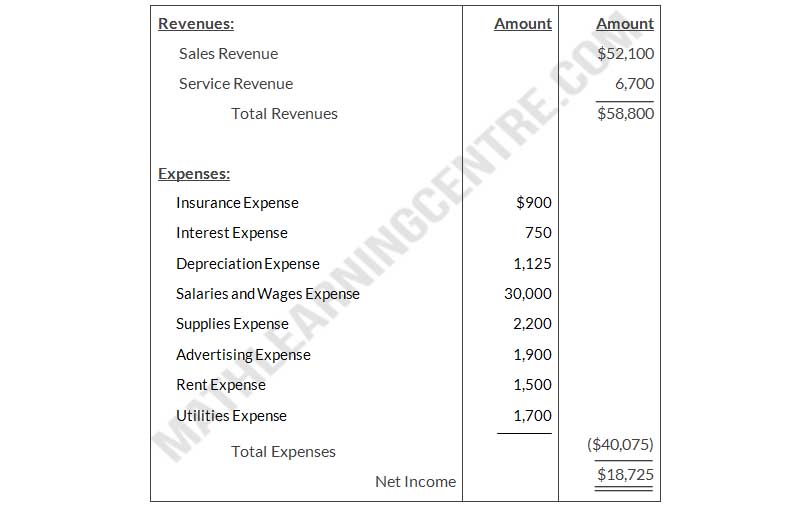

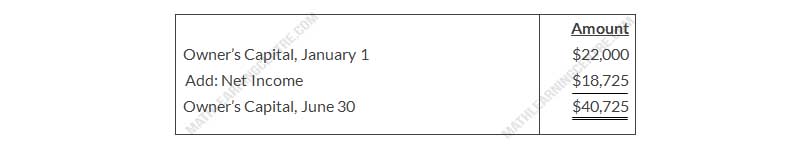

- Prepare an income statement and an owner’s equity statement for the 6 months ended June 30 and a balance sheet at June 30.

Answer

Adjusting Journal

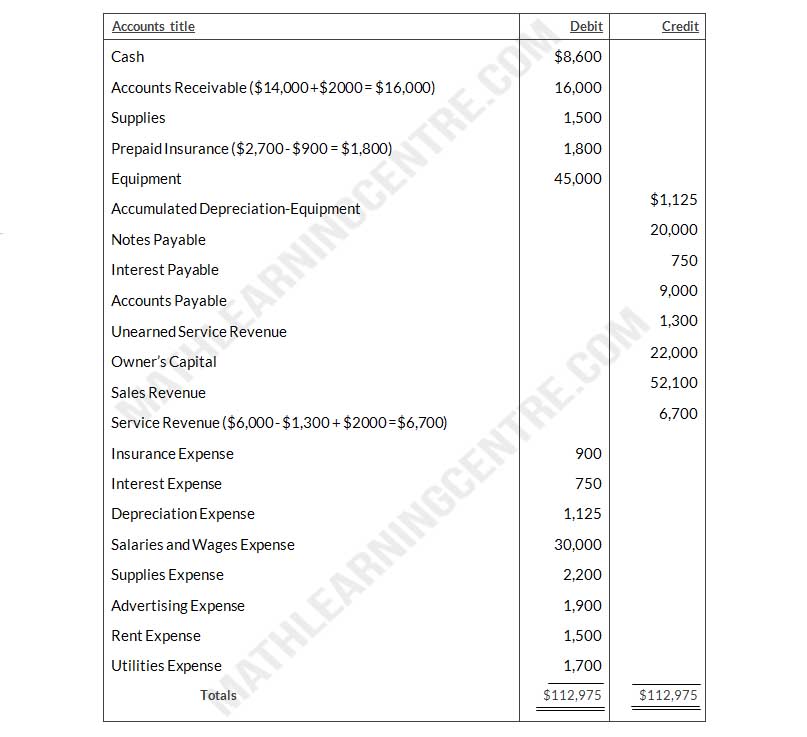

Adjusted Trial Balance

June 30, 2019

Income Statement

For the 6-Months Ended Juner 30, 2019

Owner's Equity Statement

For the 6-Months Ended June 30, 2019

Johnson Graphics Company

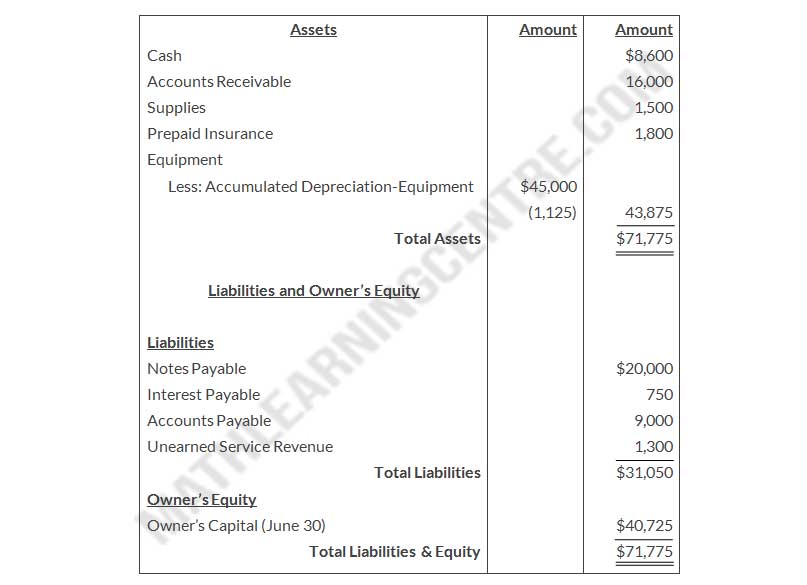

Balance Sheet

June 30, 2019