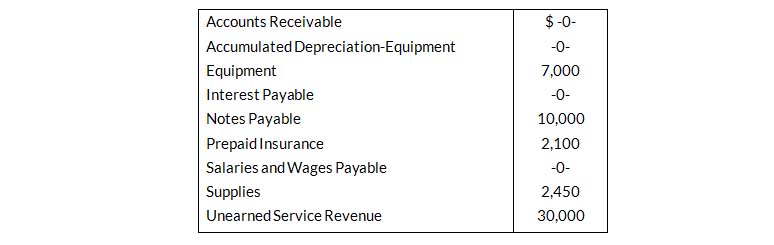

Devin Wolf Company has the following balances in selected accounts on December 31, 2019

All the accounts have normal balances. The information below has been gathered at December 31, 2019.

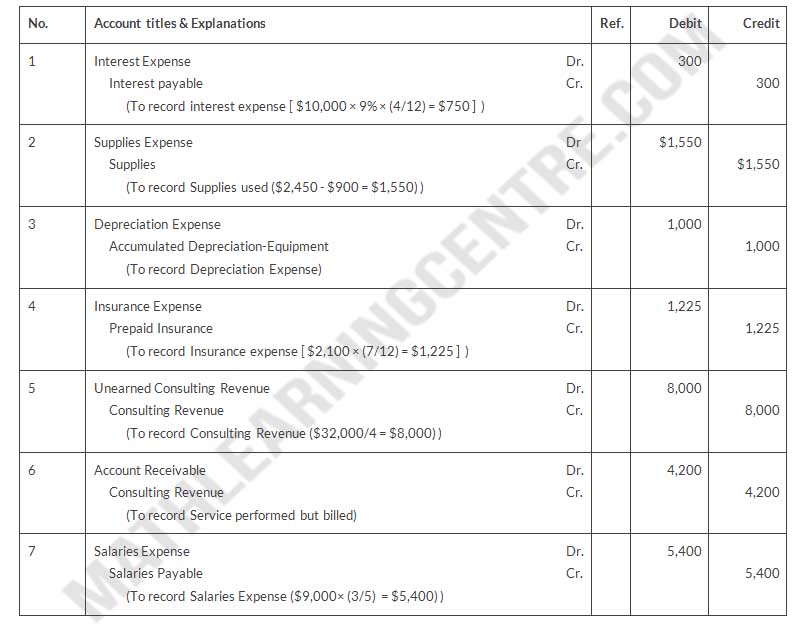

- Devin Wolf company borrowed $10,000 by signing a 9%, one-year note on September 1, 2019.

- A count of supplies on December 31, 2019, indicates that supplies of $900 are on hand.

- Depreciation on the equipment for 2019 is $1,000.

- Devin Wolf Company paid $2,100 for 12 months of insurance coverage on June 1, 2019.

- On December 1, 2019, Devin Wolf collected $32,000 for consulting services to be performed from December 1, 2019, through March 31, 2020

- Devin Wolf performed consulting services for a client in December 2019. the client will be billed $4,200.

- Devin Wolf Company pays its employees total salaries of $9,000 every Monday for the preceding 5-day week (Monday through Friday). On Monday, December 29, employees were paid for the week ending December 26. All employees worked the last 3 days of 2019.

Instructions

Prepare adjusting entries for the seven items described above

Answer

Devin Wolf Company

Adjusting Entries

Adjusting Entries